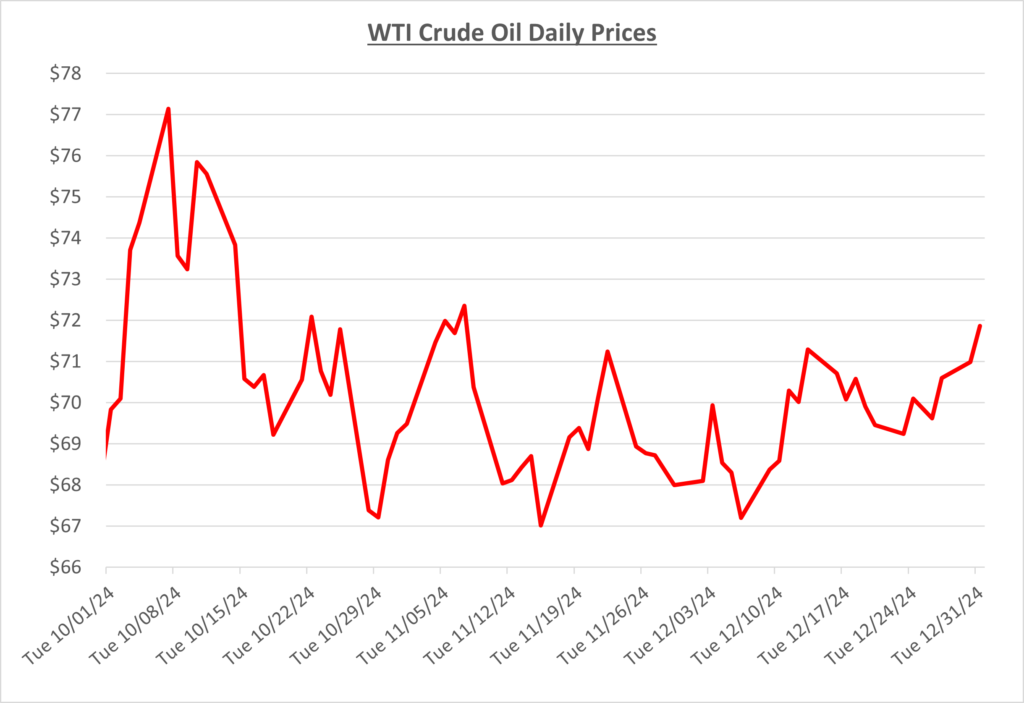

Oil prices opened the last month of 2024 in the high $60s/barrel. OPEC+ met in early December and decided to move any production increases until April 2025. Previously, production cuts were supposed to begin unwinding in January. Furthermore, they announced an additional year of restrictions, as suppliers are showing their concern about oil prices falling further in 2025’s weaker demand market. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices climbed above $70/barrel with hopes of China’s stimulus increasing global demand. At the same time supply was in question among speculation that the U.S. could further sanction Russia and Iran. These new U.S. sanctions against Iran would punish transporters of Iranian oil, which are typically delivering to China. The uncertainty has given oil prices a short-term boost.

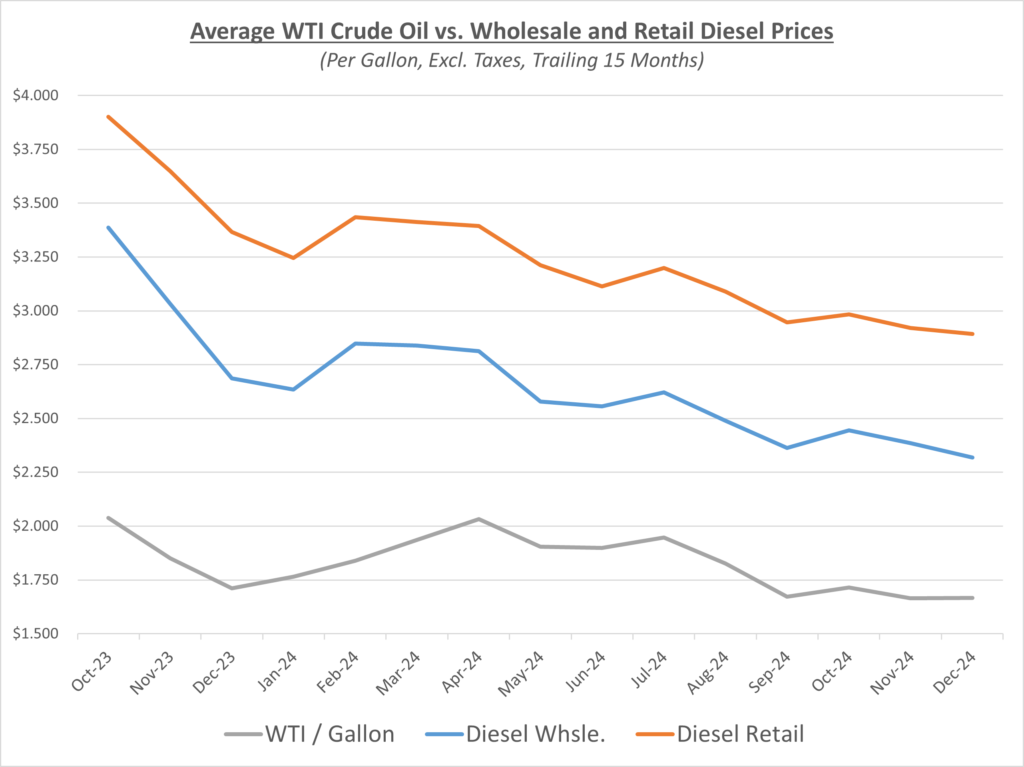

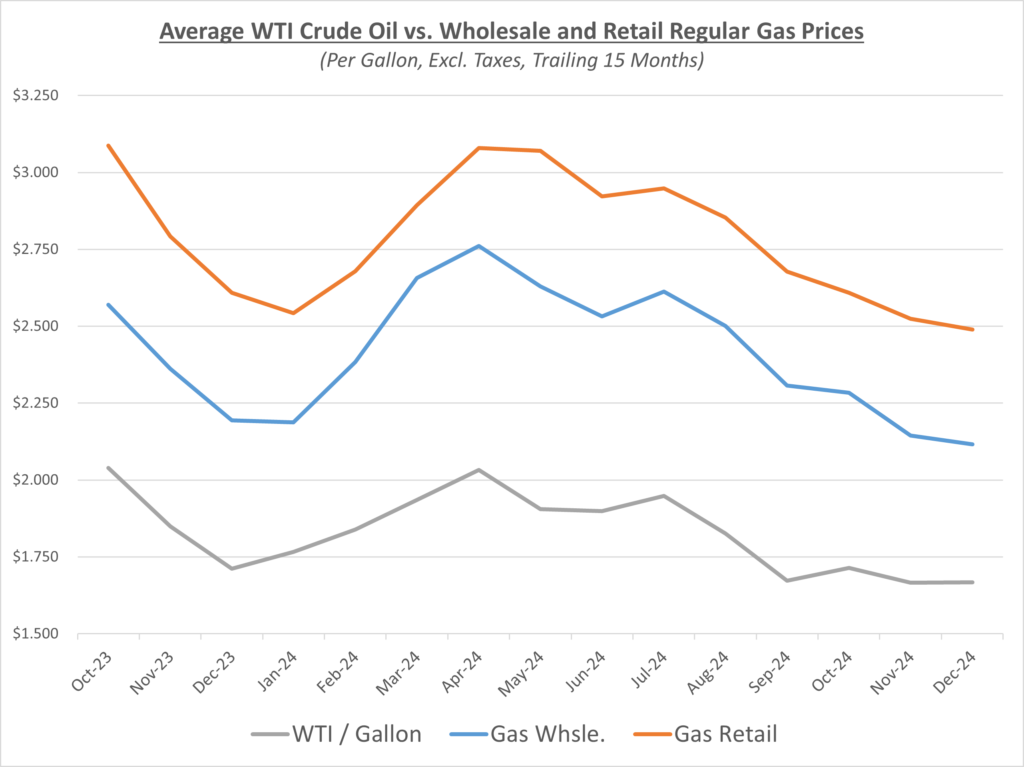

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

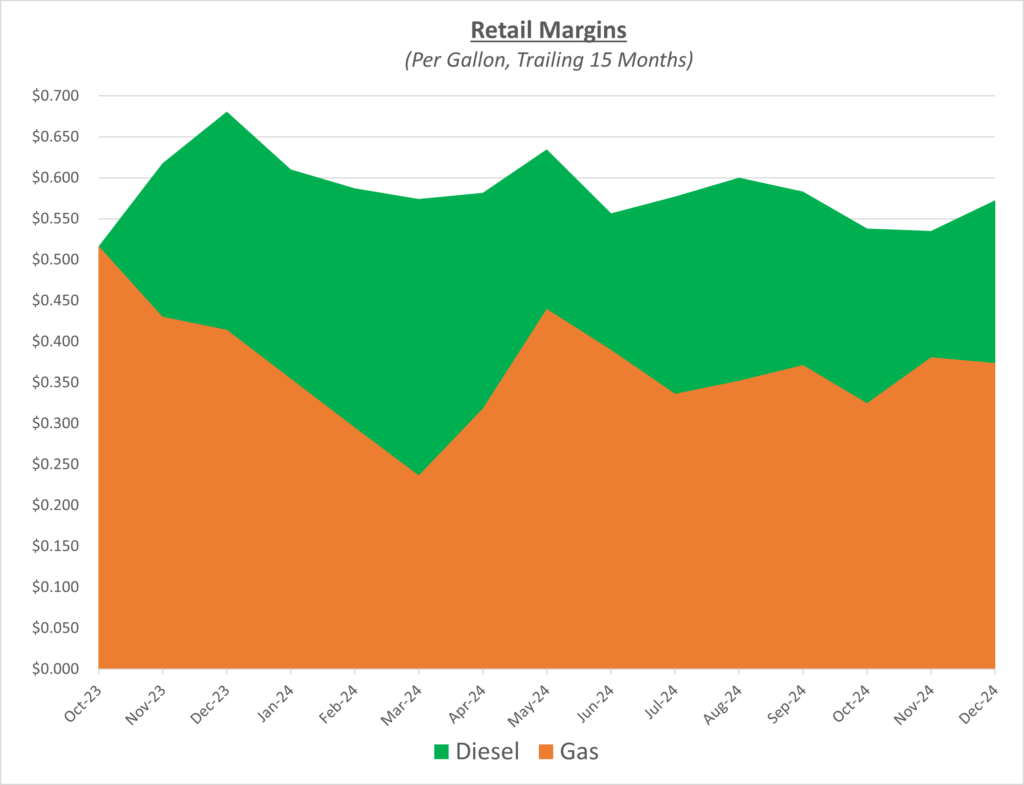

In December, diesel wholesale prices were falling while retail prices only declined slightly. This resulted in suppliers’ profit margins increasing. For gas, both wholesale and retail prices decreased, which caused profit margins to be approximately the same as last month. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average retail price for gas finished December at $3.04/gallon which is a penny lower than last month. The national average price for diesel finished at roughly $3.51/gallon which is a decrease of $0.03 compared to November.

After the holidays, oil prices began to surge, finishing the month at about $72/barrel. Fuel prices seem to be climbing higher with optimism about the previously gloomy demand picture, which is heavily tied to the status of China’s economy. China released revised numbers showing economic growth in 2025 and beyond, giving oil traders hope that demand will improve. Some positivity about demand and the news OPEC+ released earlier in December, have oil prices increasing to begin 2025.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $70-80/barrel in the near term.