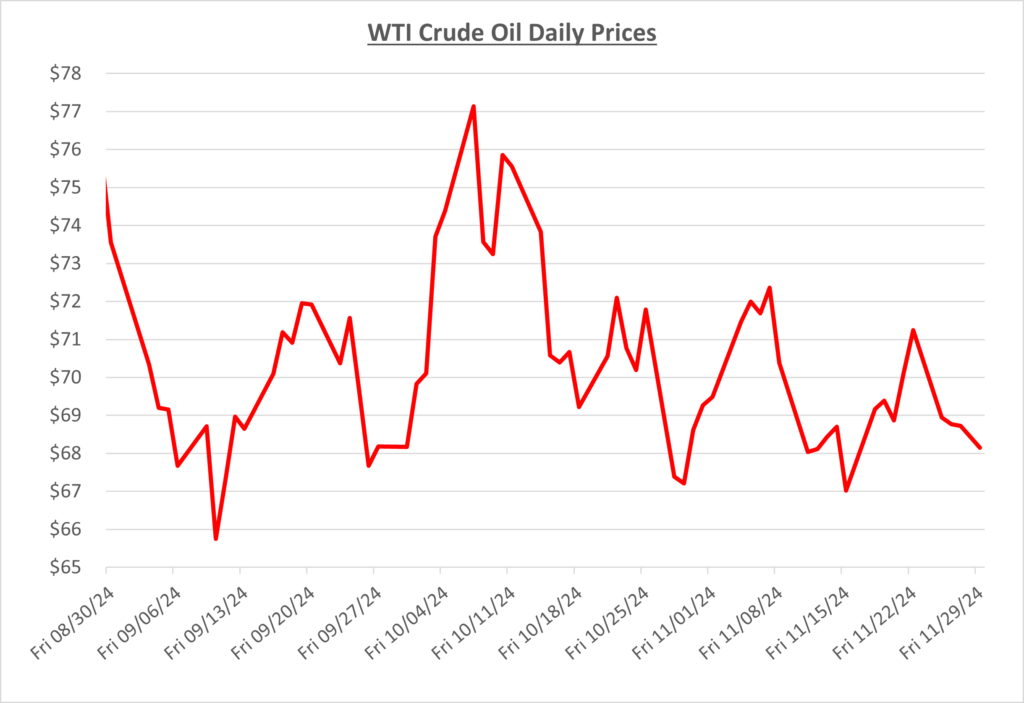

Oil prices began November in the low $70s/barrel after OPEC+ announced delaying their production increase until at least January 2025. The potential damage of Hurricane Rafael threatened to disrupt oil production, which also helped support rising oil prices for the meantime. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices began to fall into the high $60s/barrel. Rafael was downgraded to a tropical storm and the anticipated disruption to production in the Gulf of Mexico was much less than originally feared. Without supply in jeopardy and global demand still weak, fuel prices softened.

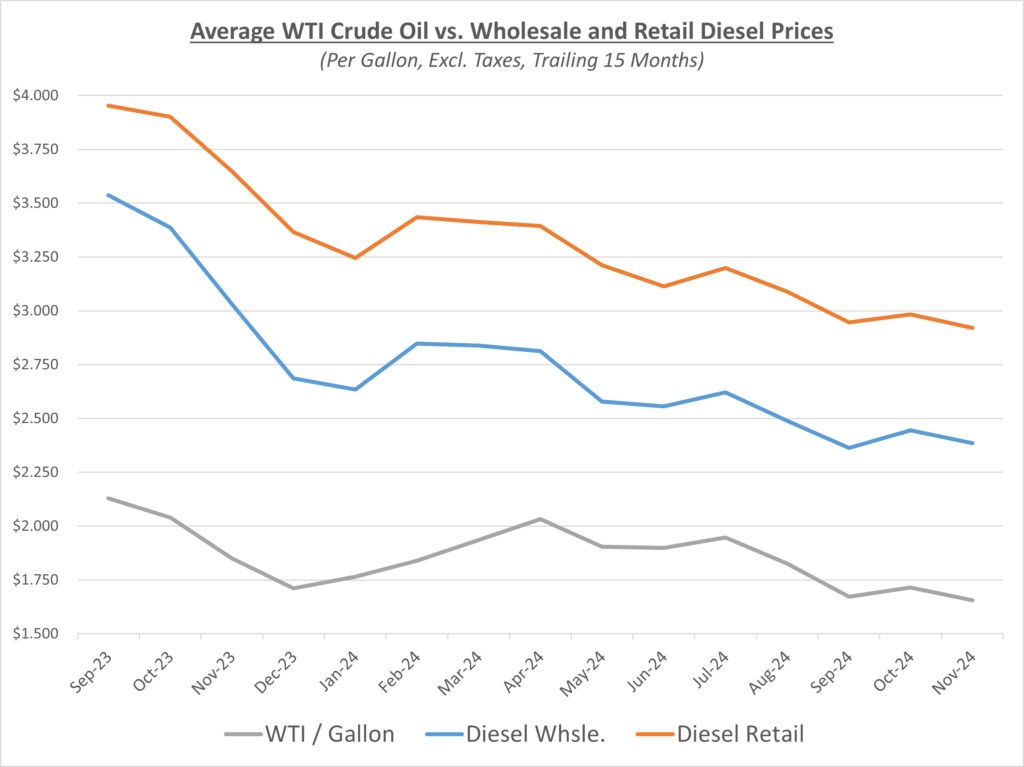

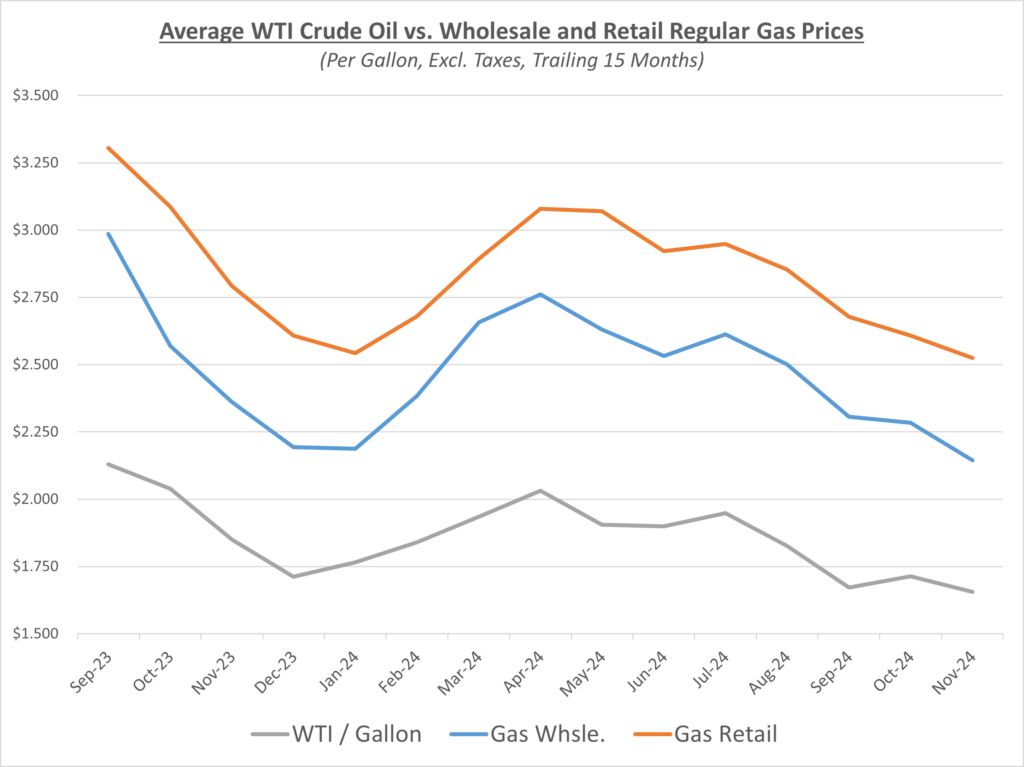

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

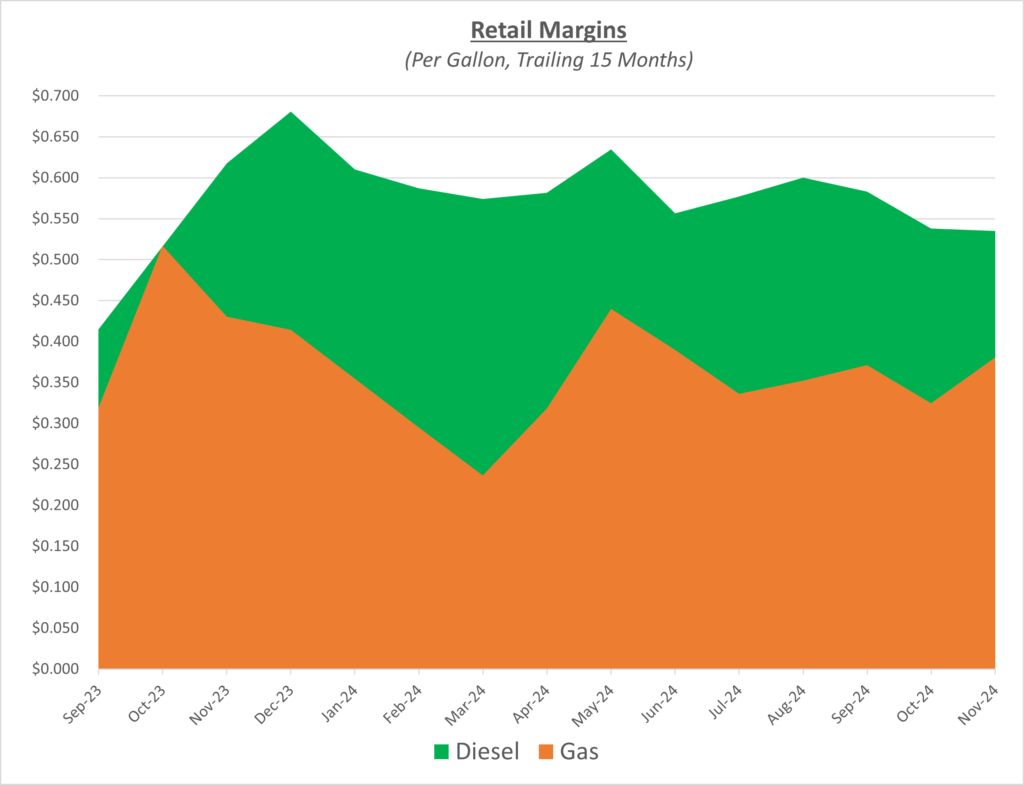

In November, wholesale and retail prices for diesel both decreased resulting in no significant change in suppliers’ profit margins compared to October. However, for gas, wholesale prices fell quicker than retail prices in November which caused profit margins to surge. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average retail price for gas finished November at $3.05/gallon which is a decrease of about $0.08 compared to last month. The national average price for diesel finished at roughly $3.54/gallon which is a decrease of $0.03 compared to October.

November saw a late but brief surge in oil prices with both Ukraine and Russia exchanging missile strikes. Analysts were factoring in potential damage to energy infrastructure which could cause supply issues and therefore elevating prices for the short term. Ultimately oil prices finished the month just above $68/barrel with the expectations that OPEC+ will extend production cuts for at least another month (or longer) during their next meeting, and global demand remaining weak.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $65-75/barrel in the near term.