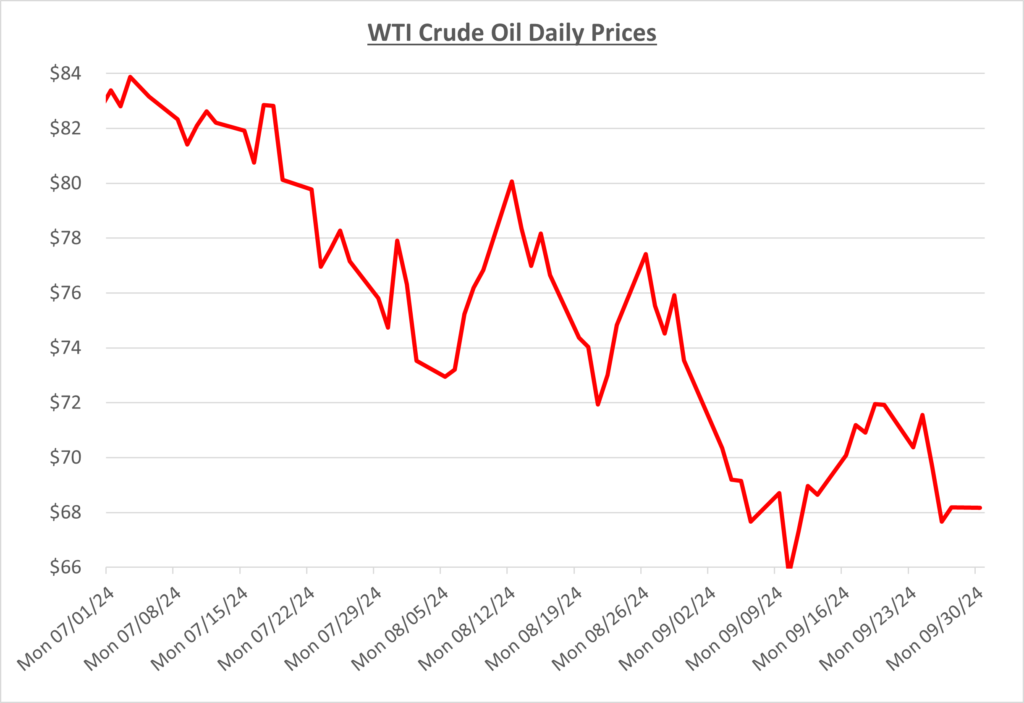

Fuel prices continued their slide into September as oil fell into the high $60s/barrel for the first time since December 2023. The market has continued to battle with poor global demand as China yet again posted weak economic numbers. This is outweighing Libya’s ongoing production shortage and forcing OPEC+ to delay their planned production increases. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices were able to climb above $70/barrel due to supply disruptions caused by Tropical Storm Francine landing in Louisiana. Chevron, Exxon, and Shell were forced to suspend operations, and it would take some time to get them up and running at full capacity. Also supporting oil prices was the Fed’s announcement of a 0.5% interest rate cut; the first the U.S. has seen since pre COVID-19. Traders are hoping that rate cut leads to growth in economic activity which would help increase demand for oil.

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

Wholesale and retail prices have continued their decrease since mid-summer for both diesel and gas. In September, diesel retail fell slightly quicker than wholesale, resulting in decreased profit margins for suppliers. Gas wholesale prices lowered at a faster pace than retail, which caused profit margins to rise. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished September at $3.22/gallon, which is a decrease of about $0.11 compared to last month. The national average for diesel prices finished at roughly $3.57/gallon, which was also $0.11 less than August’s average price.

Hurricane season continued with Helene hitting the Big Bend of Florida before traveling up into the Carolinas. Its impact was not felt with fuel prices spiking, but a few markets in the southeast are still recovering from its destruction and disruption. To make things worse, there is potential for another storm to develop in early October. Even with hurricane season in full effect and the unceasing war in the Middle East, demand has repeatedly outweighed any concerns of supply.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $65-75/barrel in the near term.