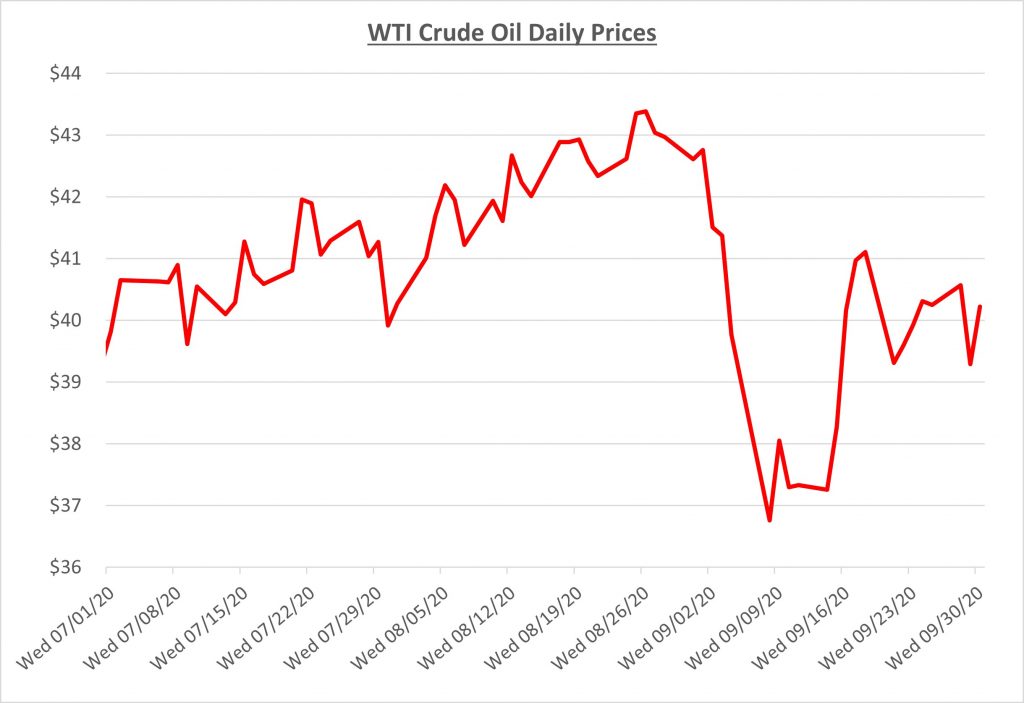

Oil prices showed some volatility during September after several months of trading in a tight range. Shortly after the start of the month, prices fell by more than 10%, dipping just below $37 per barrel. Within a week, prices managed to climb back to the familiar $40 level and stayed nearby for the remainder of the month. The following graph shows the daily price movements over the past three months:

The large decline at the beginning of September was accompanied by similar weakness in the financial markets. The primary factors driving the volatility were a rising number of global coronavirus cases along with uncertainty about US legislators’ ability to broker a deal for additional economic stimulus.

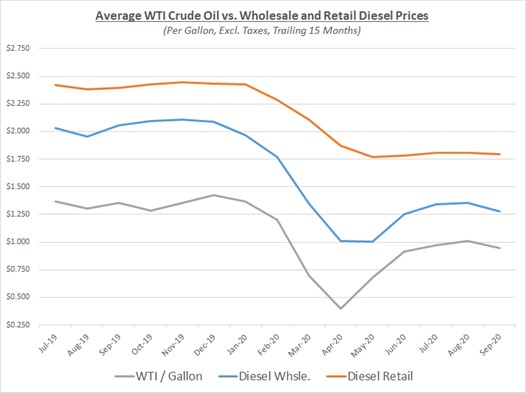

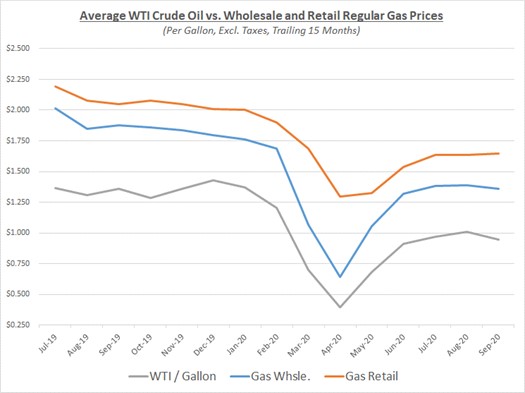

As a result of the movement in oil prices during September, the overall average price for September declined slightly compared to August. Wholesale prices for refined fuels also reflected small declines while retail prices remained steady. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

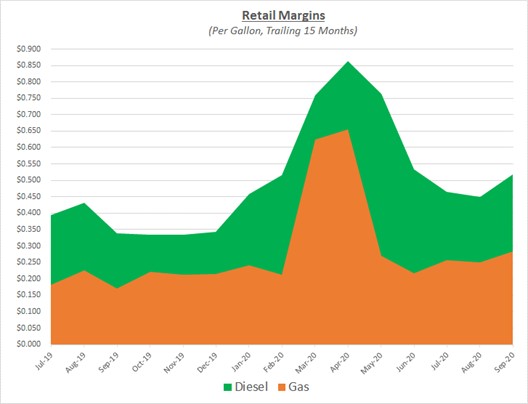

Retail margins increased in September as wholesale prices declined while retail prices were flat. The following graph shows the retail margins over the trailing 15 months:

For the remainder of this year, Sokolis believes oil prices will hover near $40 per barrel. This is primarily based on the continued uncertainty about COVID-19’s economic impact. Weakness in fuel demand, particularly for diesel, will likely prevent any appreciable increases. In addition, rather than increase, prices have a greater chance of declining because of the rising number of global virus cases being fought with new restrictions. Any other significant price changes would need to be driven by an unexpected political, economic, or environmental event.