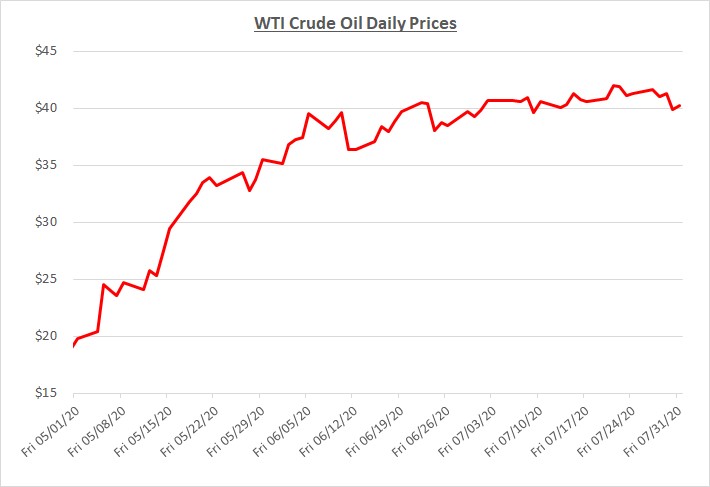

During July, oil prices traded in an extremely narrow range, primarily between $40 and $42 per barrel throughout the month. The following graph shows the daily price movements over the past three months:

Although prices increased in rapidly May when COVID-19 restrictions started to ease, they lost momentum in June, then stagnated in July as concerns grew about a resurgence of the virus. Significant uncertainty regarding an economic recovery from the virus’ impact cast doubt on the demand for oil and fuel, leaving prices in a holding pattern.

While COVID-19 has been the overriding factor impacting prices, political tensions also came back into the picture with offsetting impacts. The relationship between the US and China deteriorated further in July raising the possibility of another trade war flare-up that could negatively impact global economic activity and demand for oil. In addition, Iran conducted military exercises in the Strait of Hormuz targeting a mocked-up US Carrier raising concerns of an escalation that could disrupt Middle East oil supplies.

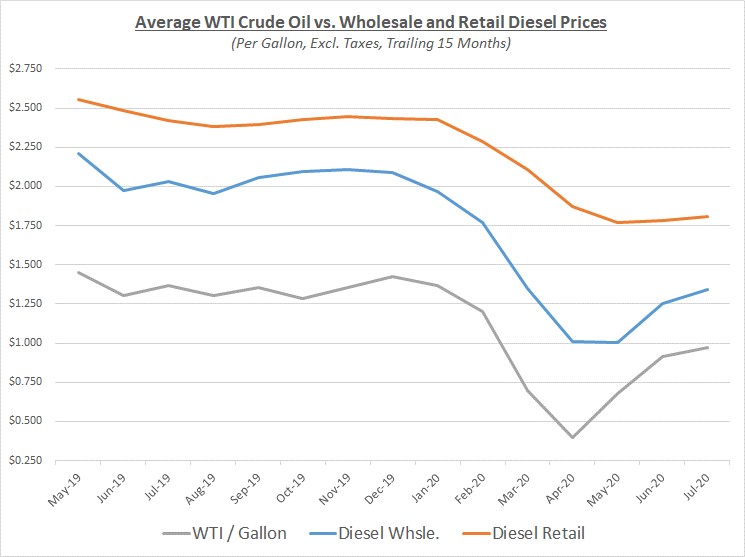

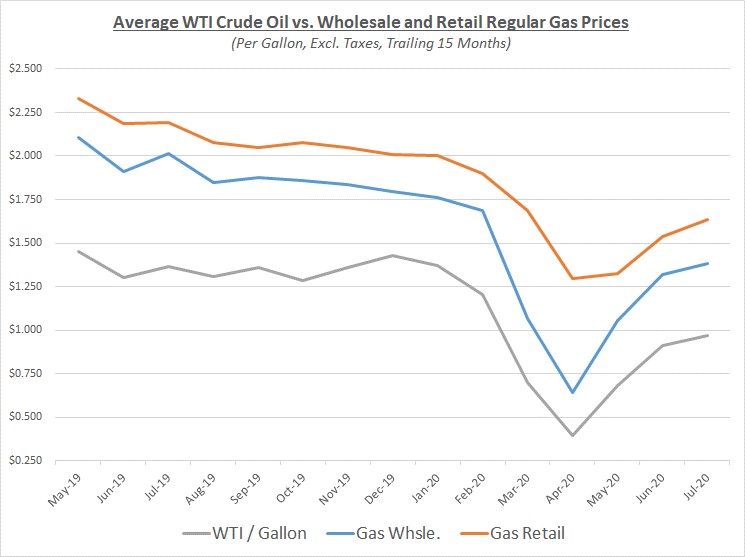

Despite the very limited movement in daily prices during July, the overall average for July increased compared to June primarily because prices increased modestly throughout June. Average monthly wholesale prices for diesel and gas also increased. Retail prices for diesel continued to be relatively flat while retail prices for gas showed a small gain. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

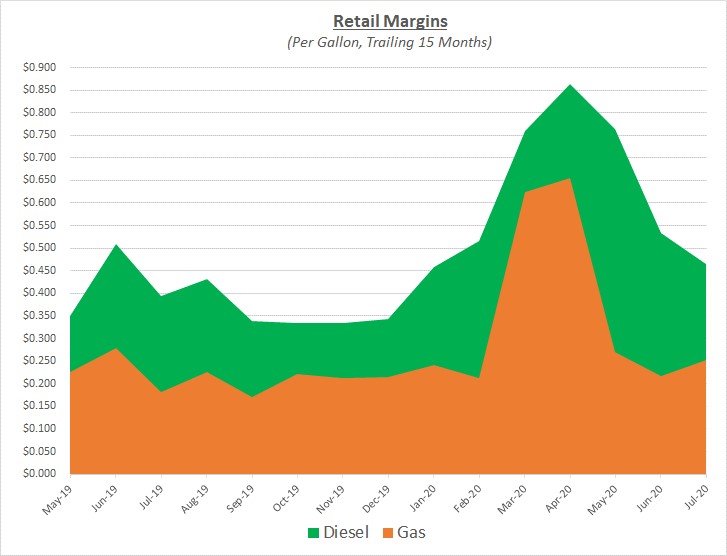

As the graphs above show, retail prices for diesel were relatively flat compared to the prior month as retailers continued to absorb the wholesale price increase. The result was that margins for diesel decreased again but remained above their typical level. For gas, margins increased slightly while remaining on the upper end of their typical range. The following graph shows the retail margins over the trailing 15 months:

The outlook for oil prices over the next few months remains very uncertain and will be highly dependent on the course of COVID-19. The political factors mentioned above are less likely to have any significant impact on prices compared to the virus, but they should not be ignored as history has shown they can significantly and rapidly impact prices.

Sokolis believes oil prices will continue to trade in the low- to mid-$40’s per barrel through early fall with the potential to fall back into the $30’s if restrictions must be expanded to combat the spread of the virus. However, there have also been reports of vaccine trials reaching advanced stages with the potential for approved use before the end of the year. If positive vaccine results are announced soon, oil and fuel prices will likely begin rising toward $50 in anticipation of more robust economic activity and demand for oil.