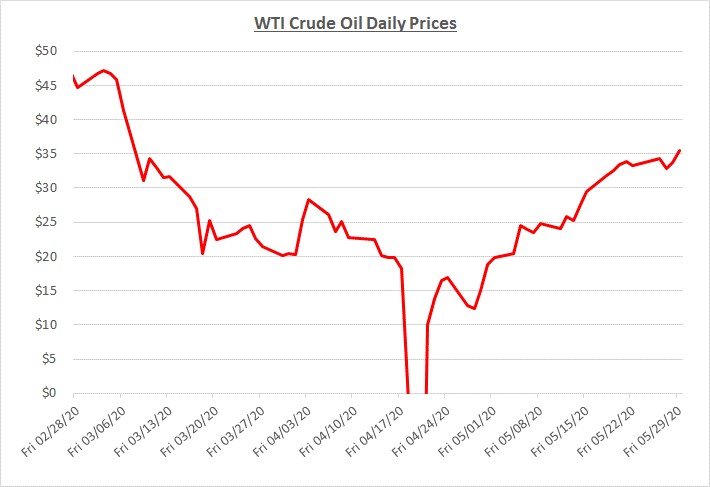

Following the historic collapse near the end of April, oil prices began rebounding throughout May. May’s prices started slightly under $19/barrel and nearly doubled by the end of the month closing over $35/barrel. The following graph shows the daily price movements over the past three months:

The historic negative price dive in April was caused by a lack of liquidity in the futures markets when traders fled their positions as rising inventory levels threatened to exceed storage capacity. During May, those storage concerns subsided as some countries, along with many states in the US, began to loosen their COVID-19 restrictions. As businesses reopened and travel began to increase, global demand for oil and fuel began to grow. With increasing demand and inventory levels receding, prices began rising.

The recent production cuts by Saudi Arabia, Russia, and other OPEC+ countries were another factor contributing to rising prices in May. US oil producers also scaled back their operations. These cumulative production cuts combined with the increase in demand provided solid support for oil prices in May.

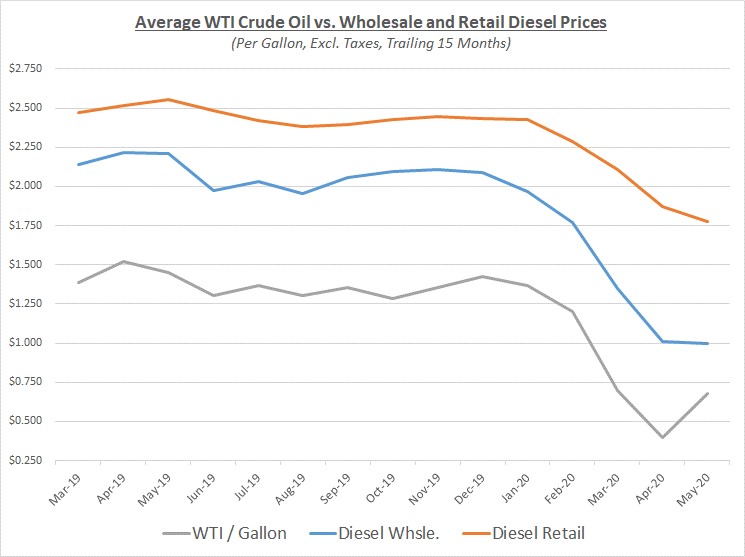

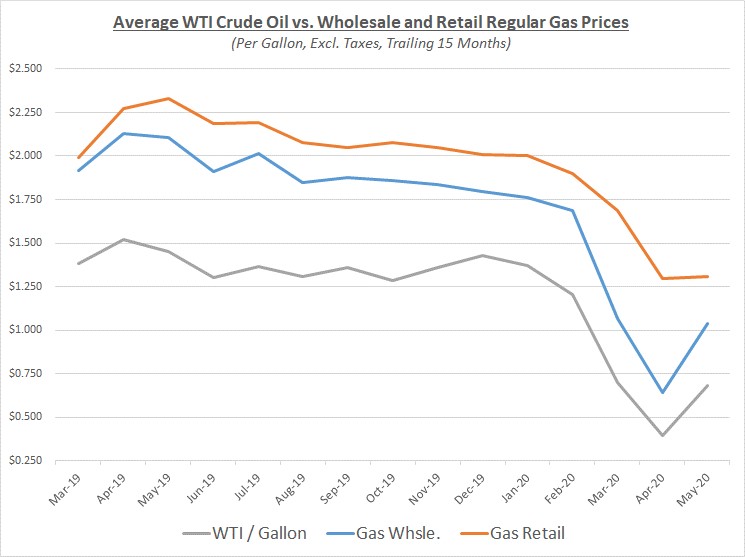

Although oil prices rebounded sharply when looking at the overall overage for May versus April, diesel wholesale prices were surprisingly flat while gas increased significantly. The growth in demand for gas was much more significant than diesel as individuals began to venture out of their homes again. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

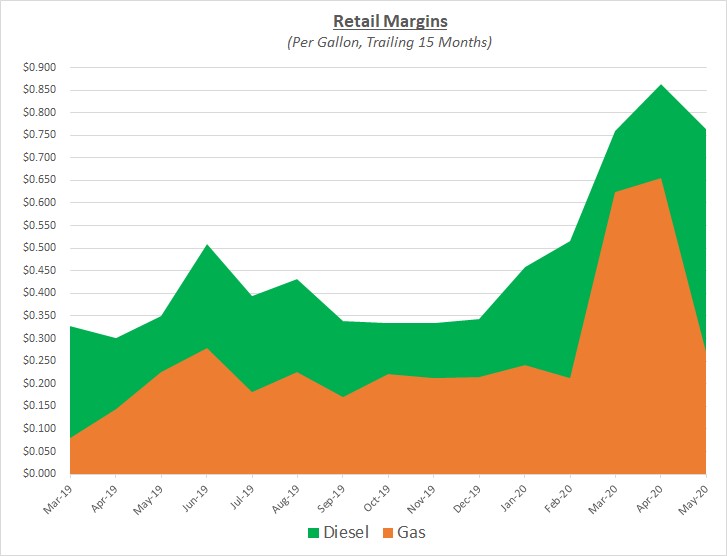

As the graphs above show, retail prices for diesel showed a slight decline in May while gas retail prices were flat. Despite the underlying increases in oil and wholesale costs, retailers absorbed those increases by sacrificing extraordinarily high margins they had been generating over the past couple months. Even though margins declined, they remained at a very high level for diesel. Gas margins declined significantly to a level modestly above their typical range. The following graph shows the retail margins over the trailing 15 months:

As the summer months unfold and COVID-19 restrictions continue to be eased, Sokolis believes oil prices will remain in the $30’s per barrel with some potential to break into the $40’s if demand continues to rebound quickly. However, the possibility also exists that oil producers could begin to increase production as prices rise which may partially offset any increases. In addition, if a significant resurgence of the virus emerges and restrictions are tightened, the potential still exists for oil prices to fall back into the $20’s or lower.