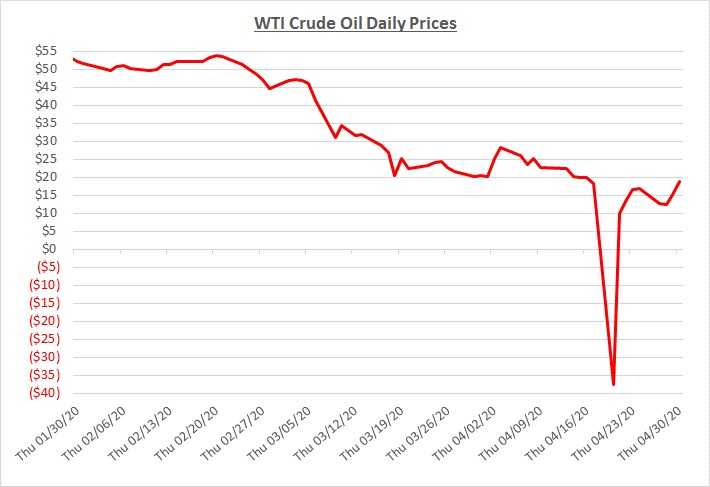

As part of the sharp decline that began in January, oil prices set another somber record in April when they crashed below zero for a short period during the month. Prices started the month at $20/barrel and managed to claw their way back to $19 by the end of the month despite the historic dip in negative territory. April’s ending price is 70% below the start of this year along with the same time last year. The following graph shows the daily price movements over the past three months:

COVID-19 continues to be the primary force driving prices down. Global travel restrictions and lockdowns have significantly reduced economic activity and the demand for oil. The decrease in demand across the globe has been estimated at roughly 30 million barrels per day, almost a third of pre-virus daily consumption.

Looking closer at the historic negative dive in April, this event was caused by a lack of liquidity in the futures markets. Oil is traded in option contracts that expire each month. During the third week of April, options for the month of May were approaching their expiration date. If option holders held their contracts to the end, they would have been obligated to take delivery of the oil. The problem was that oil storage had become very limited as inventories grew from weak demand. Traders were faced with the dilemma of taking delivery of oil with no place to store it. They decided to pay someone else to take the option off their hands to solve the storage problem causing the option price to go negative.

Another notable item for April was that Saudi Arabia, Russia, and other OPEC+ countries agreed to scale back their oil production in an effort toward balancing the market. Their cuts only amounted to about 10 million barrels per day which was far short of the decline in demand. Oil prices barely responded to their action. Production in the US also declined as a result of market forces. With prices so low, many domestic wells became unprofitable to continue operating.

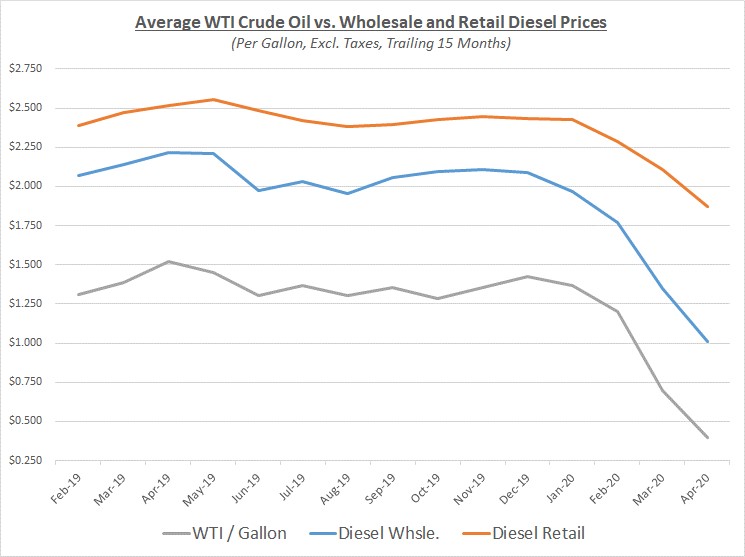

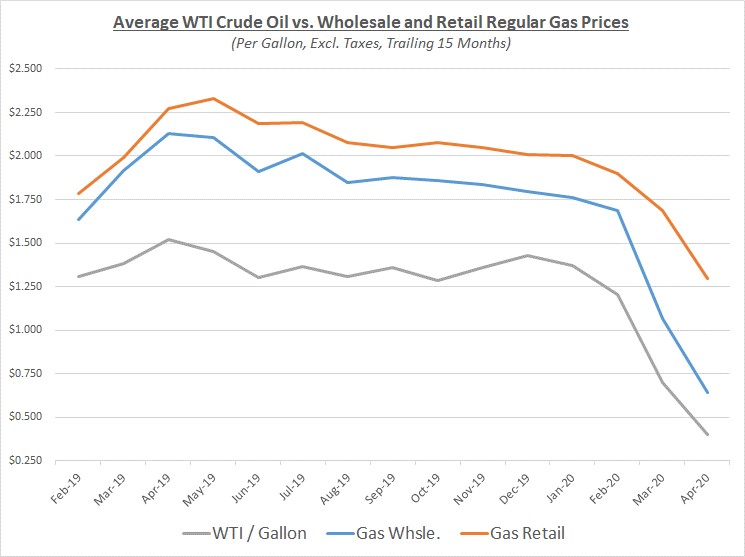

Due to the continued decline in April, along with the sharp negative spike, the overall average price for oil was almost half of March’s average. Substantial declines also continued for diesel and gas. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

While refined fuels declined, they did not get anywhere close to sub-zero like oil and should not be expected to do so in the future. Refiners have cut back their utilization rates to a level around 70% compared to a more typical 90% as they adjust their throughput for lower fuel demand. Even at the diminished output, they will still sell fuel at positive prices and generate crack spread margins, with diesel providing higher returns compared to gas. Because they are refining less fuel, they are drawing less oil which is why storage has become very limited causing the negative option trades described earlier.

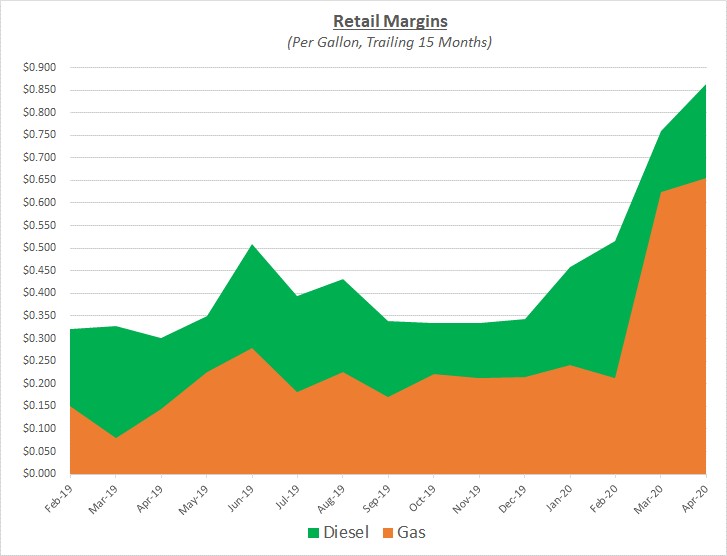

The retail price decline in April continued at a slower pace than wholesale. Retail margins, already at unprecedented levels, rose even further in April. As noted in the past, it is common for margins to increase during periods of rapid wholesale price declines when retailers take advantage of the opportunity to maximize their margins. However, under these circumstances, it is important to recognize that retailers are pumping far fewer gallons and need higher margins to cover their overhead. The following graph shows the retail margins over the trailing 15 months:

Due to the market changes in April, almost all fleets should have seen a significant drop in fuel prices compared to March. Fleets with diesel deals tied to wholesale cost indexes would have seen a larger decline at a faster rate compared to fleets purchasing at retail.

Looking out over the next couple months, parts of the world have begun easing their COVID-19 restrictions including many states in the US. Sokolis believes that oil prices will remain at their relatively low levels through the summer until demand increases significantly. If inventory storage remains tight while demand is low, the possibility exists for oil prices to drop quickly in late May when the next set of option contracts expire. This would then be followed by a rebound like what happened in April. For diesel and gas prices, as economic activity begins to strengthen, demand for fuel should grow. Prices should stabilize and then start moving upward.