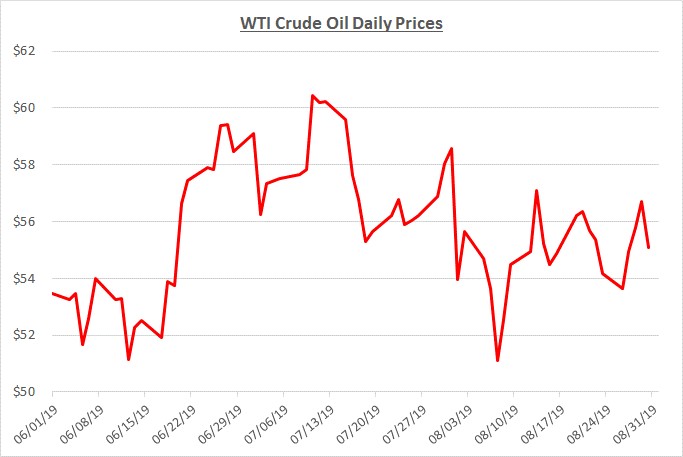

August opened with oil prices just over $58 per barrel but they fell sharply during the first week of the month. By the 7th of the month, prices hit their lowest point at $51 and then started to rebound. For the remainder of the month, prices traded in a narrow range near $55 which is where the month finally closed. The following graph shows the daily price movements over the past three months:

Within a few days following the start of August, prices rapidly declined after an unexpected burst of friction between the US and China regarding their trade dispute. Oil prices and financial markets plummeted based on a renewed pessimistic outlook for future global economic activity and demand for oil. Although prices rebounded shortly after the decline, the following two weeks reflected little change. By the last week of August, prices found some support as oil inventory levels showed a large decline. In addition, the tone between the US and China began to soften ahead of face-to-face talks scheduled for September.

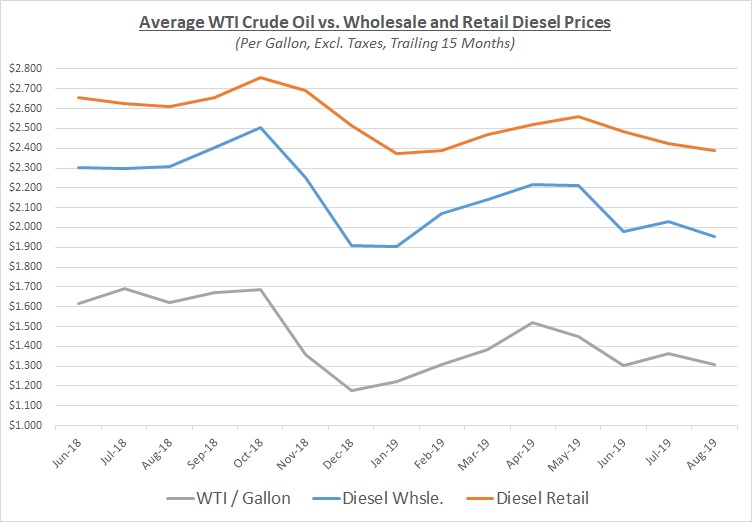

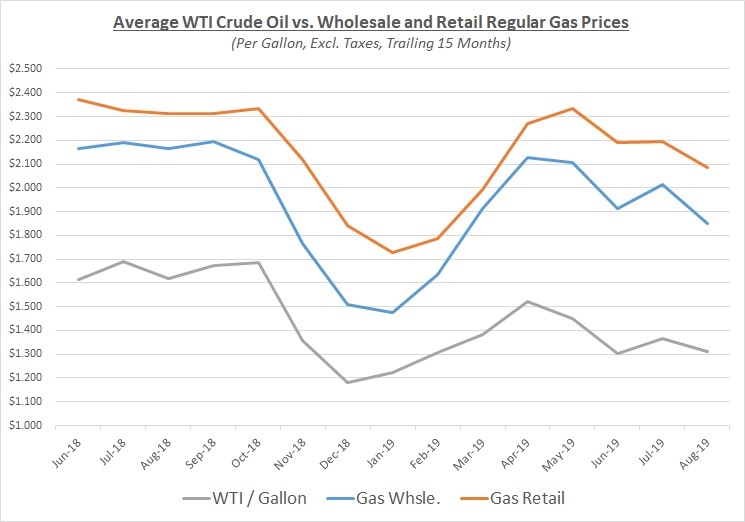

Overall average prices for oil and wholesale fuels declined in August compared to July. Diesel retail prices continued a slow decline that began in May. Gas retail prices fell slightly slower than the wholesale decline. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

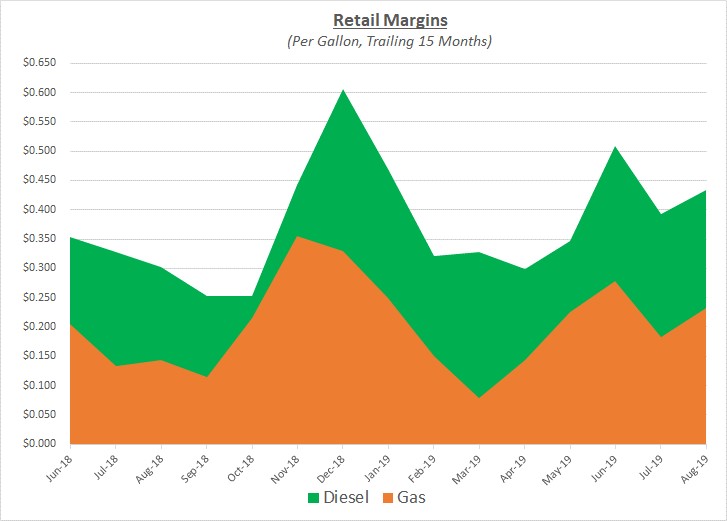

Due to the way average wholesale prices decreased a bit slower than retail, margins increased modestly and remained at relatively high levels during August. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Despite the decrease in oil and fuel prices during August, Sokolis continues to anticipate that oil prices will reach $60 or more per barrel as we look across the remainder of the year. Although the chances of resolving the US-China trade conflict had been fading, any progress toward reaching a deal will support rising prices. And, we believe it is more likely there will be some progress over the next few months rather than a total collapse in negotiations.

Other factors continue to support rising prices including ongoing tensions in the Middle East with Iran. Also, OPEC and Russia have extended their production cuts through the end of the year, and possibly into 2020, in their effort to tighten supply and support prices. Lastly, the deadline for the IMO 2020 maritime fuel transition is approaching which is anticipated to increase demand for oil and diesel fuel.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.