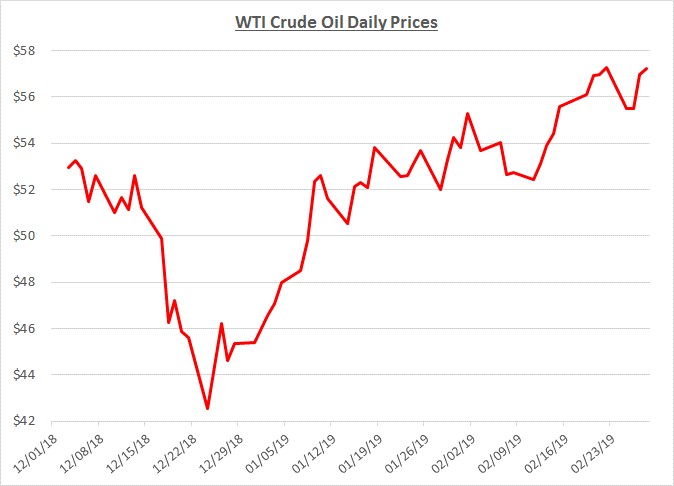

During February 2019, oil prices traded in a narrow range during the first 10 days, then began climbing for the remainder of the month. Prices opened the month at just under $54 per barrel and closed at just over $57, a 6% increase. The following graph shows the daily price movements over the past three months:

The overall increase in prices during February was primarily caused by news that the US and China were making progress in negotiations to resolve their trade war. The positive updates supported the belief that greater economic activity could be anticipated in the future which would generate more demand for oil.

The only exception to the rising trend near the end of the month was a downward blip attributed to President Trump’s tweet encouraging OPEC to hold down prices. However, attention quickly returned to the fundamentals over the last few days of the month; demand continues to be strong, inventories showed significant declines, and prices resumed their climb upward.

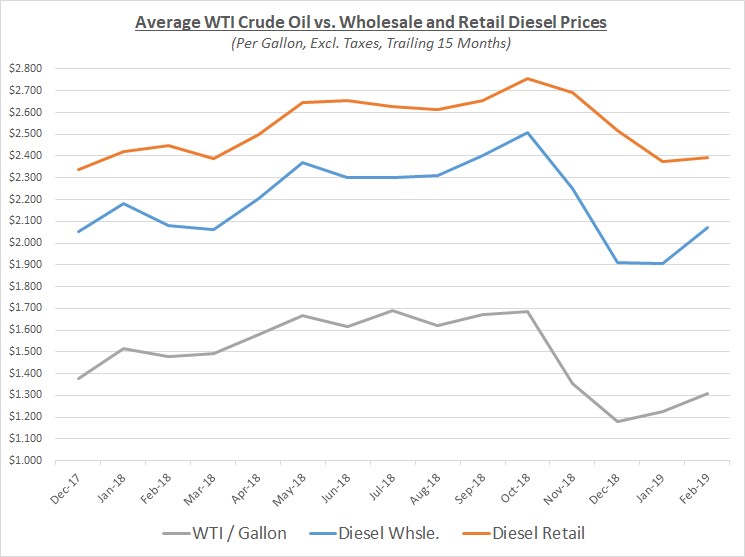

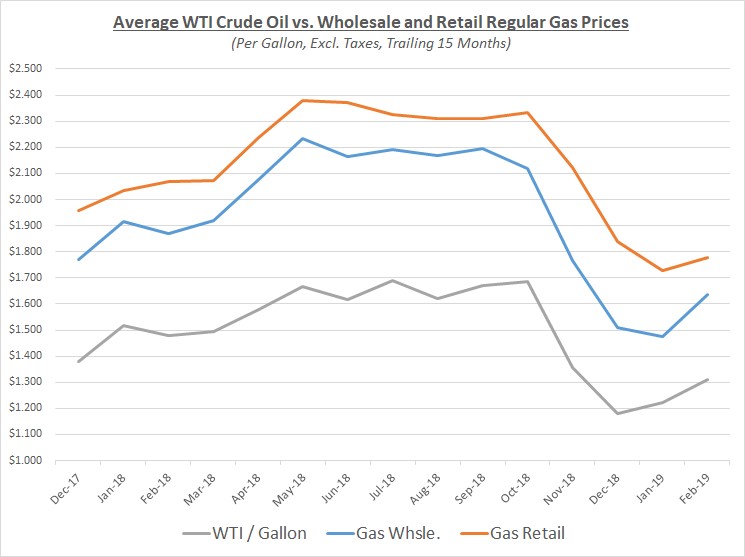

As oil prices increased during February, the average wholesale prices for diesel and gas also increased. However, retail prices for diesel and gas were slow to move higher. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

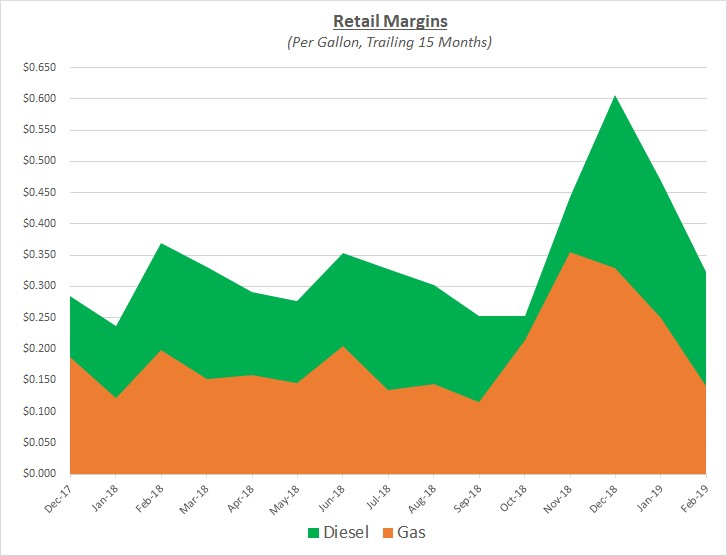

As oil continued to increase along with wholesale prices, lagging retail prices pinched retail margins. Although margins remain elevated, they are now within a more typical range. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates oil prices will remain in the mid-to-high $50’s for the foreseeable period but will likely increase to $60 and beyond by the second half of the year. There continue to be many factors to support rising prices. These include production cuts by OPEC and Russia, economic sanctions on Venezuela and Iran, a potential trade agreement between the US and China, along with IMO 2020 requiring shipping vessels to burn cleaner fuel.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.