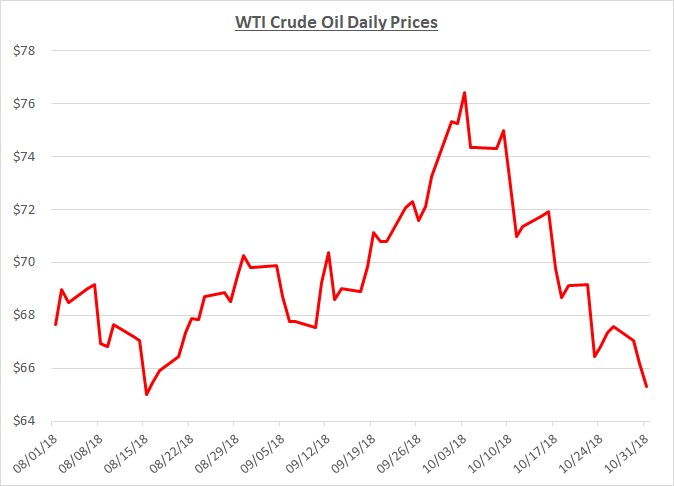

Crude oil prices tumbled by almost 13% during October. They peaked very early in the month at just over $76/barrel and proceeded to fall throughout the month to close at just over $65. The following graph shows the daily price movements over the past three months:

The rapid decline of oil prices in October followed a rapid increase during the second half of September. During that prior period, prices were driven higher by concerns about tightening supplies resulting from economic sanctions on Iran. During the first few days of October, Middle Eastern concerns increased further after the murder of Saudi Arabian journalist, Jamal Khashoggi, in the Saudi consulate in Istanbul.

As October progressed, oil prices took a downward turn. Tensions related to the Saudi murder continued but the anticipated impact on future oil supplies appeared to subside. While that helped trim prices, additional headwinds were encountered as oil inventory levels began growing again. Furthermore, the biggest blow to oil prices resulted from a significant decline in global financial markets. Fears of slowing global economic growth for a variety of reasons translated to lower anticipated demand for oil in the future.

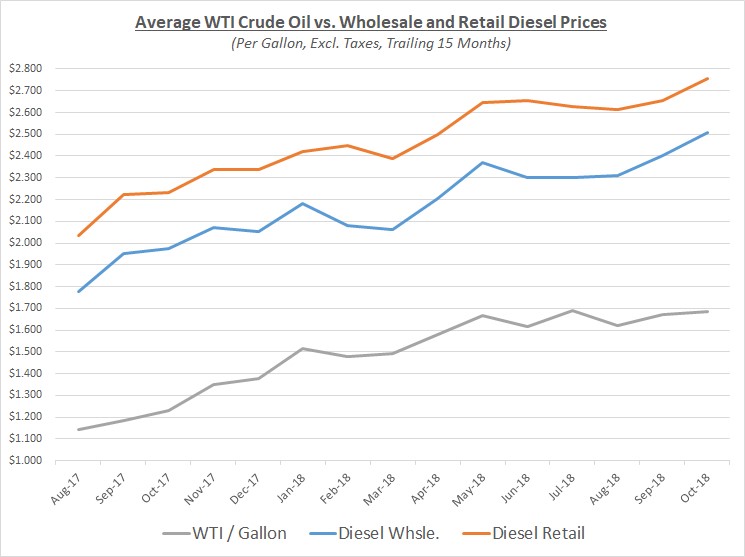

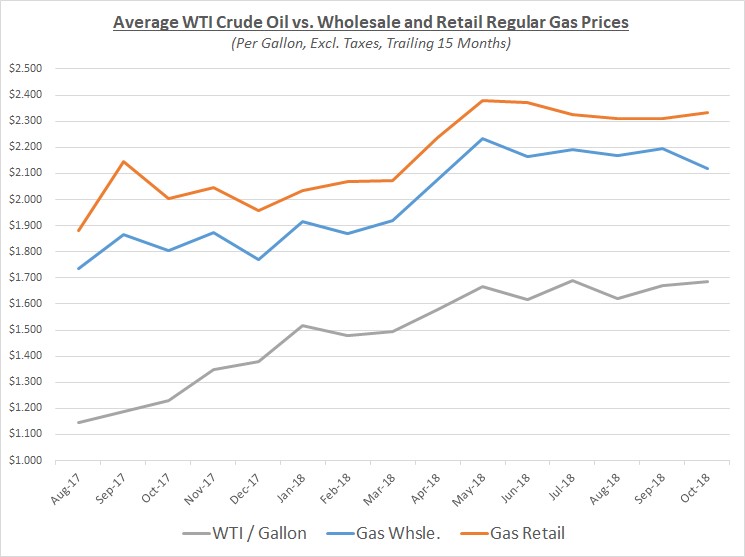

Due to the way oil prices increased during September followed by the decrease in October, the average price for each month was relatively consistent. However, average wholesale and retail prices for diesel continued rising during October due to continued strong demand. Meanwhile, wholesale gas prices began to decline as demand slowed after the summer driving season while retail gas prices lagged. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

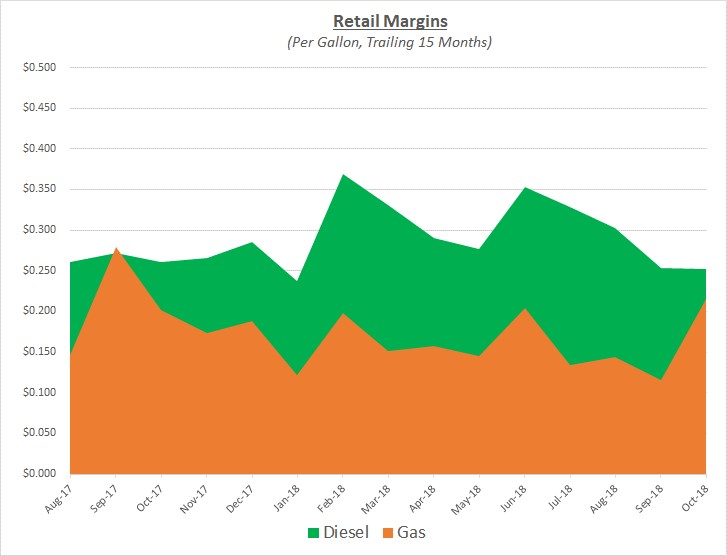

As wholesale and retail prices for diesel prices increased at a similar rate, diesel margins remained steady. However, gas margins increased sharply as retail merchants seized the opportunity to maximize their margins as wholesale prices declined. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates crude oil prices will rebound slightly higher toward $70/barrel and trade in that range for the foreseeable future as the heating oil season gets underway. However, there is still a significant possibility that prices could increase sharply over the next few months if inventory levels begin to decline again or Middle Eastern political and economic conditions worsen.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.