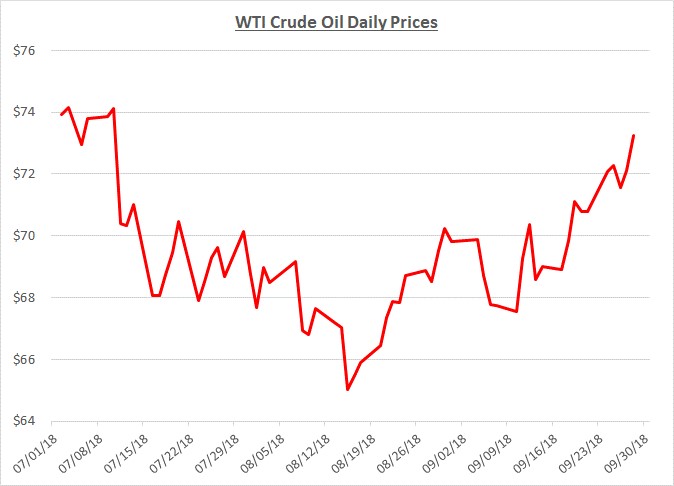

Crude oil prices traded in a narrow range near $70/barrel for most of September then started rising quickly toward the end of the month. Prices closed the month at just over $73. The following graph shows the daily price movements over the past three months:

For most of September, prices were relatively steady in the absence of any significant political or economic developments. During the last half of the month, concerns began to grow about tightening supplies due to economic sanctions on Iran. OPEC and other oil producing countries met toward the end of September and indicated they did not plan to increase production further to make up for lost Iranian gallons. As a result, oil prices began increasing through the remainder of the month.

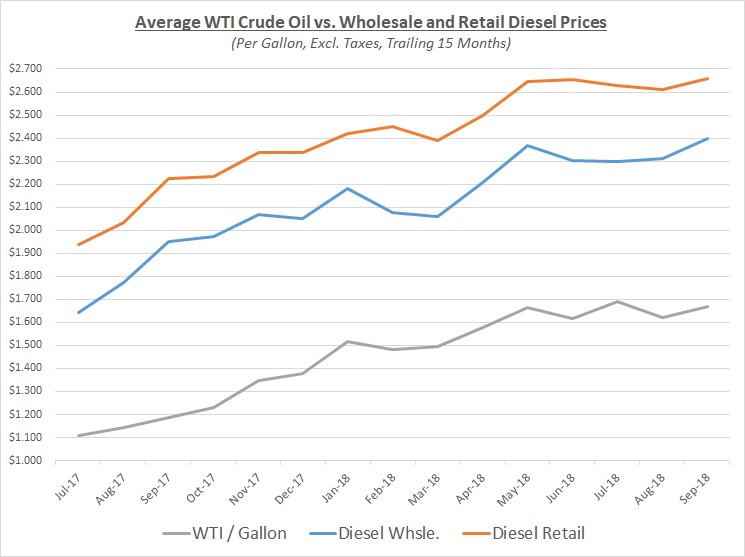

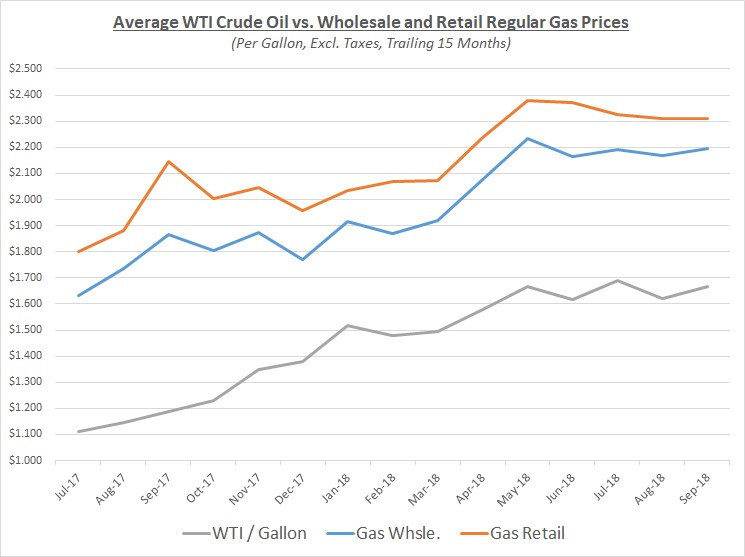

Because of the increase in oil prices during September, wholesale prices for refined products also increased although retail prices for diesel only increased slightly while gas remained unchanged. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

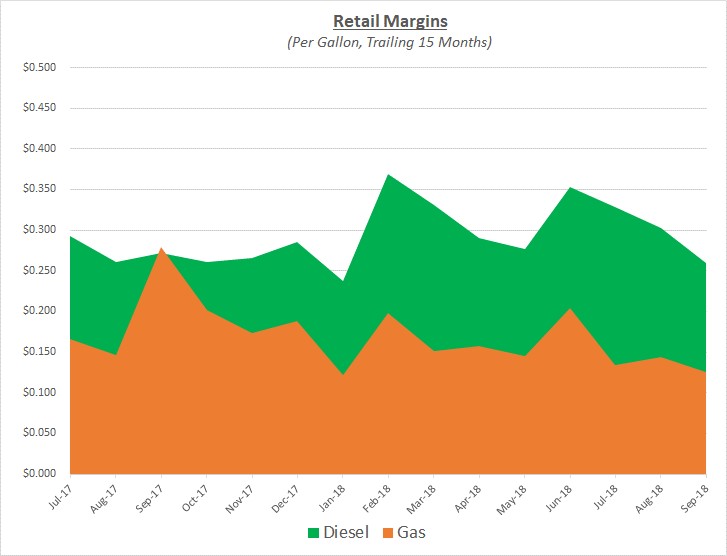

Since wholesale prices for refined products rose slightly faster than retail during September, retail margins declined modestly compared to the prior month. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates crude oil prices will continue to trade in the low- to mid-$70’s for the foreseeable future. However, there is still a significant possibility that prices could increase sharply over the next few months if supplies from the Middle East continue to tighten due to sanctions on Iran.

In addition, as we mentioned last month, more upward pressure on prices is expected over the next year and beyond due to new rules that will be put in place requiring large shipping vessels to start using low sulfur diesel by 2020. Assuming no other significant changes in the market, those rules will cause demand for oil to increase significantly to produce the additional low sulfur diesel needed for ships. Furthermore, refining capacity may not be able to expand fast enough to meet the additional demand for low sulfur diesel.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.