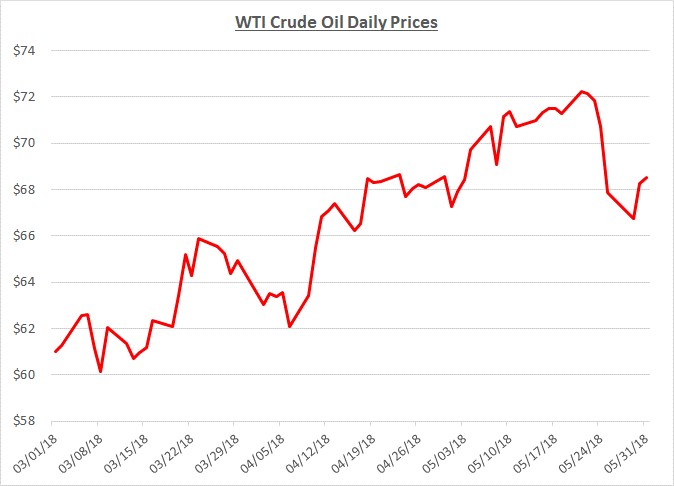

Crude oil prices continued climbing throughout May and then lost momentum near the end of the month. Despite the setback, prices are still roughly 40% higher compared to a year ago. The following graph shows the daily price movements over the past three months:

The increase in oil prices during most of May was primarily related to the decision by the US to pull out of the Iranian nuclear agreement. Re-imposing sanctions on Iran has the potential to reduce their oil exports which causes some concern about future supplies, particularly as worldwide demand for oil has continued to grow. In addition, political and economic issues in Venezuela have been limiting that country’s ability to export oil resulting in further price support.

Toward the end of May, prices fell by roughly 10% rather quickly. The main reason was due to indications from Saudi Arabia and Russia that they were prepared to increase oil exports to make up for any reductions from Iran or other producers. An OPEC meeting is scheduled for late June at which time the group will reevaluate their previous decision from 2017 that limits production through the end of 2018. In the meantime, the market will remain on edge until any decision is announced. Additional downward pricing pressure came late in May as oil inventories were reported to have unexpectedly increased when analysts were anticipating further declines.

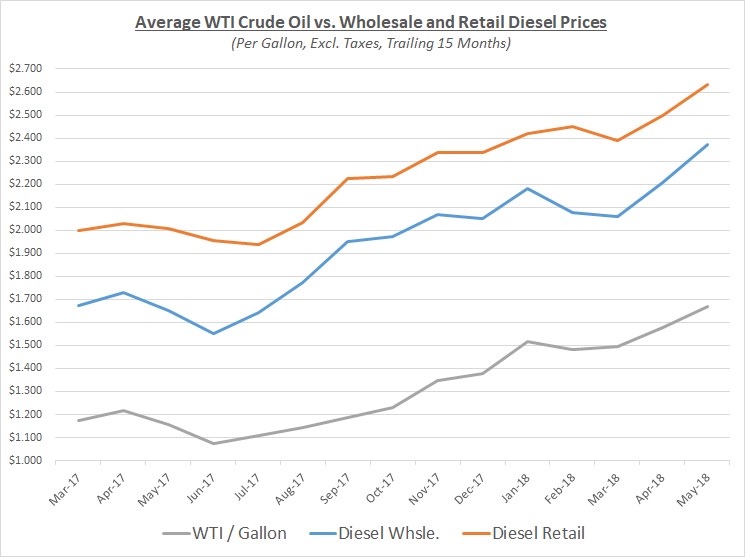

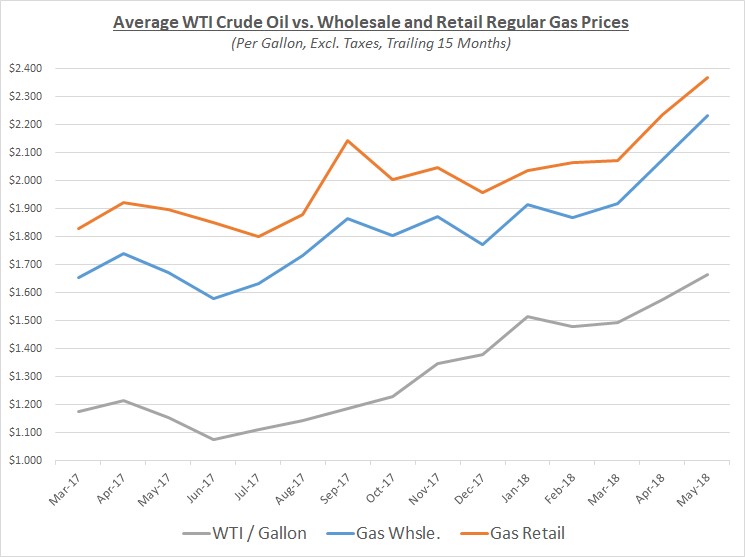

As prices for oil increased overall during May, diesel and gas followed at a swifter pace. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

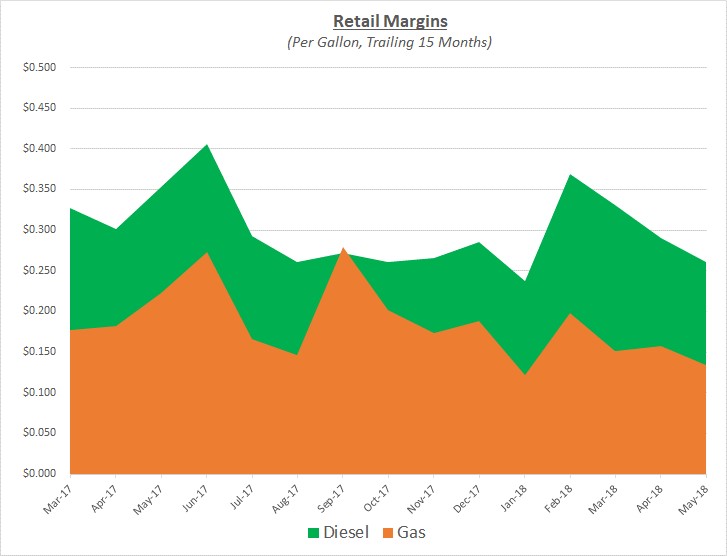

Due to the continued rapid increase in refined product prices during May, retail margins contracted further and have approached their lowest levels over the past year. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates crude oil prices will continue to fluctuate around $70 but there is significant uncertainty in the near-term. If the OPEC meeting in June results in an agreement to increase production, prices may decline toward the low- to mid-$60’s. However, prices could spike toward $75 and beyond if inventories resume their declines and no decision is made by OPEC to increase overall production.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.