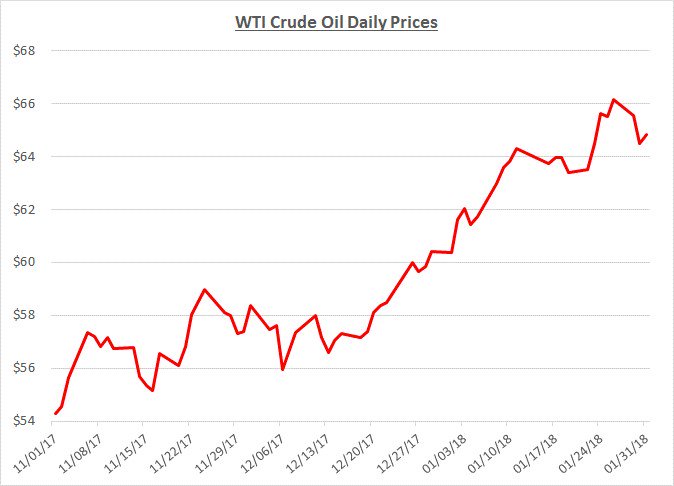

As 2018 got underway, crude oil prices continued their rapid climb and gained almost 10% during January. Prices are approximately 25% higher compared to the start of last year and have reached levels that haven’t been seen in over three years. The following graph shows the daily price movements over the past three months:

The continued rise in crude oil prices during most of January was driven by strong demand, declining inventory levels, a weakening US dollar, and news that production cuts by OPEC and other countries might be extended further into 2019. Near the end of the month, prices retreated slightly as inventory reports showed small builds. In addition, traders considered the impact of the anticipated expansion of US oil production in response to higher prices. The supply and demand balance that appeared to be within reach during 2018 could potentially be disrupted by additional US production.

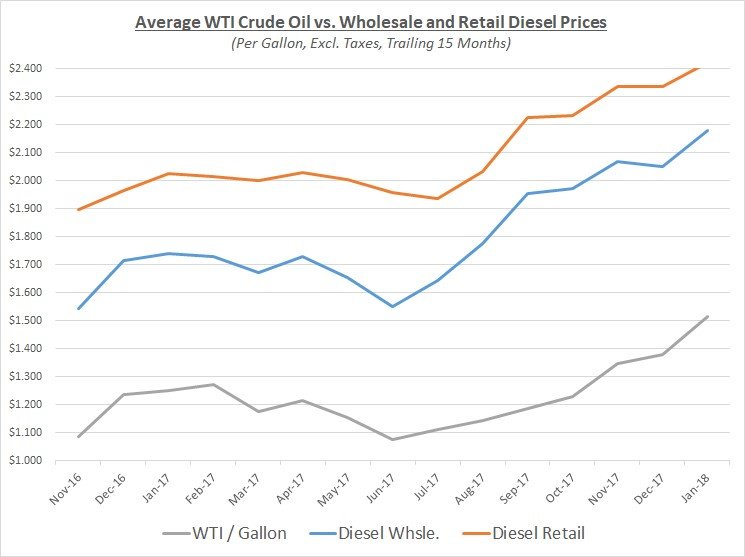

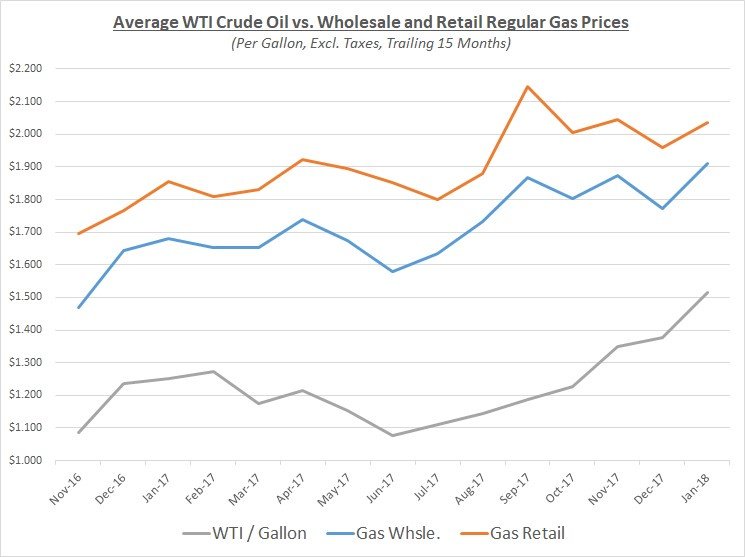

As oil prices were increasing during January, diesel and gas prices followed the trend. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

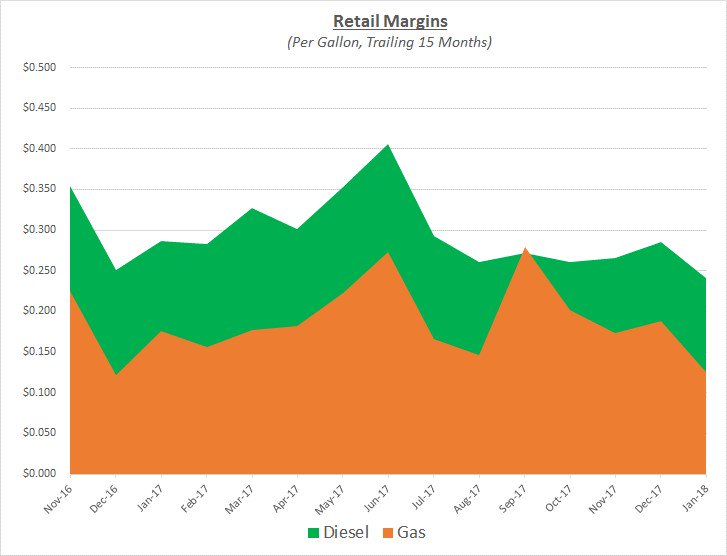

Wholesale prices, particularly for gas, rose faster than retail which sent margins to their lowest level over the past year. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Forecasting oil and fuel prices is always difficult as there are many factors to consider. This is especially true at the current time. Based on the most recent conditions, Sokolis anticipates crude oil prices will remain in the low- to mid- $60’s/barrel in the short-term. Prices could increase further toward $70 if demand remains strong, inventory levels continue to decline, and the ramp-up of US production takes longer than anticipated. If US production does increase rapidly, assuming no other major changes to demand, it could significantly limit further increases and possibly cause prices to fall back toward the $50’s by early spring.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.