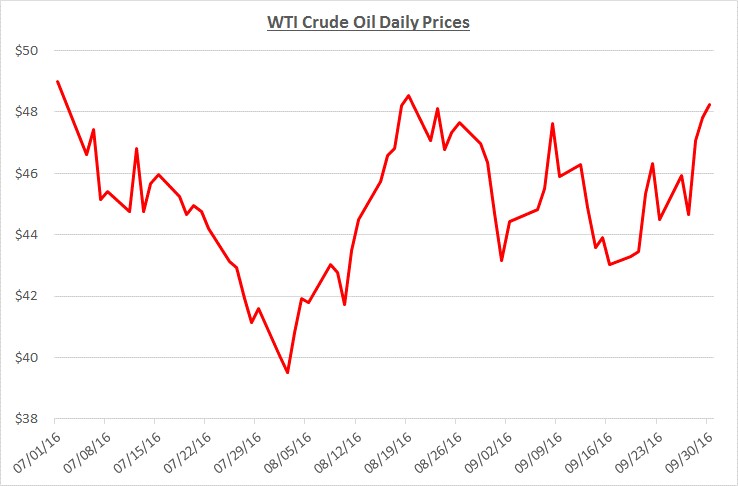

Crude oil prices were very volatile during September and the month ended just over $48/barrel. This is approximately 12% higher than where the month started. The following graph shows the daily price movements over the trailing three months:

September’s highs and lows were primarily driven by two factors; the first was the widening gap of excess supply versus demand. The second was anticipation of an agreement to limit production at an OPEC meeting scheduled toward the end of the month. The spike in prices at the end of September was directly related to an announcement following the OPEC meeting that its members agreed to work toward reducing production. The next OPEC meeting is scheduled for November at which time they will work to formalize their agreement with additional details.

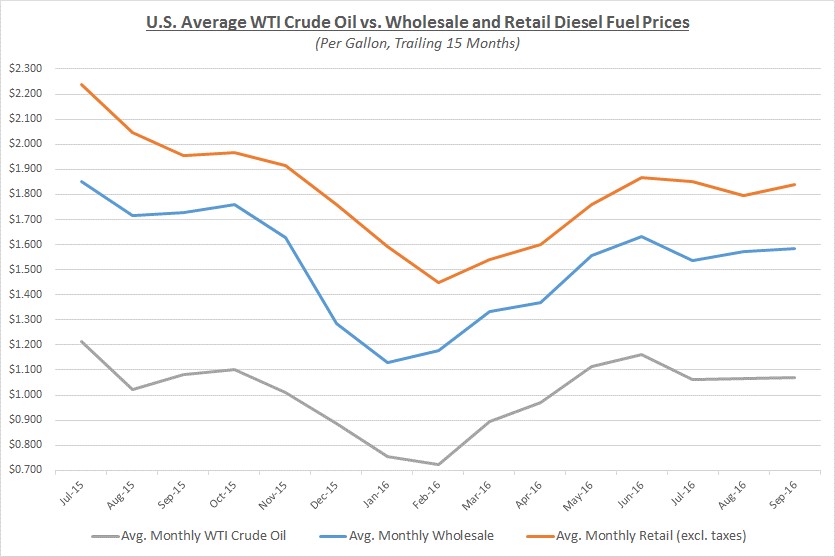

Despite the volatility in the daily price of oil, the average price for the entire month of September was relatively flat compared to August. However, wholesale diesel fuel prices moved up slightly in response to the volatility. Retail diesel prices also increased slightly more than wholesale. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

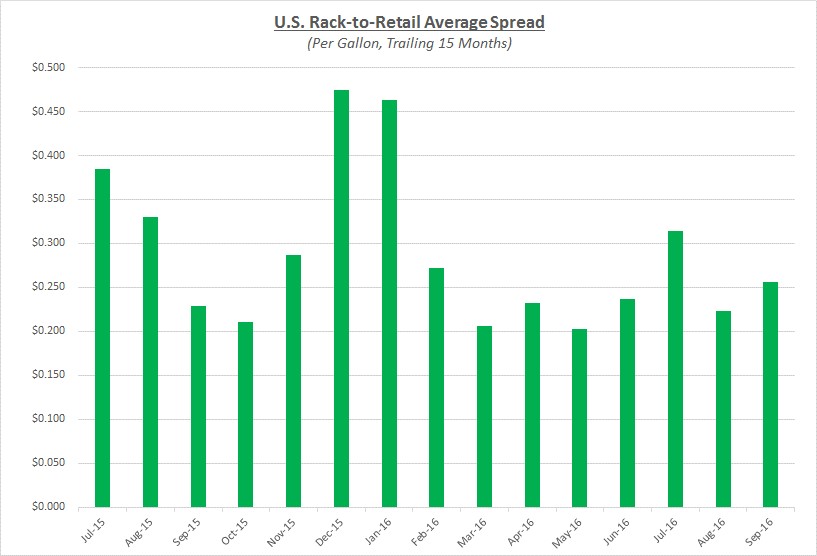

Due to the slightly larger increase in retail prices compared to wholesale prices, retail margins grew modestly as the following graph shows:

Due to the market changes in September, most fleets would have seen a small increase in their overall fuel cost compared to August. Looking beyond September, Sokolis anticipates prices will continue to be volatile as the market reacts to additional statements from OPEC members regarding their positions leading up to the next meeting in November. While an informal agreement to reduce production was announced, it is important to remember that specific plans have not been agreed upon yet and OPEC members do not have a solid history of complying with their agreements. These factors create some skepticism toward any future impact on production.

Crude prices will also continue to be very sensitive to regularly released reports measuring supply and demand. Recent news has been bearish for prices as excess supply has been growing. This has led many analysts to believe a market rebalance may be delayed until late 2017, assuming no specific action is taken by OPEC at their next meeting.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.