Happy New Year from Sokolis Fuel Management!

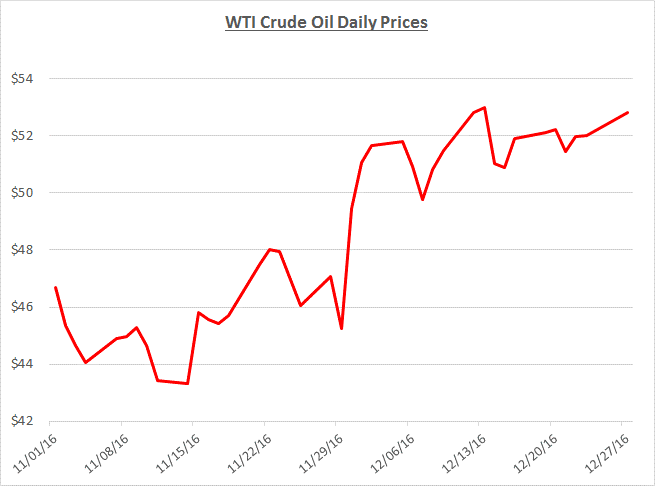

Oil prices traded in a narrow range around $52/barrel during December following a significant spike at the end of November. The spike upward was due to an agreement by OPEC and other foreign countries to reduce oil production beginning January 2017. The following graph shows the daily price movements over the past two months:

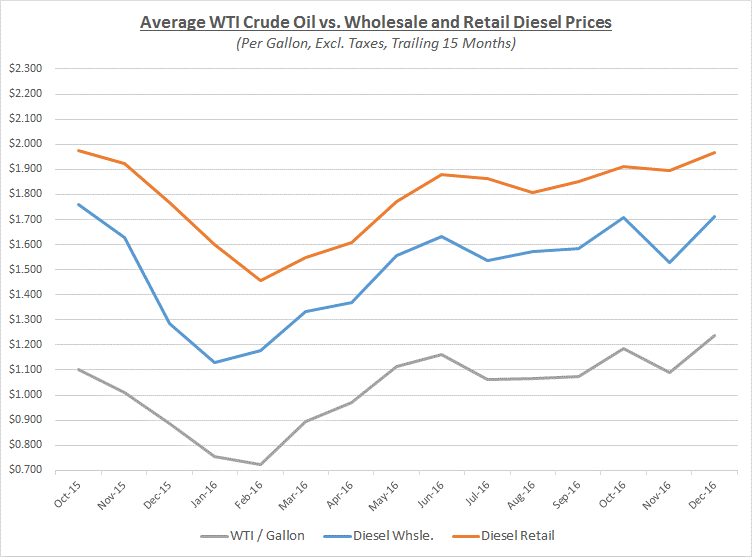

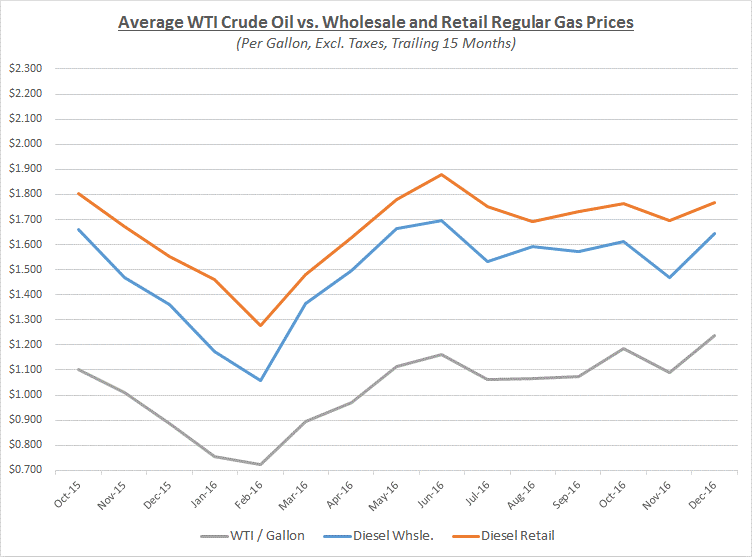

As a result of the spike in oil prices at the end of November, the average price for the entire month of December increased almost 15% compared to November. Wholesale fuel prices also increased significantly while retail prices responded slower since they had not decreased much during November. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

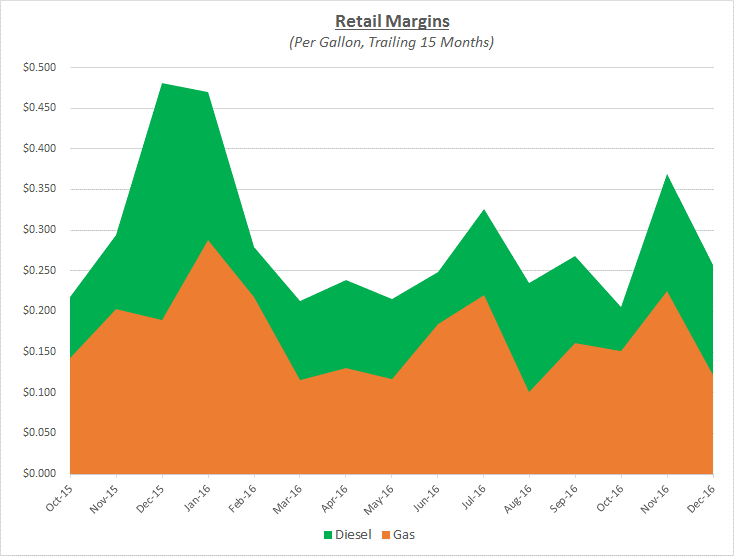

Due to the faster increase in wholesale prices compared to retail prices, retail margins fell back to their more typical levels as shown in the following graph:

As a result of the market changes in December, fleets with retail-based purchasing deals would have seen modest increases in their prices while fleets with deals based on wholesale prices would have seen more significant increases.

Looking beyond December, Sokolis anticipates prices will continue to trend above the $50/barrel level subject to evidence that OPEC and other foreign oil producers implement their agreed upon production cuts. If there is any news that indicates non-compliance with the deal, it could lead to a decline in prices.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.