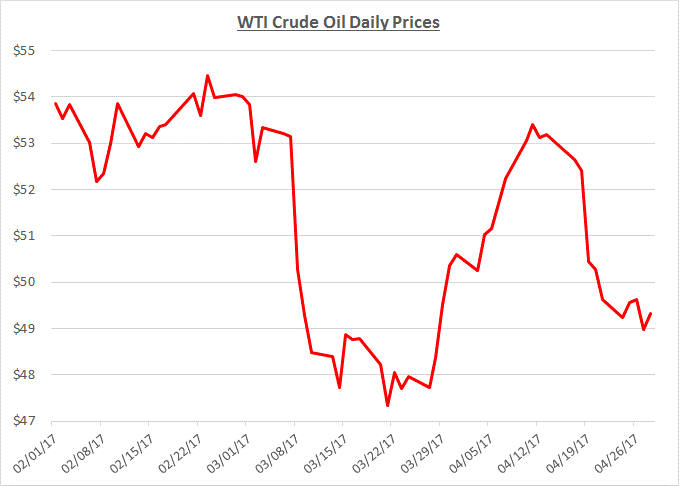

April was an active month for oil prices which started at just over $50/barrel, steadily climbed over $53 by mid-month, then fell back below $50 near the end of the month. The following graph shows the daily price movements over the past three months:

As April began, there was anticipation that inventory levels would begin to decline and the market would move closer to rebalancing supply and demand. This was partially due to OPEC’s agreement to reduce production which started during January 2017 and has been followed by a very high rate of compliance. In addition, an increase in demand for gasoline was expected as driving increases with the warmer weather. This optimism drove prices higher throughout the first half of April.

Toward the middle of April, mixed signals about inventory levels and weaker than expected demand for gasoline eroded the market’s confidence. As a result, prices began to decline through the end of the month.

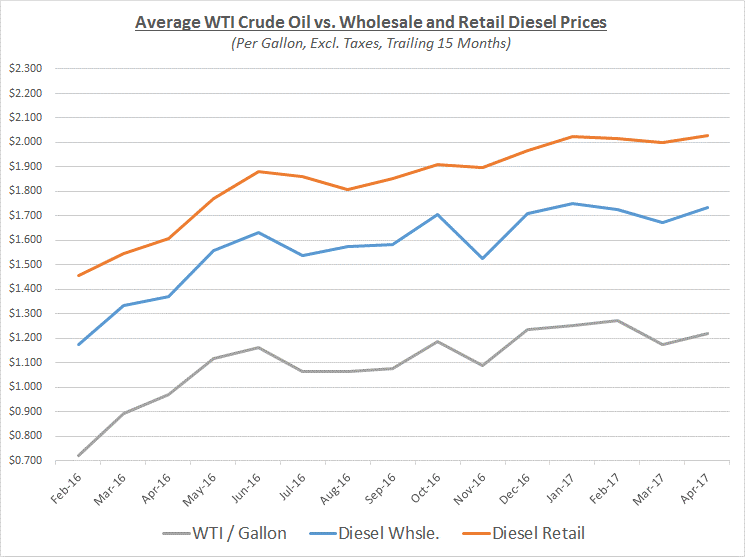

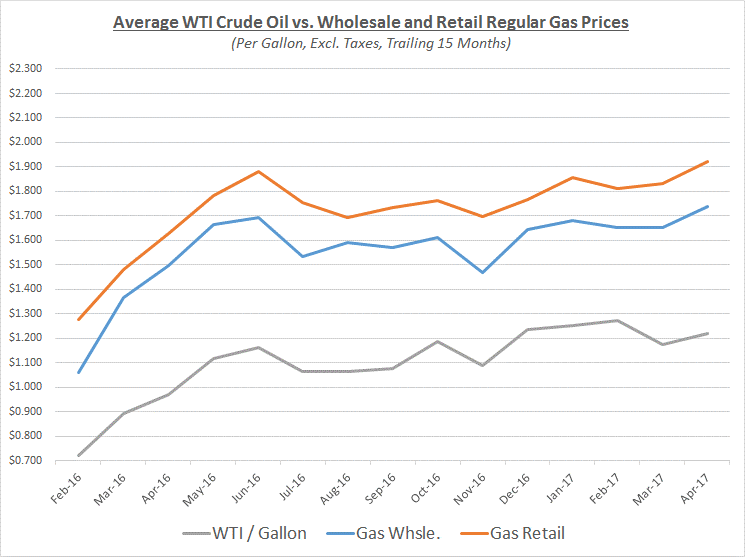

Despite the overall volatility in crude prices during April, the average price for the month increased slightly compared to March. Wholesale and retail diesel fuel prices also showed small increases while gasoline prices increased faster. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

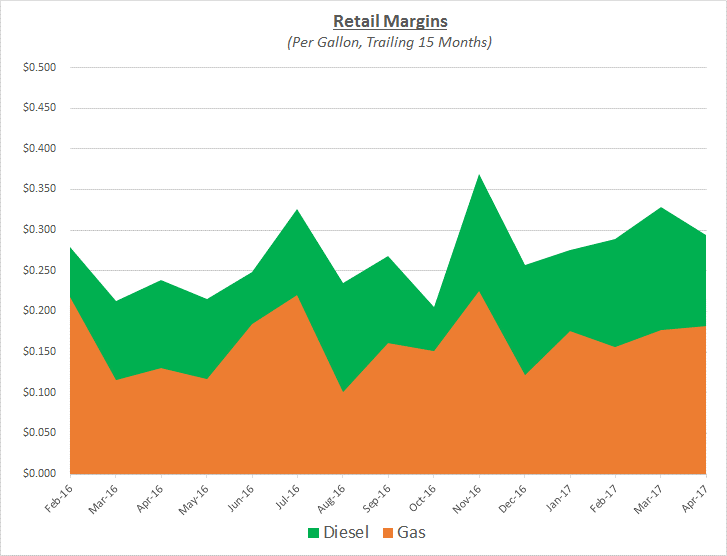

April wholesale prices for diesel increased slightly faster than retail prices causing margins to narrow. For gasoline, retail and wholesale prices increased at the same rate so margins were relatively unchanged. The following graph shows the margin trends over the trailing 15 months:

Because of the market changes in April, most fleets purchasing diesel would have seen small increases in their prices while gasoline fleets would have seen more significant increases.

Looking beyond April, Sokolis anticipates oil will continue to hover near the $50/barrel level for the next several months. OPEC will most likely extend their production cuts for an additional six months which will provide limited support for prices. However, for prices to avoid falling further, inventory levels need to decline and demand needs to increase. If rig counts continue to rise and inventory levels do not subside, prices could remain below $50/barrel with the potential to fall toward the low- to mid-$40s.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.