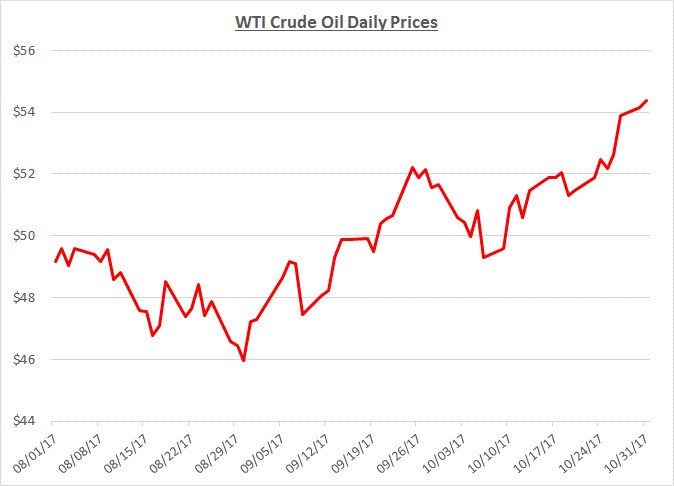

Crude oil prices posted a net gain of roughly 5% during October following an increase of approximately 10% back in September. Prices started the month at just under $52/barrel and closed the month at just over $54. The following graph shows the daily price movements over the past three months:

The continued increase in crude oil prices was primarily due to reports that OPEC and other non-OPEC countries were likely to extend their production cuts through the end of 2018. Their reductions originally went into place at the beginning of 2017 with the intent to last six months. Those cuts were implemented with very strong compliance and were also extended through 2017. Recent inventory reports have started to reflect declines which may be partially attributable to the cuts. With the likelihood that the cuts will be extended further while inventories are declining, there is widespread belief that demand could begin to outpace supply which is driving up prices.

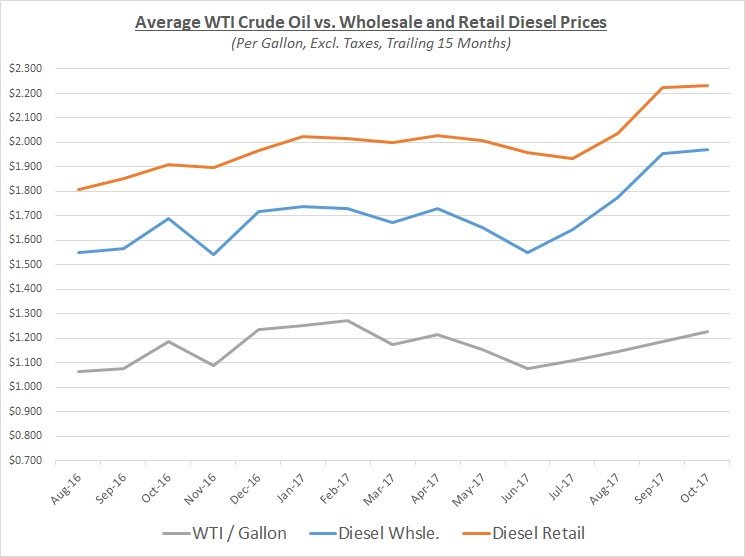

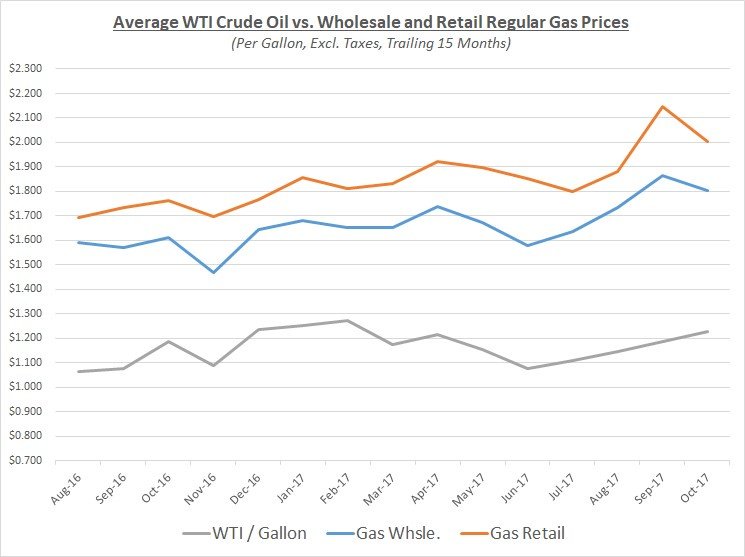

While oil prices continued to increase during October, diesel increased only slightly while gas dropped almost 10%. These refined products had experienced sharp increases in September due to the impact of the hurricanes on refining and distribution operations. Recovery from the impact of the hurricanes is substantially complete which has limited further increases. In addition, a decrease in demand for gas after the summer driving season has put downward pressure on gas prices while demand for diesel has remained strong heading into heating oil season. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

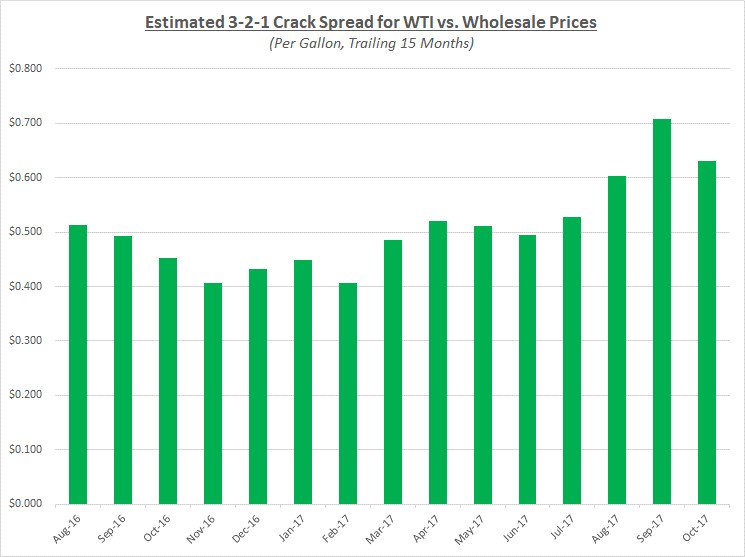

Wholesale and retail prices have remained at their highest levels since the summer of 2015 even though the recent spike was primarily due to the hurricanes. These relatively high prices have benefited refiners as they continue to enjoy unusually large “crack spread” that we highlighted last month. As a reminder, the difference in crude versus refined product prices is referred to as the crack spread in the petroleum industry. This metric is often calculated as a 3-2-1 ratio based on the assumption that three barrels of crude oil can be refined (processed through the cracking unit) into two barrels of gas and one barrel of diesel. The following graph shows the estimated 3-2-1 crack spread over the last 15 months:

The crack spread has subsided from its peak last month but remains elevated. If the crack spread returns to more typical levels in the near future, prices for diesel and gas should begin to subside. However, this assumes there are no further increases in the underlying price of crude oil.

Looking beyond October, Sokolis anticipates crude oil prices will continue to hover in the mid-$50’s/barrel for the remainder of the year. There is some potential for prices to climb further toward $60 if OPEC and other oil producing countries announce a formal agreement to extend their production cuts throughout 2018. They will review their agreement at their next official meeting scheduled for November 30th.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.