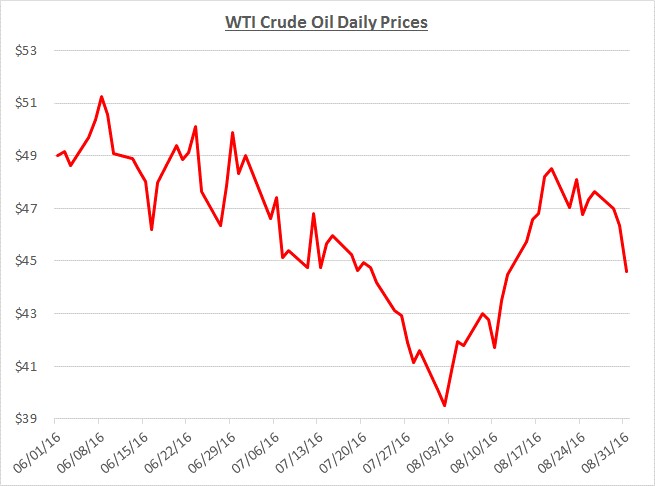

Crude oil prices rocketed upward during the first half of August peaking at roughly 20% above the opening price for the month. This was a particularly volatile change especially considering it was immediately preceded by a steep decline in July. The following graph shows the daily price movements over the trailing three months:

The rapid increase in August was primarily driven by news that OPEC members planned to reconvene in September to discuss placing limits on oil production to help support prices. In addition, statements from some prominent OPEC members had been interpreted as though they were more inclined to take action compared to previous meetings. Despite the apparent change in tone, reaching an agreement remains elusive due to the conflicting interests of the individual members.

Toward the end of August, prices retreated from their highs and the weakening may be partially attributable to doubts about OPEC’s ability to reach an agreement. In addition, a strengthening US dollar along with reports of slowing global demand contributed to the late decline.

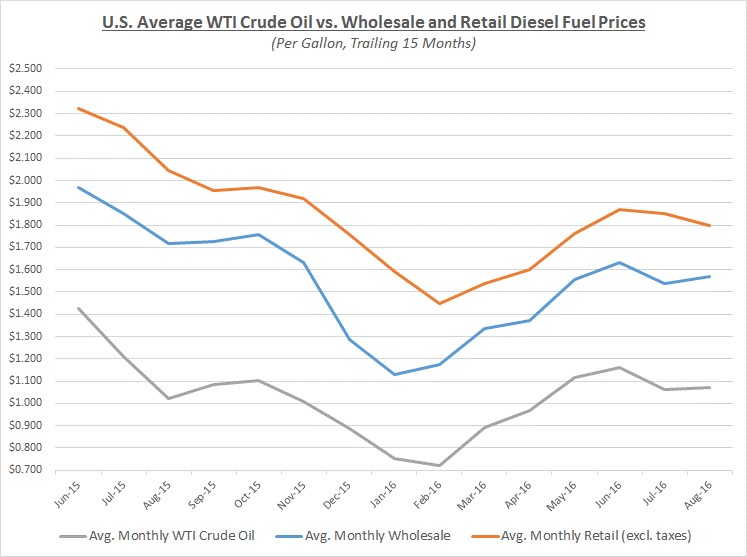

Despite the volatility in the daily price of oil, the average price for the entire month of August was relatively flat compared to July. However, wholesale prices bumped up slightly in response to the volatility. Meanwhile, retail prices continued their slow decline primarily as a delayed reaction to the rapid wholesale drop in July. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

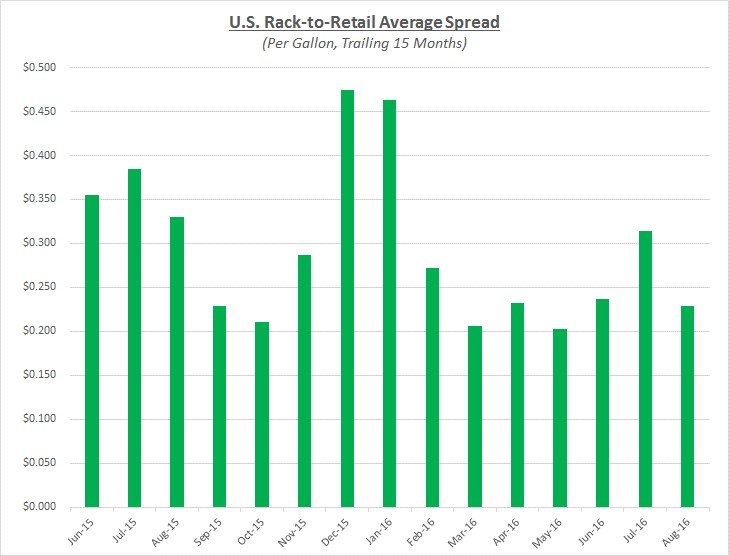

Due to the small retail decrease combined with the small wholesale increase, retail margins fell back to a more typical level as the following graph shows:

Due to the market changes in August, most fleets would have seen a modest increase in their overall fuel cost compared to July. Looking beyond August, Sokolis anticipates prices will continue to be volatile through the upcoming OPEC meeting scheduled for late September. Assuming a similar outcome as OPEC’s previous meeting, no agreement to limit production will likely cause a temporary drop in prices followed by an extended period of gradual increases through 2017. However, in the event that an agreement is actually reached, prices would likely spike higher followed by continued volatility for the foreseeable future.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.