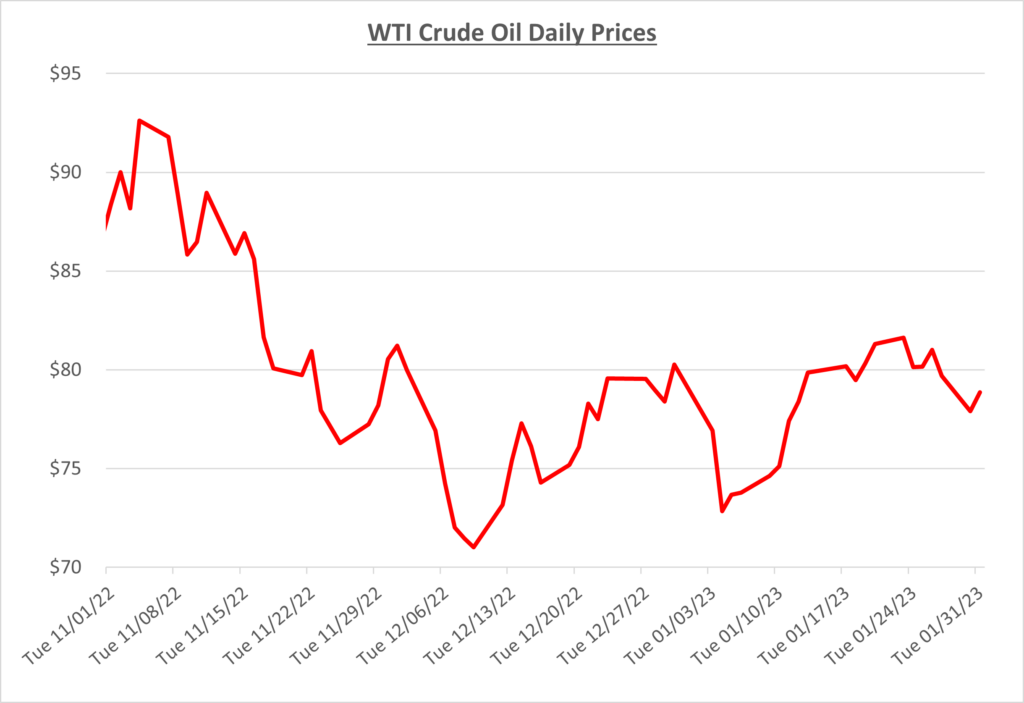

Oil finished 2022 briefly topping $80/barrel, then started 2023 just under that mark. Early in January, prices quickly fell toward the low $70’s per barrel. The decline was mainly attributable to concerns about global oil demand as China struggled with surging Covid cases. In addition, a mild start to the winter season and economic recession fears were among other reasons that sent oil prices falling. The following graph shows the daily price movements over the past three months:

By mid-January, fuel prices started to rebound with positive news coming from China. Bloomberg reported that Chinese demand could hit a record this year as the country moves away from their ZERO COVID policy. With China being the largest importer in the world, any positive news to their economy seems to result in a bullish approach to oil prices.

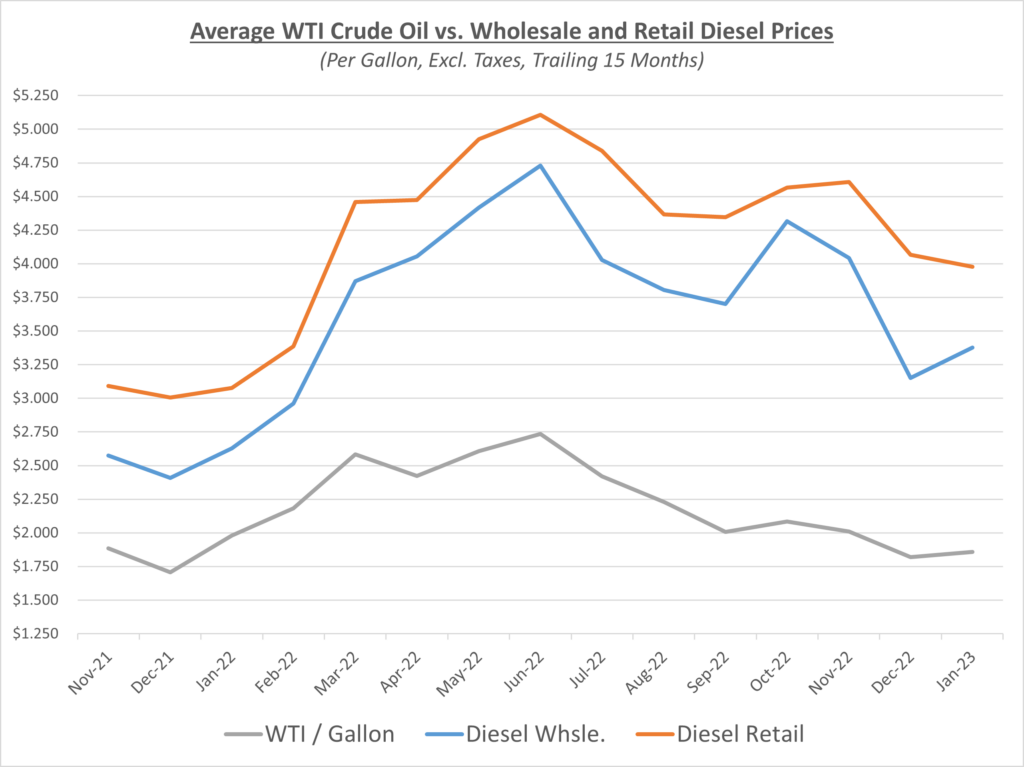

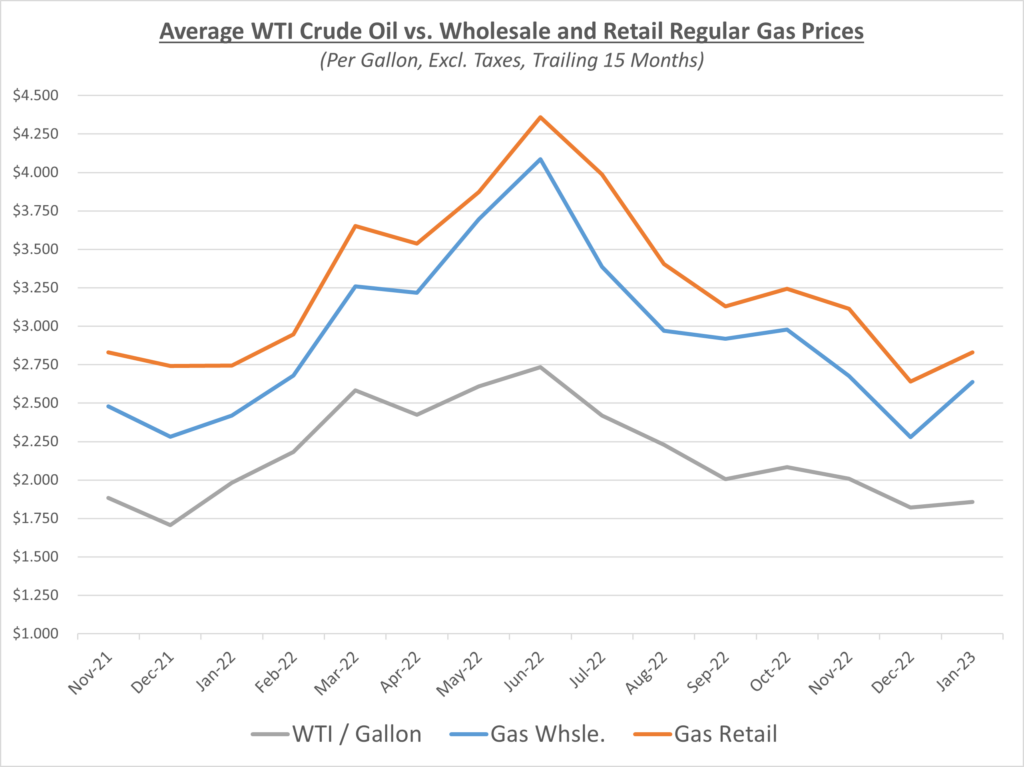

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

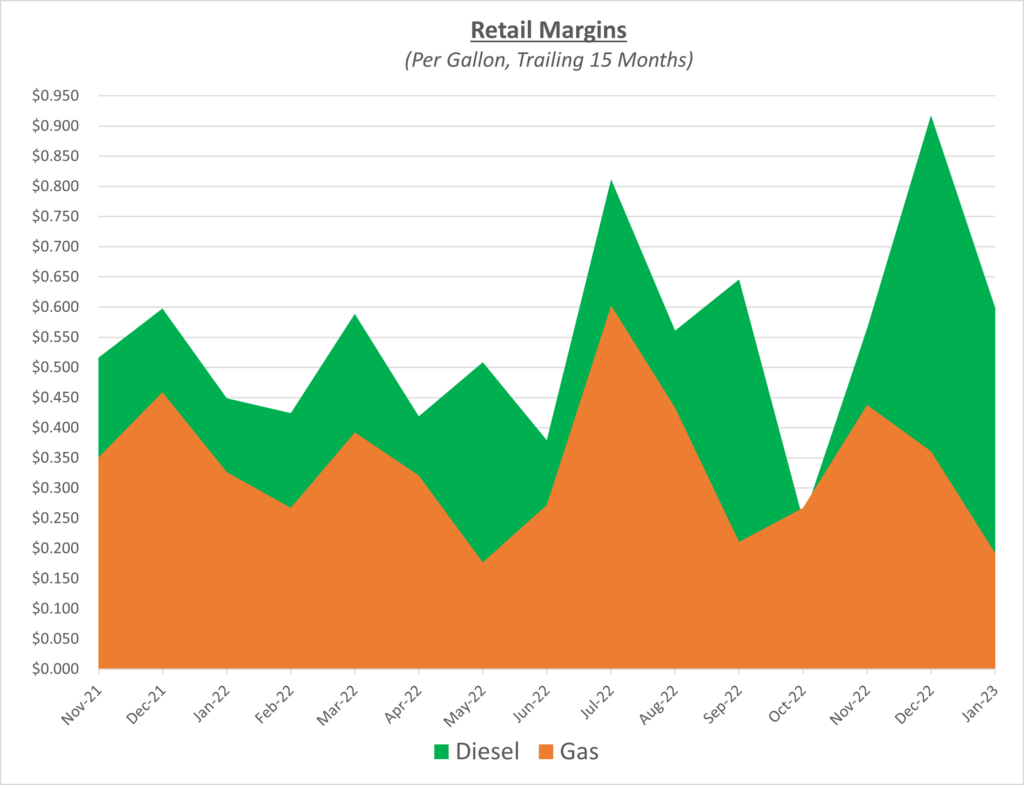

January’s diesel retail margins fell from the highs seen in December but remained elevated compared to average months. The same could not be said for gasoline. Gas retail margins nosedived as wholesale prices increased faster than retail could keep up. This created very tight margins for gas retail suppliers. The following graph shows the retail margins over the trailing 15 months:

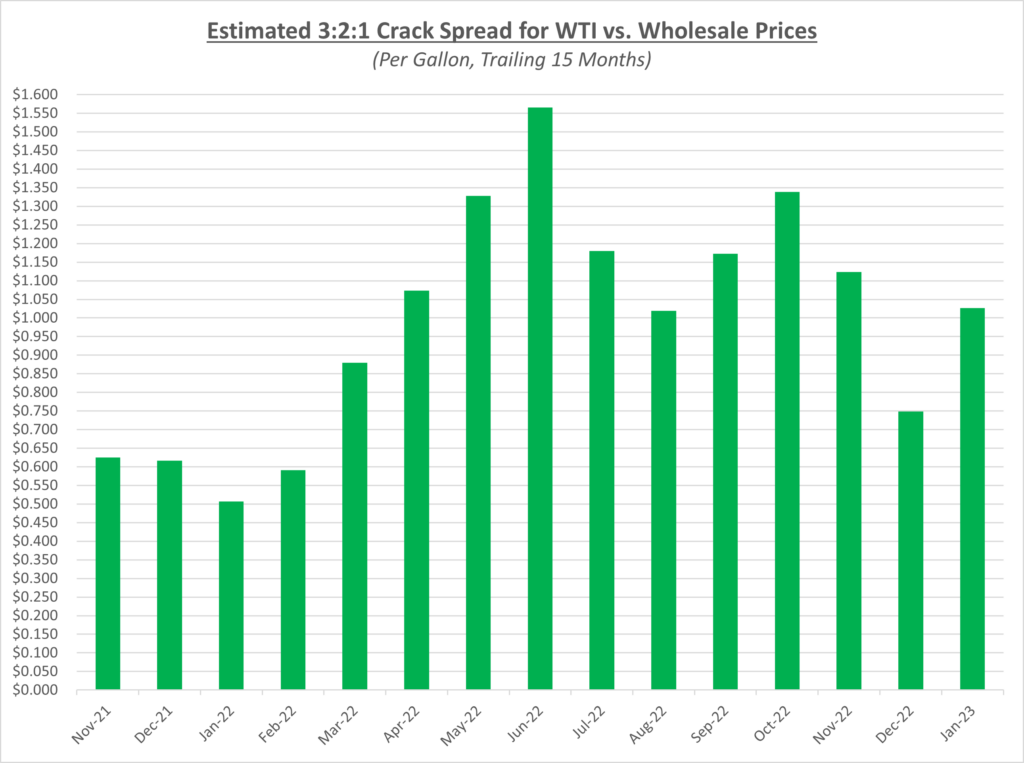

Crack spreads saw a jump in January after falling the last two months of the year. Even with this increase to start the year, if we are indeed heading into a weaker global economy, it will make it difficult for crack spreads to see the levels they reached in 2022.

Aside from the brief dip seen early in January, oil prices rebounded and hovered around the $80/barrel mark for most of the month. According to AAA, the national average gas price increased by roughly $0.30 to $3.50/gallon, while diesel prices remained virtually unchanged at about $4.68/gallon.

Crude inventories continue to see builds even with the SPR not having any additional releases into the market. Along with a relatively smooth winter so far, these are some factors that are keeping a lid on oil prices. Global demand is still not back to pre-pandemic levels, but that could change if China is able to get Covid cases under control. For the time being, Sokolis believes that oil prices will remain in the $75-90/barrel range. We will do our best to keep you updated with the latest news.