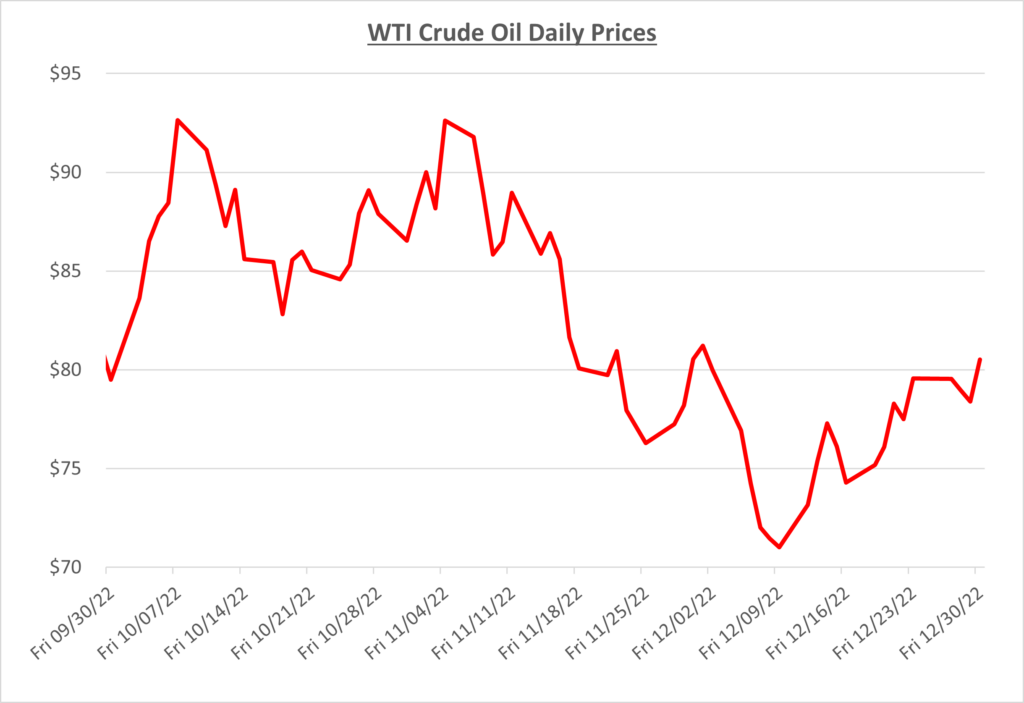

Oil spent most of December in the $70s per barrel even with OPEC’s decision to stick with their 2 million barrels per day cut established in October. Falling oil prices created some extremely high retail margins for both diesel and gas as retail stations were slow to lower their pump prices matching the market. The following graph shows the daily price movements over the past three months:

After starting December at $81/barrel, oil prices continued to fall hitting as low as $71/barrel. Even with back-to-back reports of crude oil inventories falling, we still saw builds in gas and diesel inventories. Decreasing demand has outweighed any decisions OPEC+ made in their December meetings.

A portion of the Keystone Pipeline in Kansas had to be shut off due to a leak that resulted in 14,000 barrels of crude spilling into a creek. Less than a week later the issue was contained, and the Environmental Protection Agency confirmed that it did not impact drinking water. On December 29th the Keystone Pipeline was fully restored.

By mid-month, oil prices started to increase as China made some big changes to their COVID-19 guidelines. It appears the protests influenced President Xi as China has now relaxed their once extreme “zero-COVID” policies. With China being such a large economy, signs of opening back up brings hope for increased demand which can be attributed to increasing oil prices.

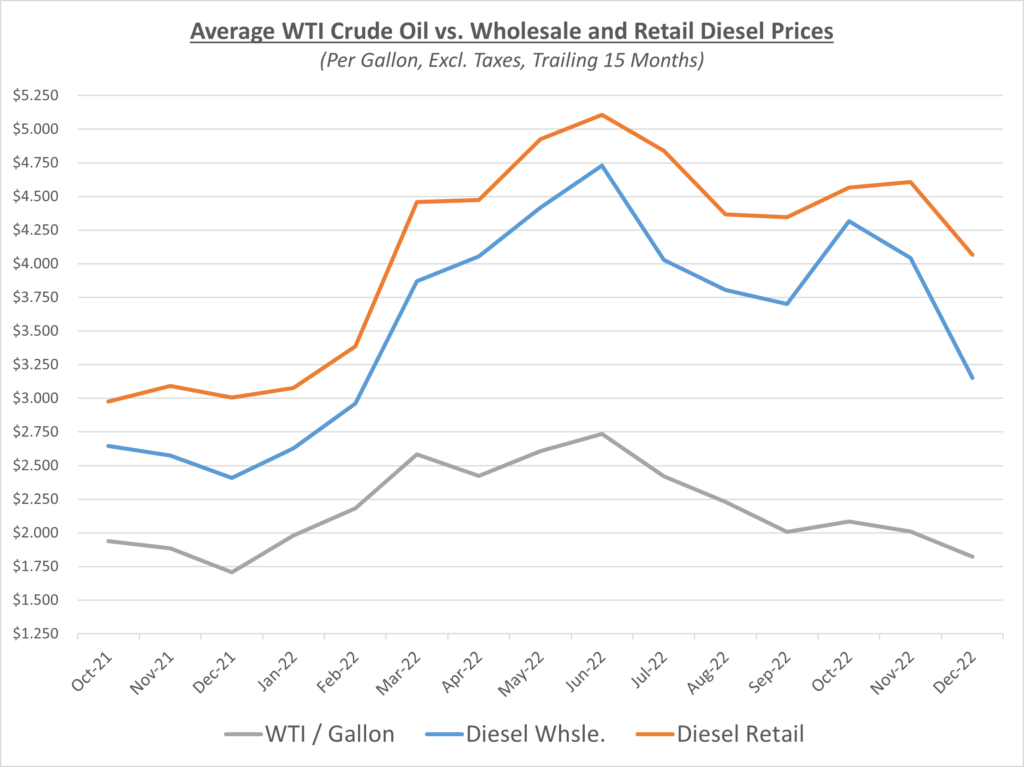

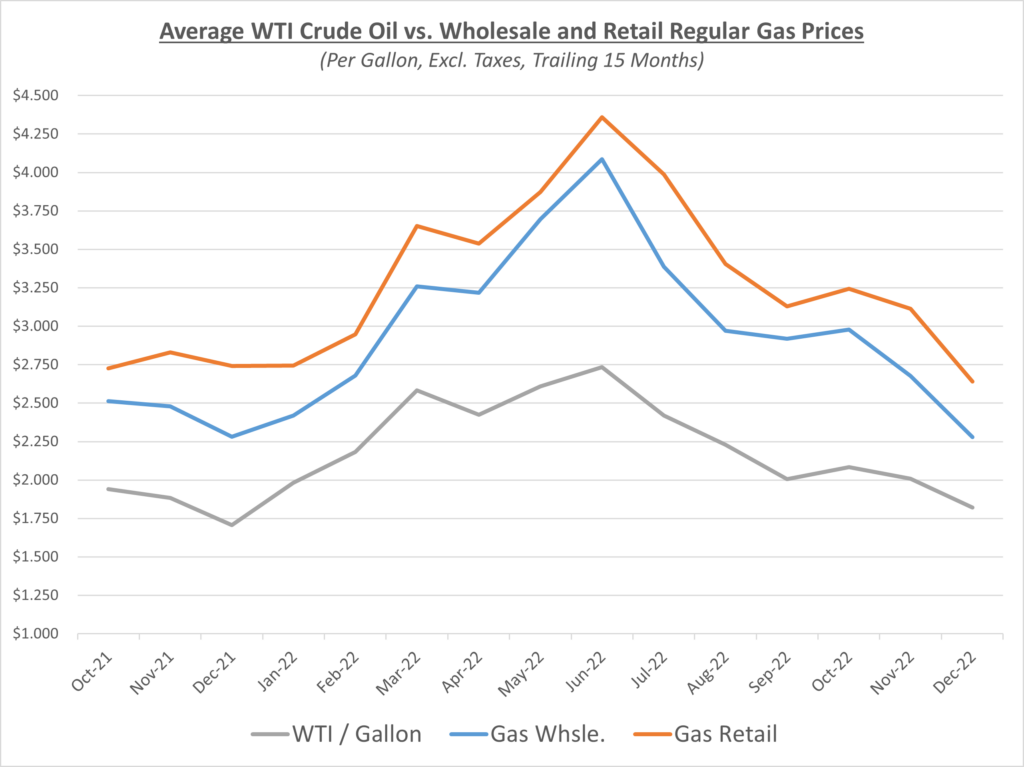

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

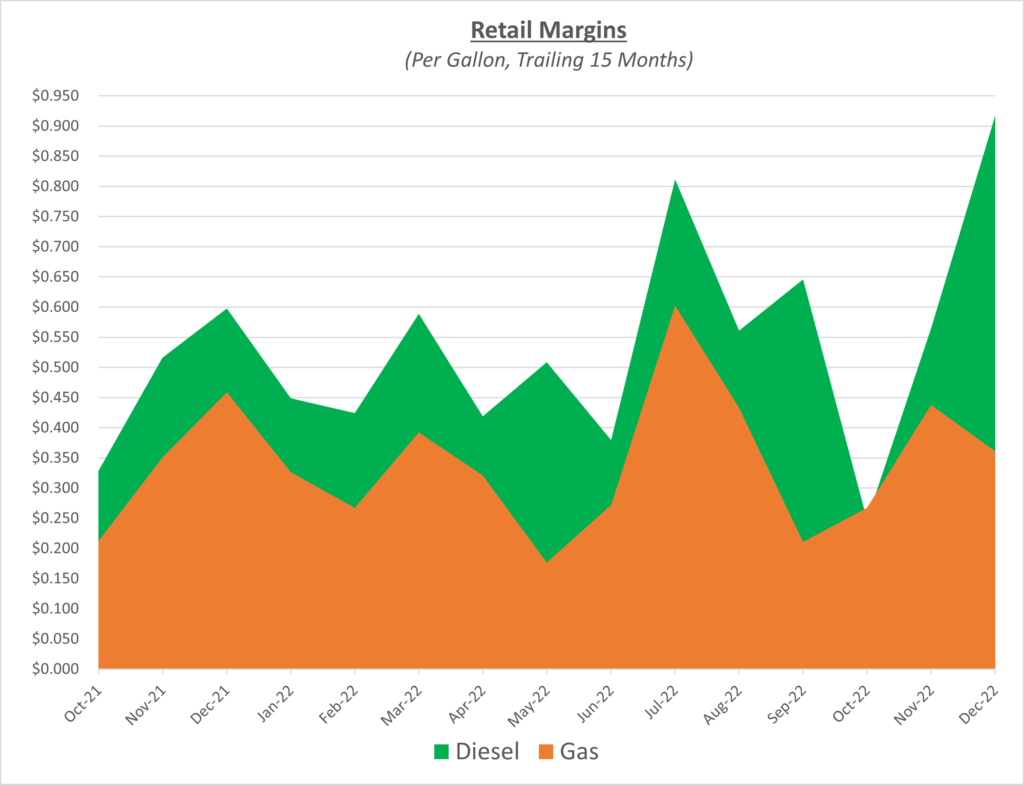

We saw unprecedented retail margins in December for both diesel and gas, which was a result of wholesale prices falling much quicker than retail prices. Consumers saw prices dipping at the pumps around the holidays, and fuel suppliers received a nice gift of high profit margins. Both sides had a merry end to the year! The following graph shows the retail margins over the trailing 15 months:

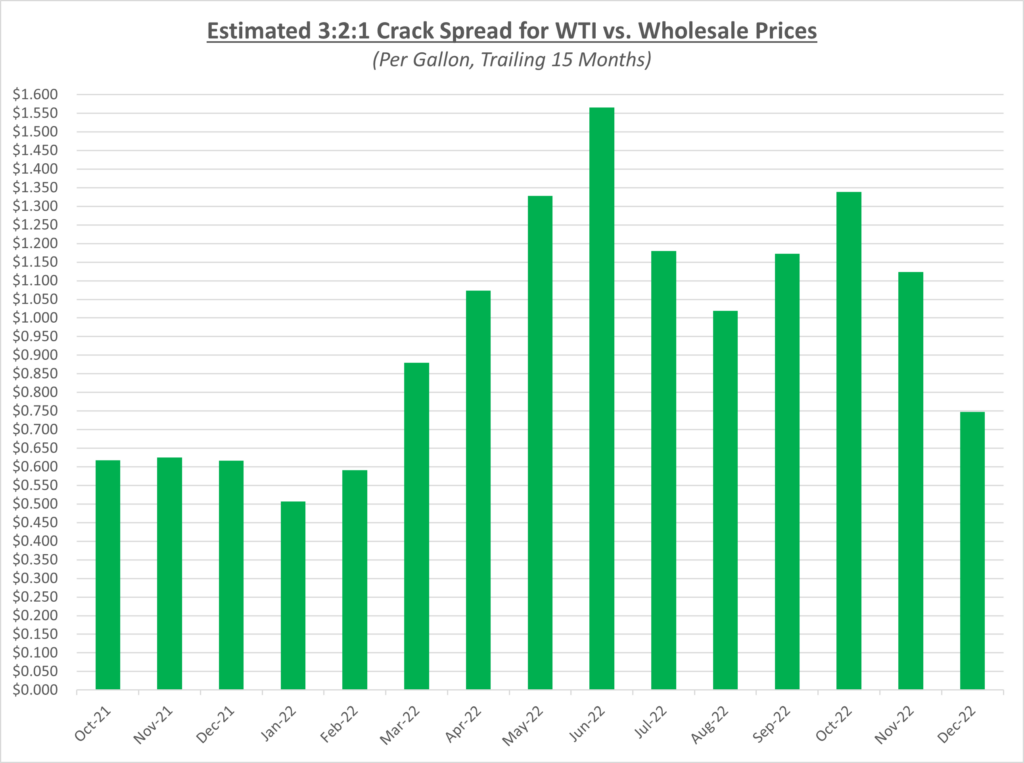

As shown in the graph below, crack spreads continued their decline from November into December, but at a much steeper pace. This is lowest we have seen crack spreads since February of 2022. This may be a sign that the glory days of 2022 are behind us and 2023 will have much lower crack spreads due to many factors including a weaker global economic outlook.

December oil prices were like rolling hills as they started the month at $81/barrel, dipped all the way to $71/barrel and then finished the month above $80/barrel. According to AAA, the national average gas price declined to $3.23/gallon, a drop of approximately $0.20/gallon. Diesel prices had a much larger drop of $0.43/gallon to a national average of $4.68/gallon.

2022 was a year of volatility for fuel prices. 2023 could be just as interesting with the potential for a weaker global economy, continuing war in Ukraine, and many other issues. For the time being, Sokolis believes that oil prices will remain in the $75-90/barrel range. We will do our best to keep you updated with the latest news.