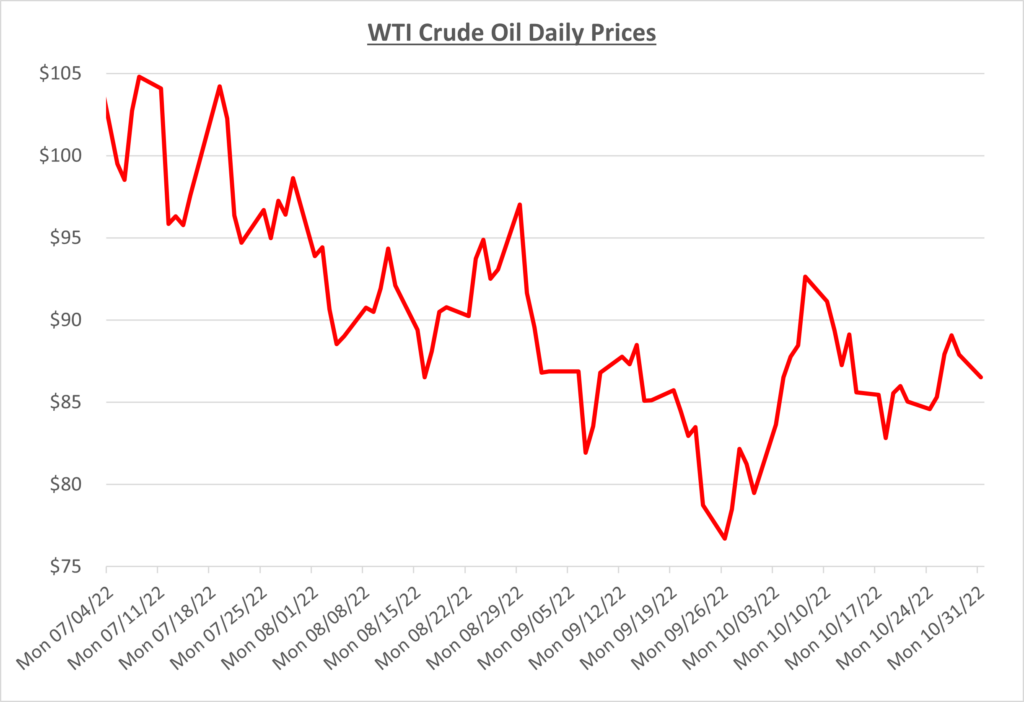

After bottoming out at about $76/barrel in September, oil prices turned upward in October. OPEC+ met and announced supply cuts of 2M barrels per day which resulted in oil prices passing $90/barrel in early October. The following graph shows the daily price movements over the past three months:

It’s pretty evident that OPEC+ would prefer to keep oil prices as close to $100/barrel as possible with the announcement of their production cuts, even with the attempted persuasion from the U.S. to go the opposite route and increase supply. Fuel suppliers were unhappy seeing the decline in profits they grew accustomed to over the past year. Unfortunately, the U.S. doesn’t have the ability internally to fill the gap as it may once had with shale production. Diesel is at its lowest seasonal level in 40 years and China demand only has one way to go at this point, up.

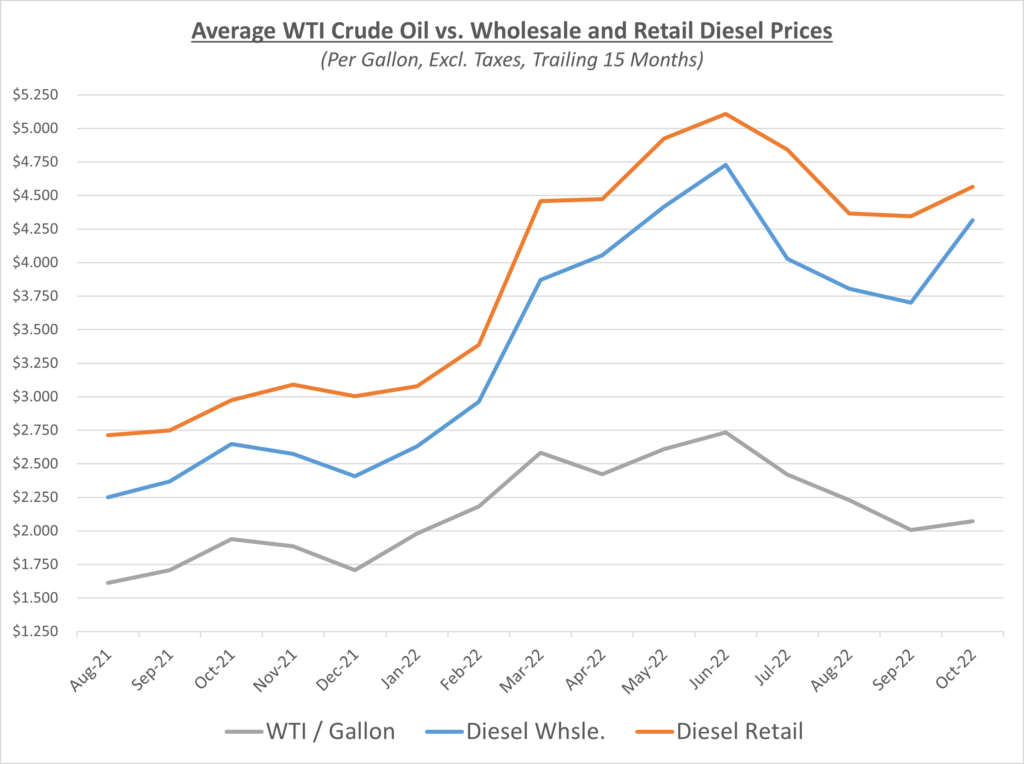

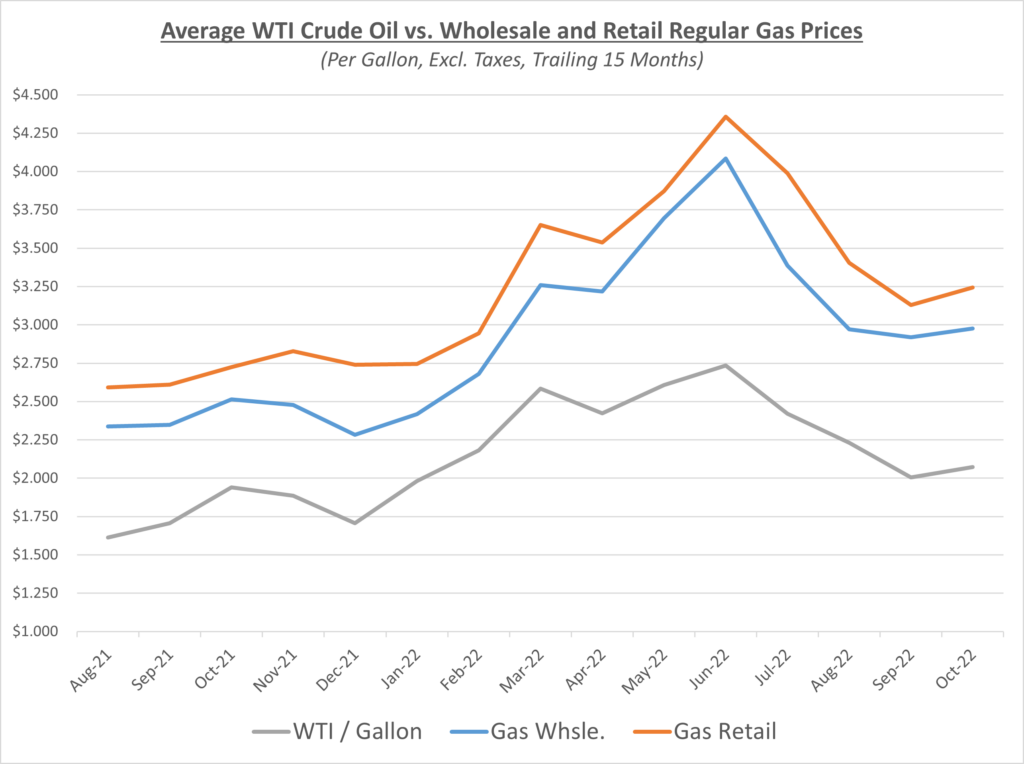

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

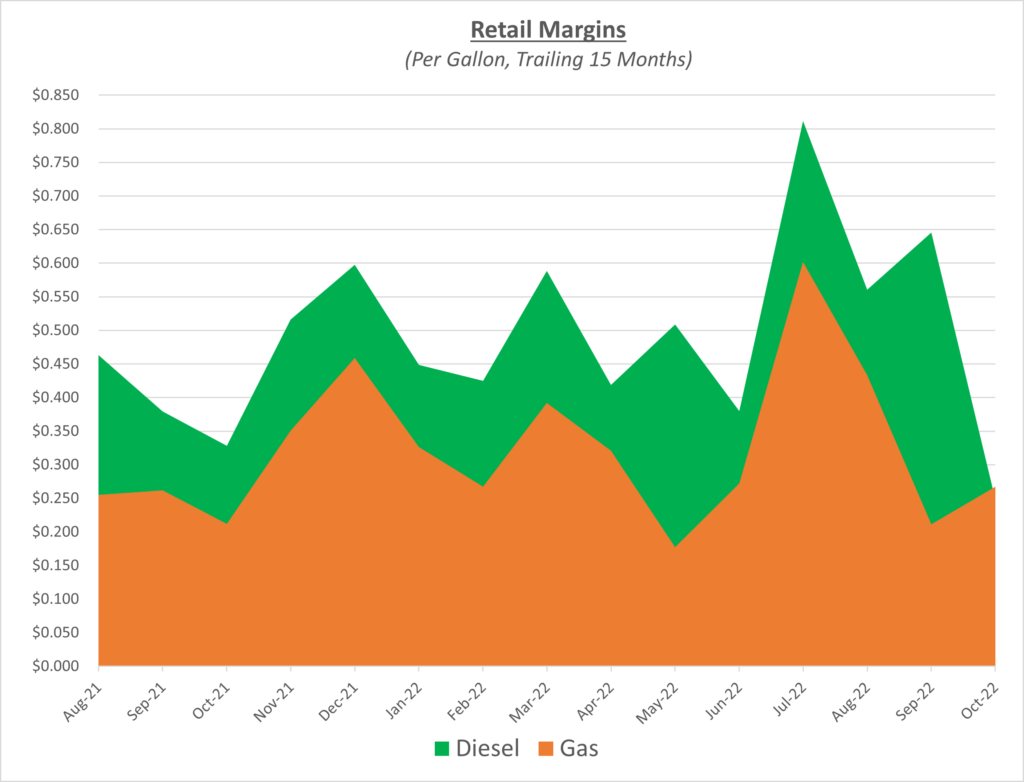

Diesel wholesale prices increased sharply in October outpacing retail prices. This resulted in a large drop in retail margins throughout the month. Retail gas prices and wholesale were on similar trajectories, but retail gas price increased slightly more than wholesale which caused a small increase in profit margins for gas retail suppliers. The following graph shows the retail margins over the trailing 15 months:

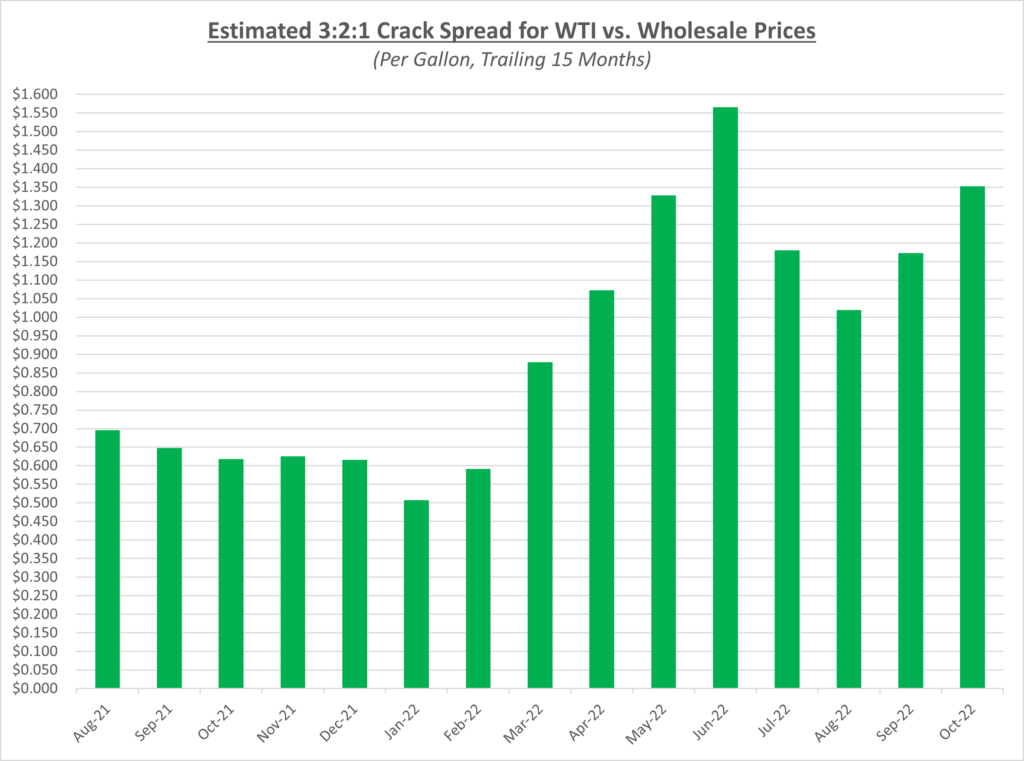

Crack spreads increased in October to the second highest level in 2022 as show in the graph below. Sitting at over $1.35/gallon, these spreads are extremely elevated.

Oil finished October at over $86/barrel, which was about 9% higher from where it ended in September. According to AAA, the national average gas price declined to $3.758/gallon, a drop of approximately $0.04/gallon. Diesel prices on the other hand showed a large ascent by about $0.44/gallon to a national average of $5.31/gallon.

As mentioned in our “East Coast Diesel Fuel Supply Alert”, the hot topic of the month was diesel supply falling to just 25 days’ worth of supply. While supply is tighter than we would like to see, especially on the East Coast, this has been the case for most of 2022. The news reports can be misleading seeing as this is more of an industry benchmark than an actual count down to how many days we have left until fuel has run out. However, the result of tight stockpiles will keep diesel prices elevated until supply begins to outgain demand.

With what we know presently, Sokolis believes that oil prices will remain in the $85-95/barrel range. They could increase further if supply were to get even tighter, or demand increases sharply. We will do our best to keep you updated with the latest news.