Oil and fuel prices extended their downturn from July. Oil dropped below $87/barrel in August, which is the lowest we’ve seen since the end of January. Demand destruction and global economic worries continue to lead the way in causes for the fuel market to cascade. The following graph shows the daily price movements over the past three months:

It has been quite some time since oil prices have remained under $100/barrel for a consistent period. In August, prices struggled to remain above $90/barrel which is the lowest we have seen since the war between Russia and Ukraine began. China’s demand is down almost 10% year over year due to their COVID restrictions and that is giving supply some breathing room. The EIA and API started the month with consecutive large crude builds while analysts were expecting a draw. There has also been positive news of a US and Iran nuclear deal which would bring more product into the market.

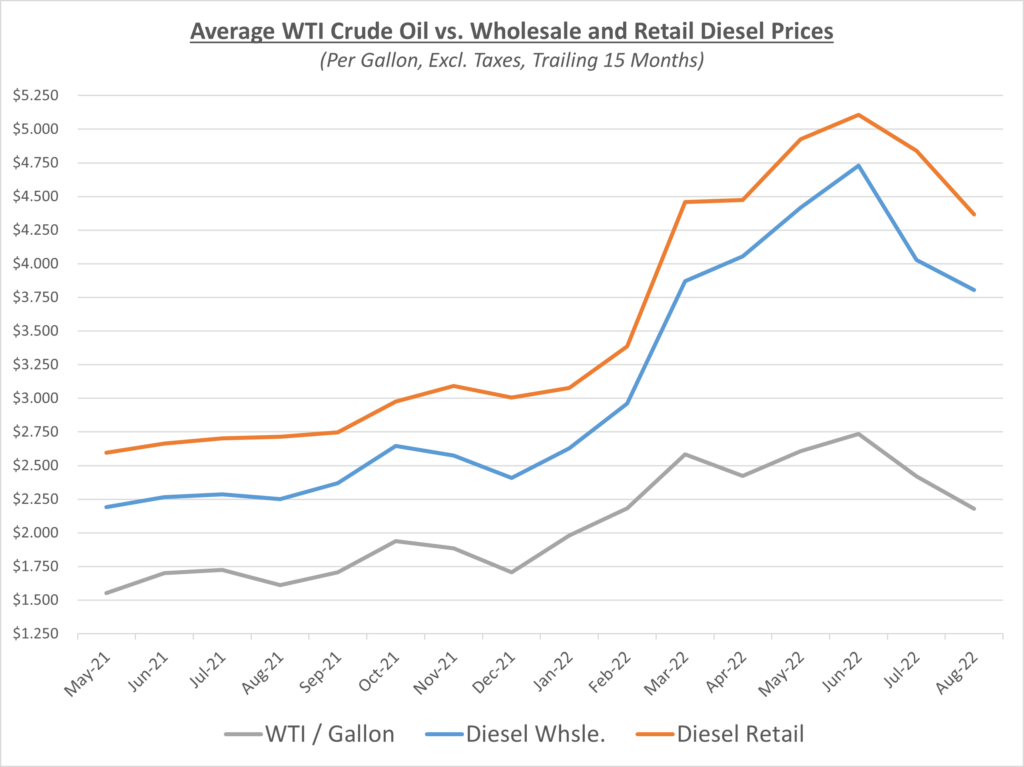

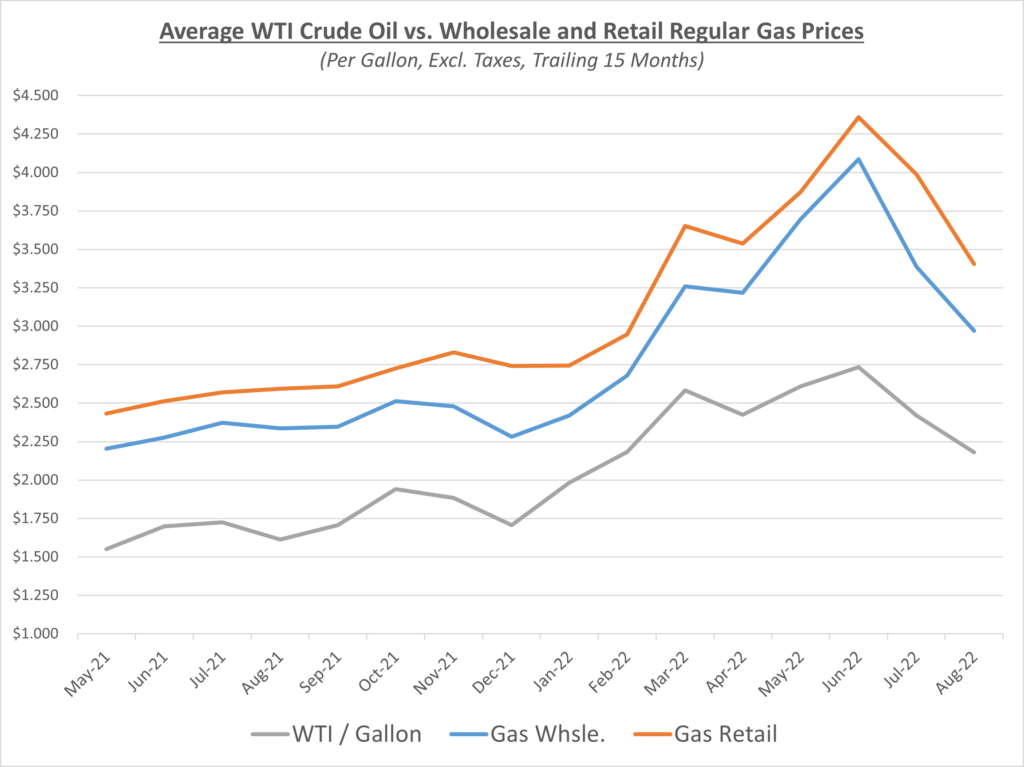

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

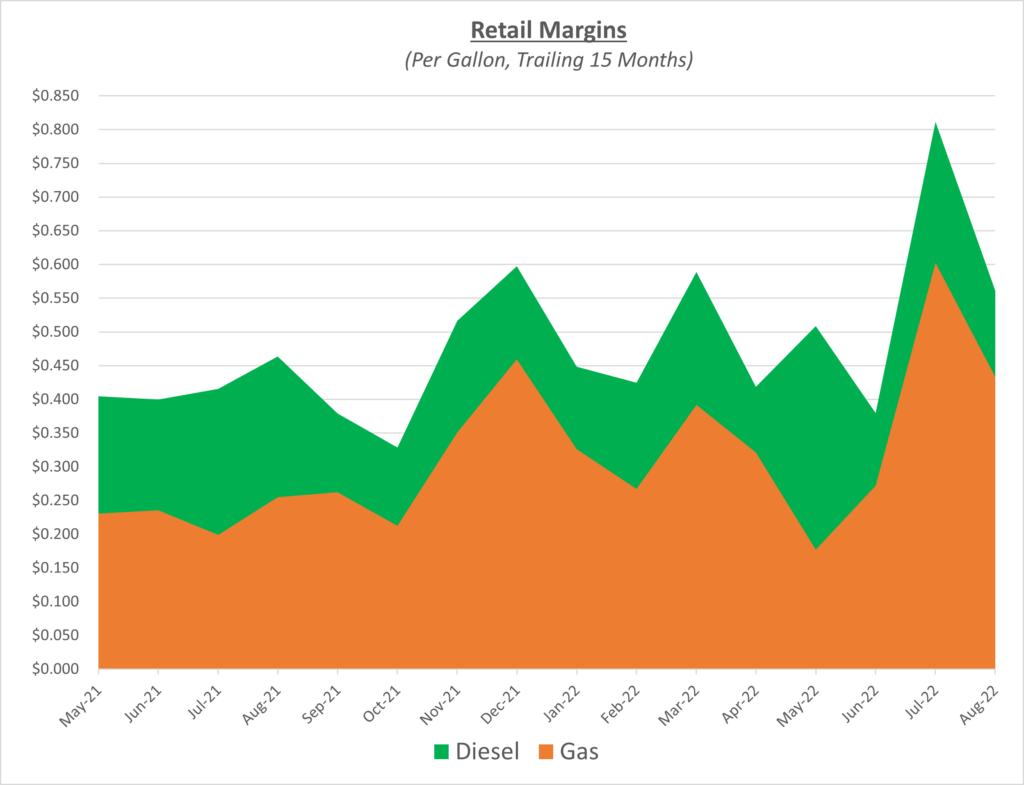

Both diesel and gas prices dropped throughout August. Retail diesel and gas prices declined slightly quicker than their wholesale prices which resulted in lower profit margins for fuel stations compared to what we saw in July. However, margins remain higher than their typical levels. Diesel saw margins roughly $0.57/gallon and gasoline roughly $0.43/gallon. The following graph shows the retail margins over the trailing 15 months:

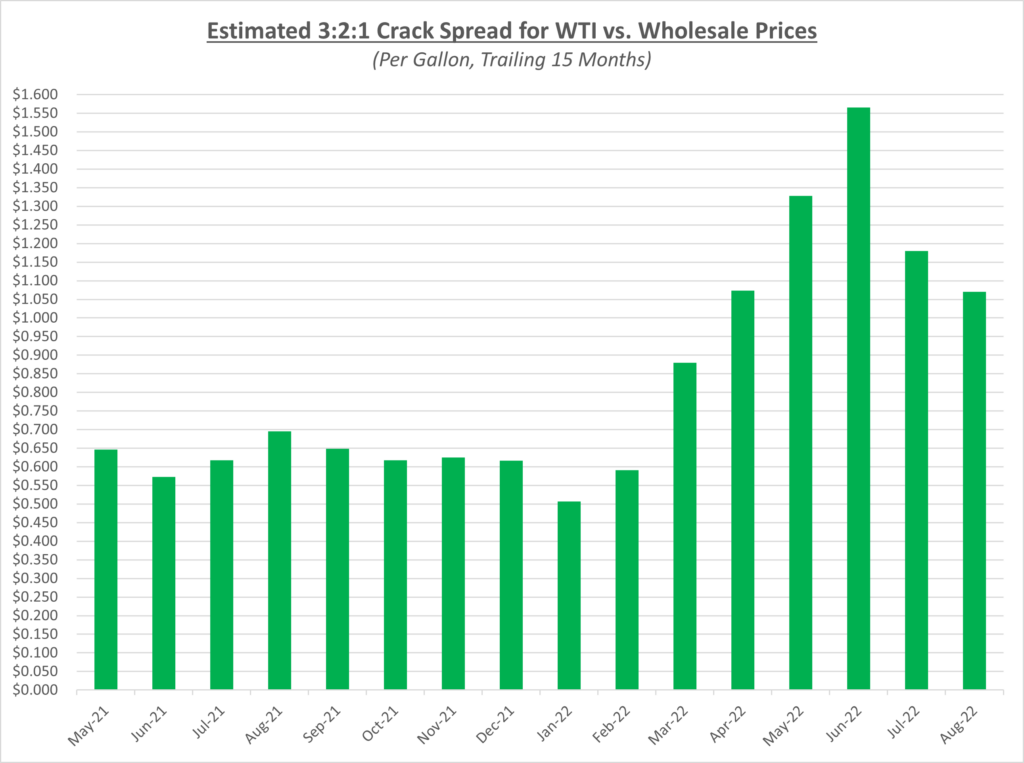

In August, crack spreads declined slightly compared to July, but remain higher than usual at well over $1/gallon as shown in the graph below. If fuel prices continue to fall, so will refiner’s profits. However, there is still a lot of room for correction with the spreads so elevated.

Oil finished August at just under $90/barrel, which was about 9% lower from where July ended. The national average gas price fell from $4.22/gallon last month to $3.84/gallon and diesel fell from $5.29/gallon to $5.08/gallon, according to AAA.

Hurricane season is off to a slow start (knock on wood), but as mentioned before, any disruptions to refineries would cause prices to increase. Another factor to consider is maintenance in the fall for refineries is expected to be more rigorous. Refineries have held out the past few years due to the extremely high crack spreads. These are signs pointing towards tight supply for diesel in the winter and potentially rising prices.

For now, Sokolis believes that oil prices will remain in the $85-95/barrel range. Prices are falling due to lower demand and economic worries, but things change quickly in the fuel market and we’ll keep you updated.