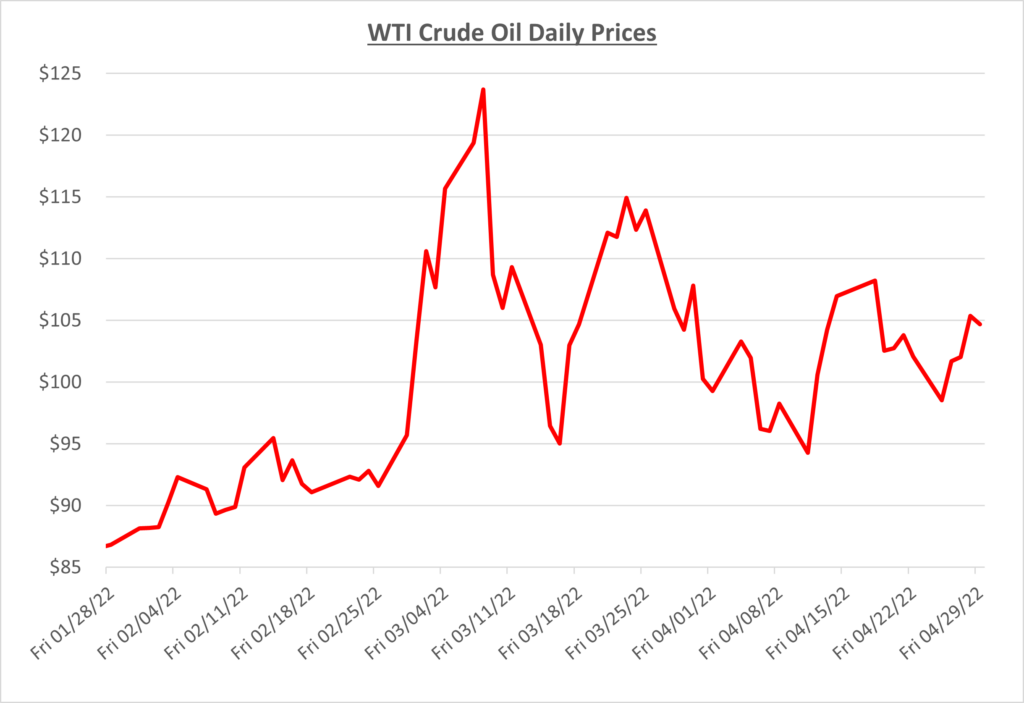

Compared to March, things were much calmer in April. Crude oil started around $100 and finished just under $105/barrel. About a month after oil hit it’s high of roughly $124/barrel, oil has dipped below $100 on three separate occasions. However, consumers have yet to feel relief at the pump as gas and diesel remain well over $4 and $5/gallon respectively. The following graph shows the daily price movements over the past three months:

Big oil executives from the likes of BP, Chevron, ExxonMobil met with congress to defend their innocence on price gouging of the American people. Ultimately, they claimed a necessary increase in oil and natural gas as a long-term fix to today’s high prices. Shortly after it was announced by the International Energy Agency that countries such as Japan would release barrels like the U.S. had previously done. By mid-month oil was at a 7-week low with the strategic reserve releases looking to give supply a boost and new COVID strain concerns in China causing fears of lockdown resulting in lower demand.

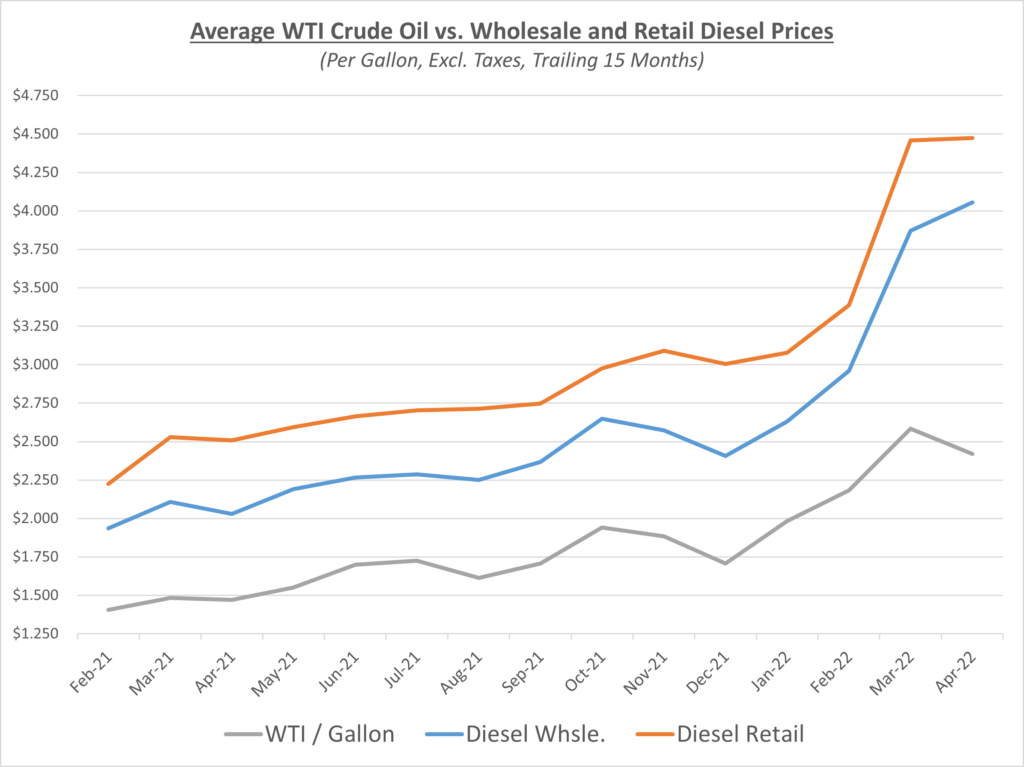

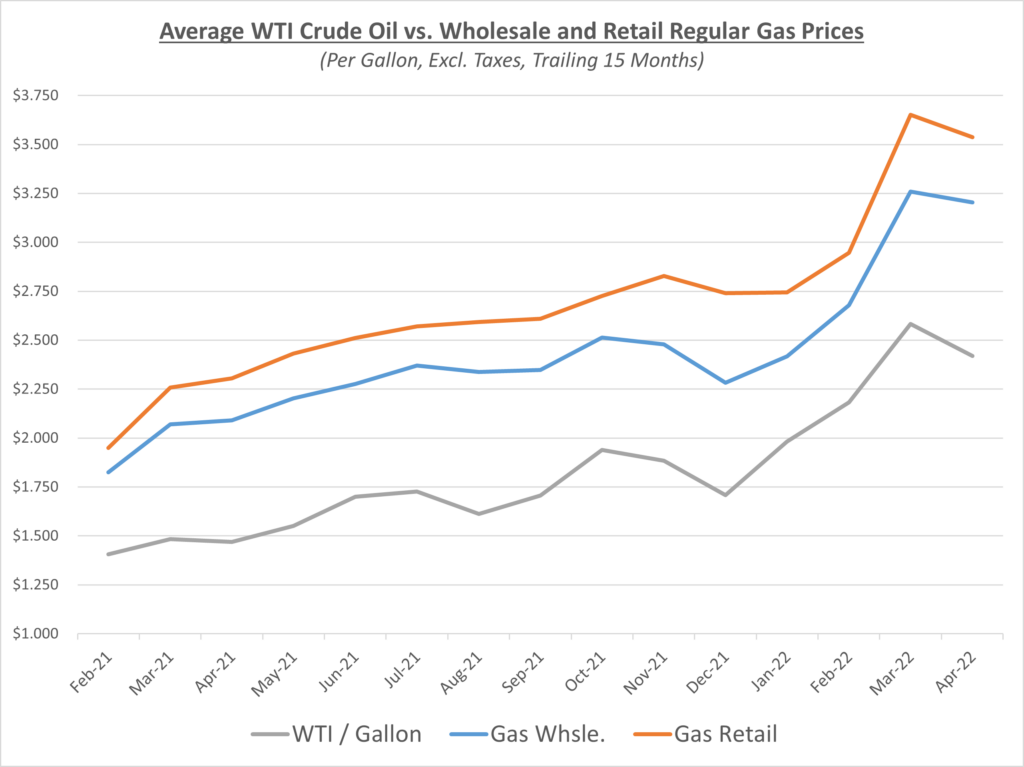

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

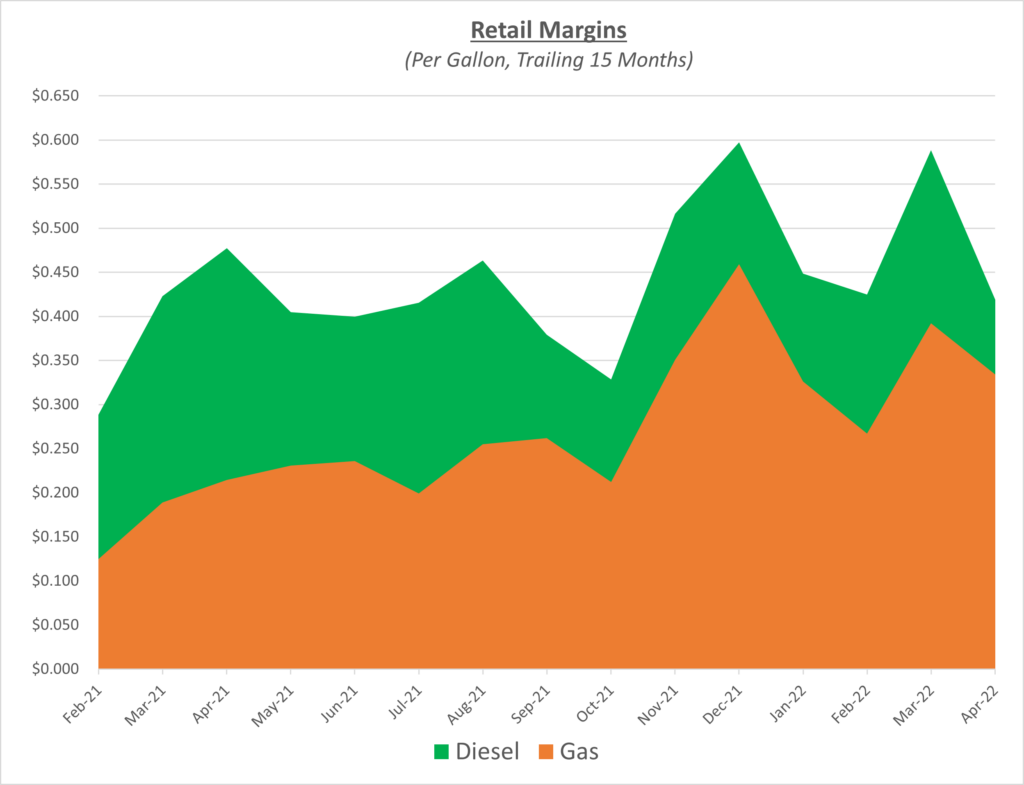

Diesel wholesale prices increased slightly, but not as drastic as they had the previous two months. Retail prices for diesel which were already at an elevated level, were relatively flat which resulted in lower margins in April. Gas wholesale and retail prices declined from their peaks in March and resulted in slightly lower margins. The following graph shows the retail margins over the trailing 15 months:

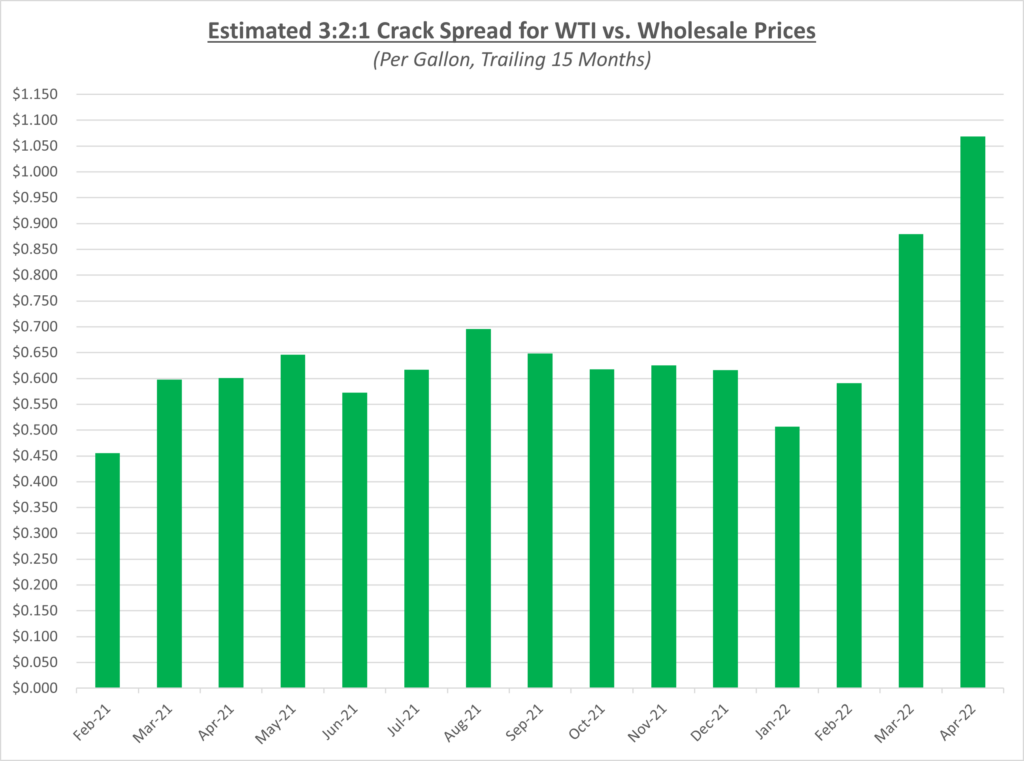

Crack spreads continue to be extremely large and the highest they’ve been since 2008. In April they surpassed the $1/per gallon mark (as seen below), indicating the profitability for companies making gas, diesel, jet fuel, etc. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel.

As fuel prices continue to be extremely high, President Biden has attempted to see if he could lessen the blow at the pump for Americans. He has a plan to allow E15 to be sold this summer to help lower fuel costs during the driving season. Typically, only E10 or lower can be sold during these months. His administration also decided to bring back leases for oil and gas drilling on federal lands. This move seemed to upset both sides of the political spectrum as he increased royalties on oil companies drilling (from 12.5% to 18.75%) upsetting pro-oil/American energy independence and upset climate activists who of course want to move towards greener energy.

Sokolis believes that oil prices will remain above $100 as the war in Ukraine continues and supply concerns continue to outweigh any potential relief in demand. Any developments that would hinder supply further could result in oil spiking much higher.