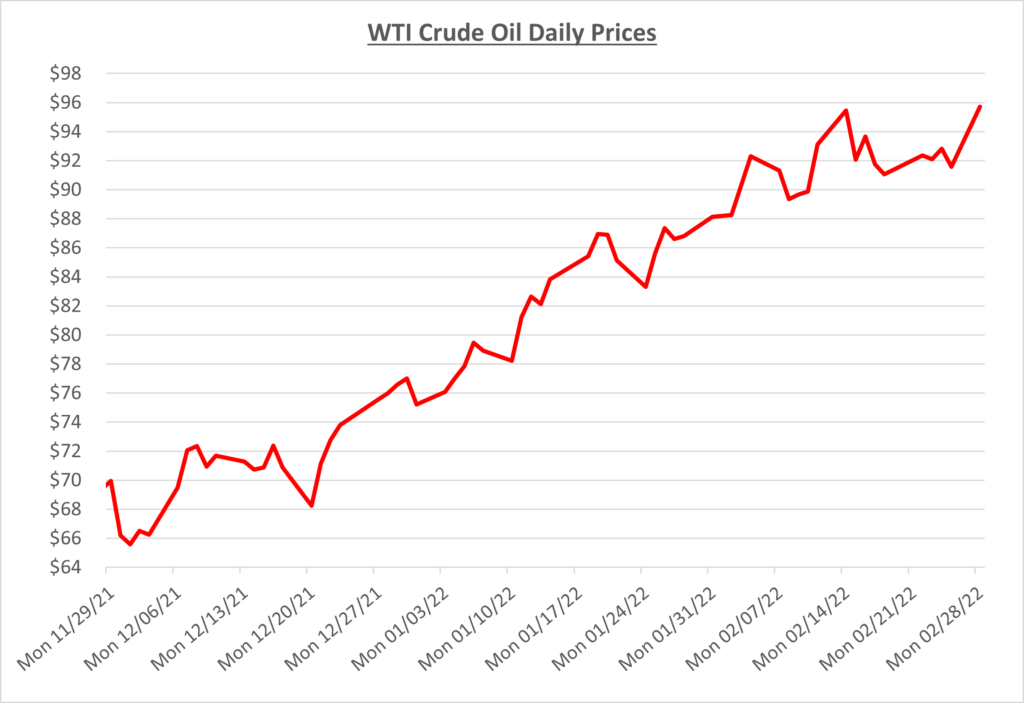

Crude oil started February in the high $80s, before breaking through the $90 mark a few days into the month. OPEC continues to meet each month and even though oil prices soar, they continue to make no adjustments to their 400k barrels per day increase plan. Demand remains strong and oil inventory levels continue to drop making supply extremely tight. All eyes are on the Russian invasion of Ukraine which is now the primary driver of rapidly escalating prices. The following graph shows the daily price movements over the past three months:

As we moved towards the middle of the month, prices briefly dipped below $90 with some hope that US and Iran were resuming talks on the nuclear deal. However, that was short lived as EIA soon after reported that oil inventories dropped by 4.8 million barrels, which was the lowest point since 2018. With supplies already extremely tight, the conflict between Russia and Ukraine could cause prices to top $100/barrel, as Russia accounts for 10% of global supply.

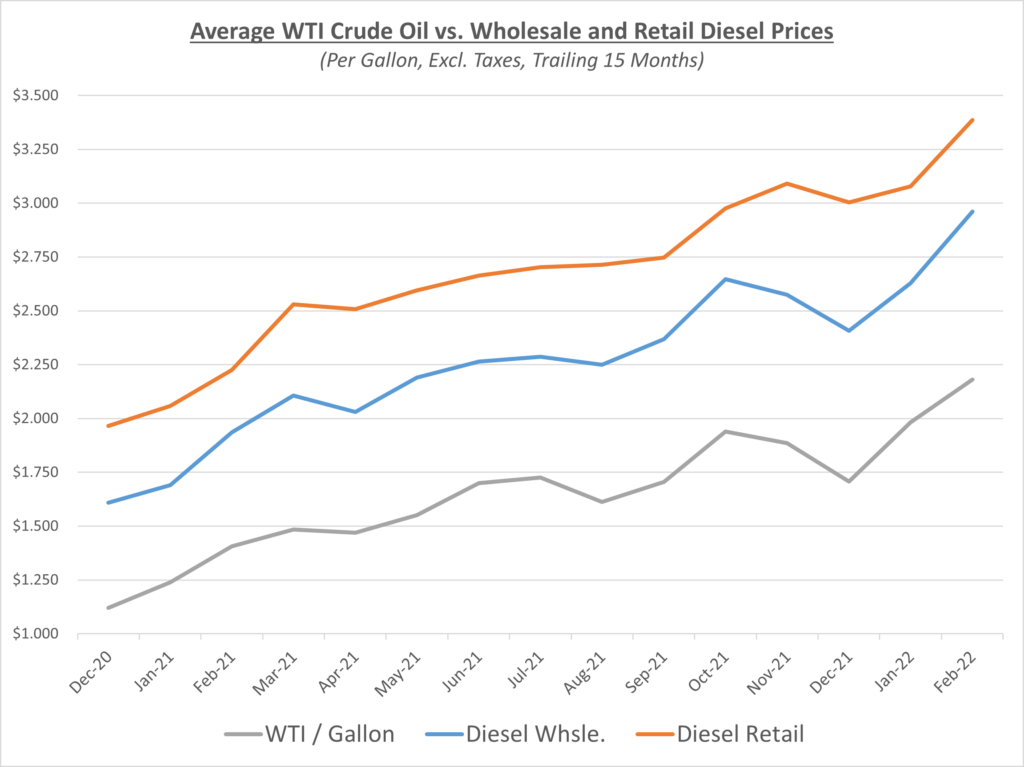

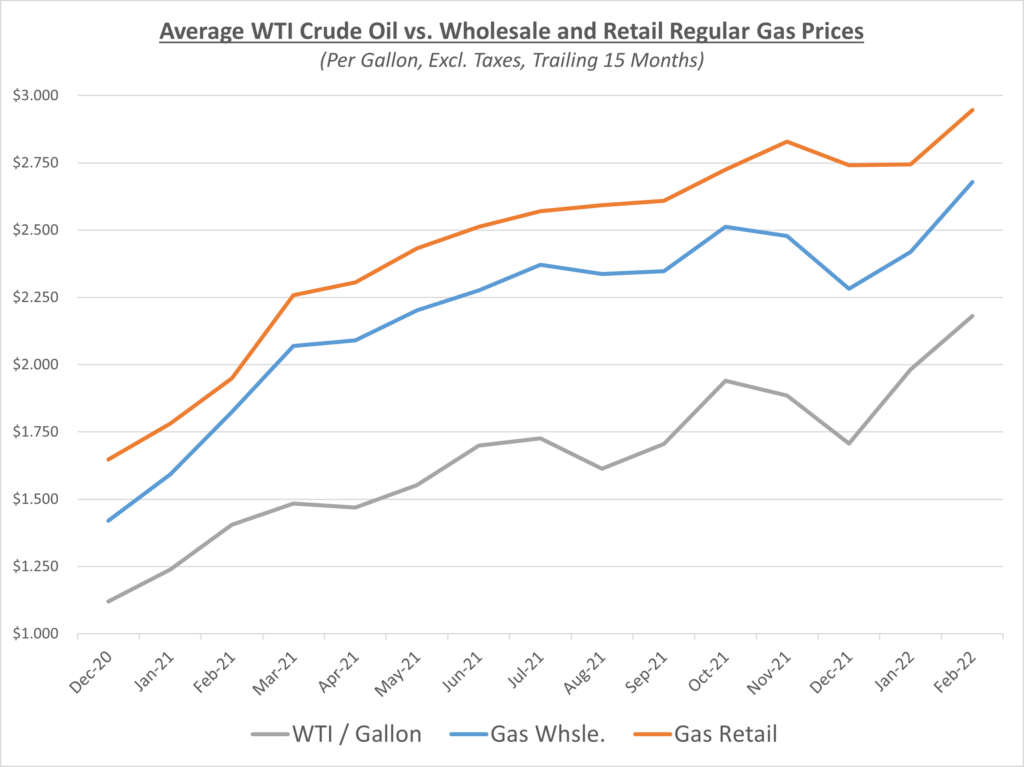

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

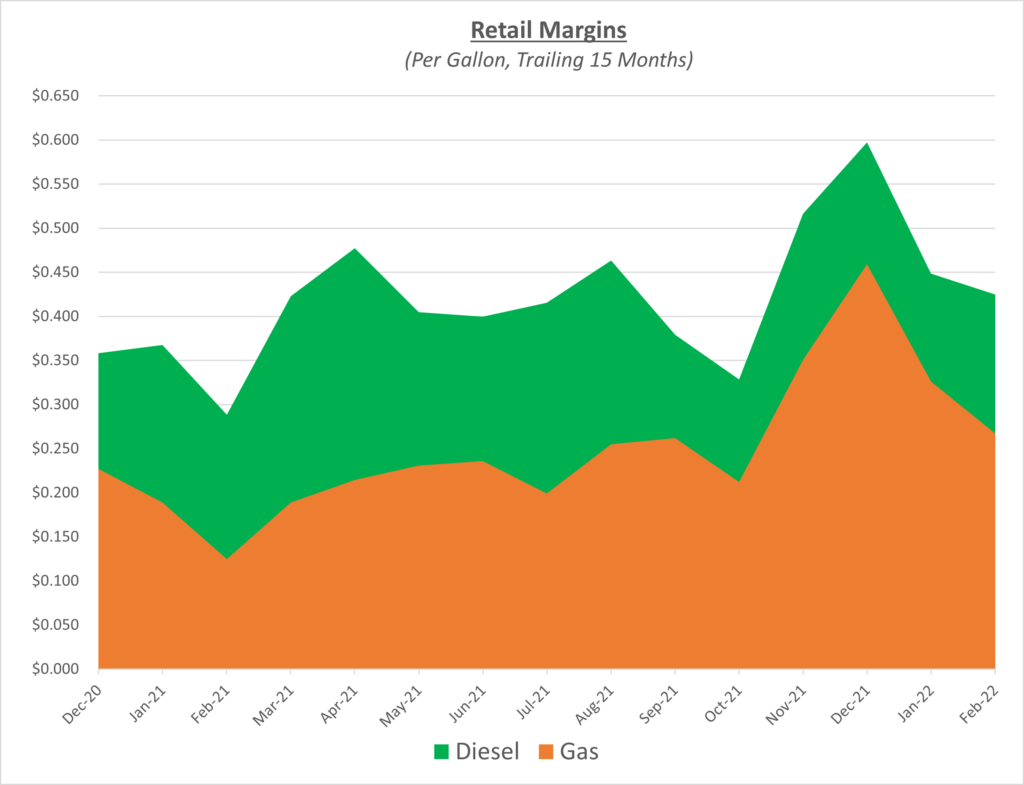

In February diesel retail margins declined slightly as wholesale prices continued their rise from January. Gas margins sunk further than diesel as wholesale prices shot up and retail wasn’t as quick to adjust. Margins for both products remain average to above average. The following graph shows the retail margins over the trailing 15 months:

Russia has invaded Ukraine and President Biden immediately announced Russia would be held responsible with sanctions. One move made was to halt the Nord Stream 2 pipeline, an $11B project controlled by Russia which was designed to double gas flow capacity from Russia to Germany. As mentioned above, with Russia being the second largest oil producer, these moves will have a ripple effect on the fuel market. The U.S. will continue to see higher gas prices at the pump as a result, as there is no easy solution to backfill supply.

OPEC meets in early March, but it’s believed that they will continue with their 400k plan. Estimates show they’re still missing that number by a significant margin. Even if OPEC decided and was able to increase production, or if Iran’s production came back online with the easing of U.S. sanctions, there is still a large supply gap in lost Russian supply. Sokolis believes that oil prices will remain above $100 if the war in Ukraine drags on, with likelihood of going much higher if the conflict escalates further.