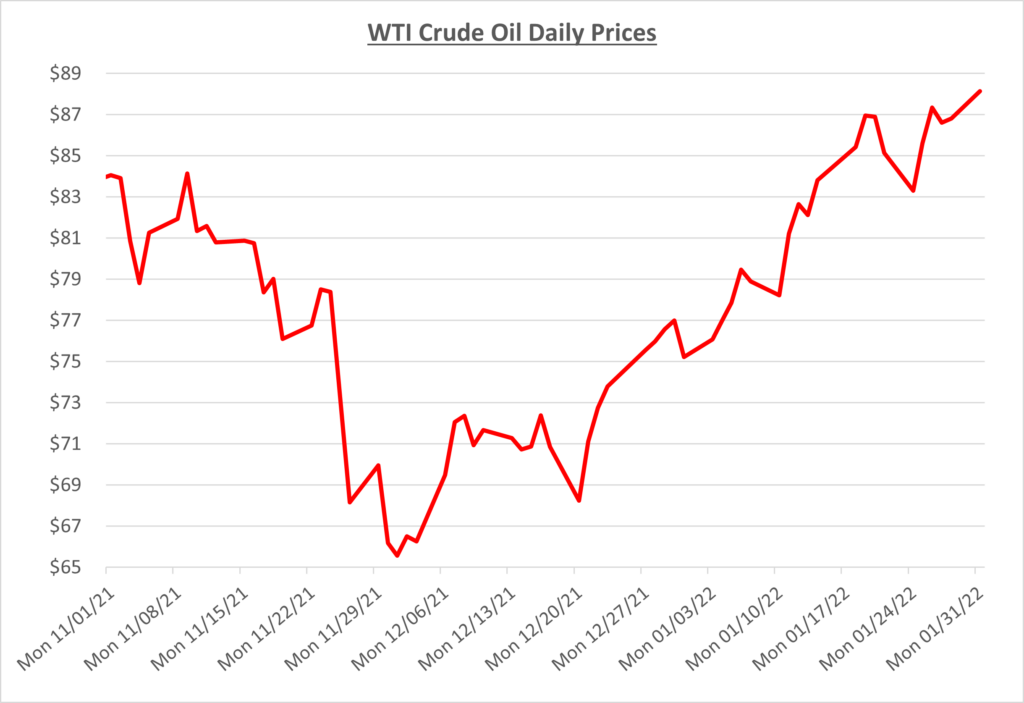

Oil prices started the year at $76/barrel, the highest mark since Thanksgiving, and they would not stop there. OPEC+ had met early in January and agreed to another output increase in February, but it was not enough to offset other factors driving prices higher. Global demand has remained strong compared to supply as the Omicron variant proves to be less destructive than former variants. In addition, unrest in Kazakhstan and Libya caused production problems which also kept prices increasing. The following graph shows the daily price movements over the past three months:

By mid-month we were in the mid-$80’s for oil prices, the highest since early November. At this point it was too appealing for drillers in the Permian Basin to ignore. The number of active drilling rigs in the U.S. reached over 600. According to Baker Hughes, compared to this time last year there were over 200 more active rigs. Prices would continue to increase from here as demand remained strong and we had some turmoil in the Middle East. Houthi rebels attacked UAE targets via drone that resulted in the death of several people and blew up three tanker trucks.

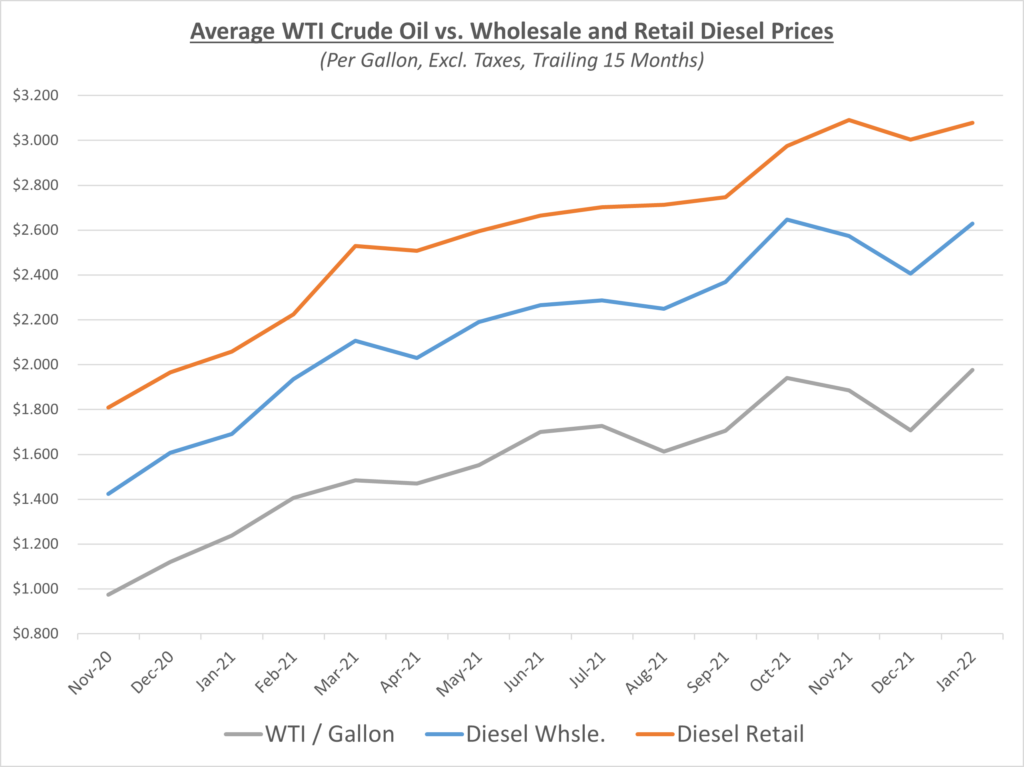

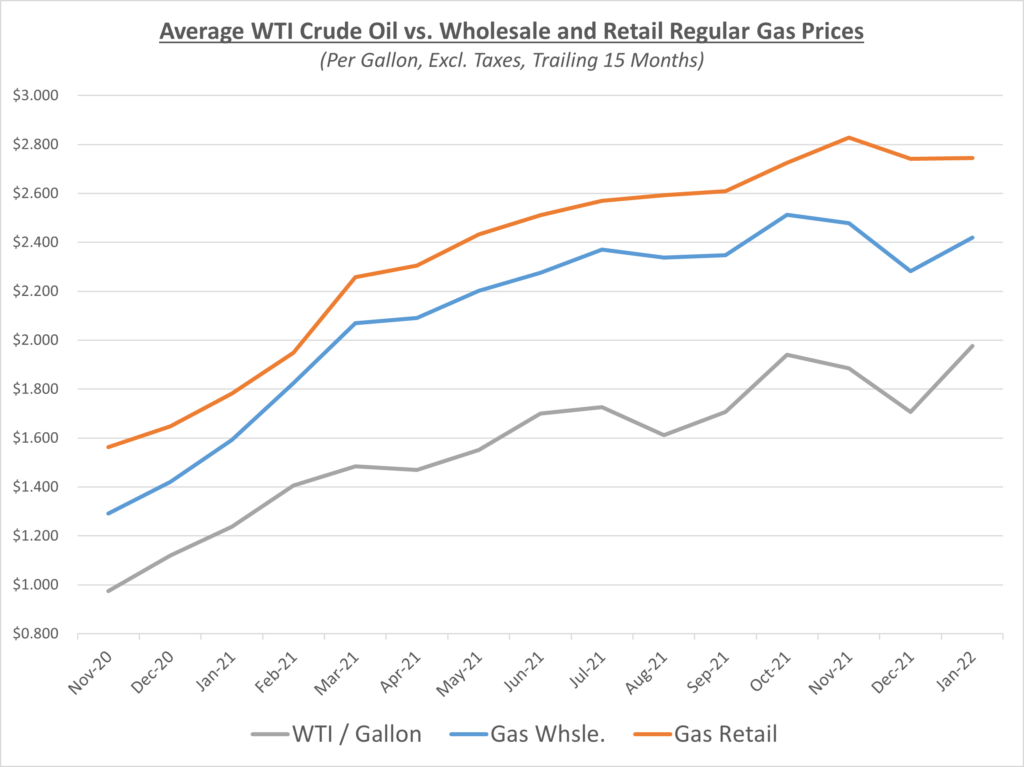

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

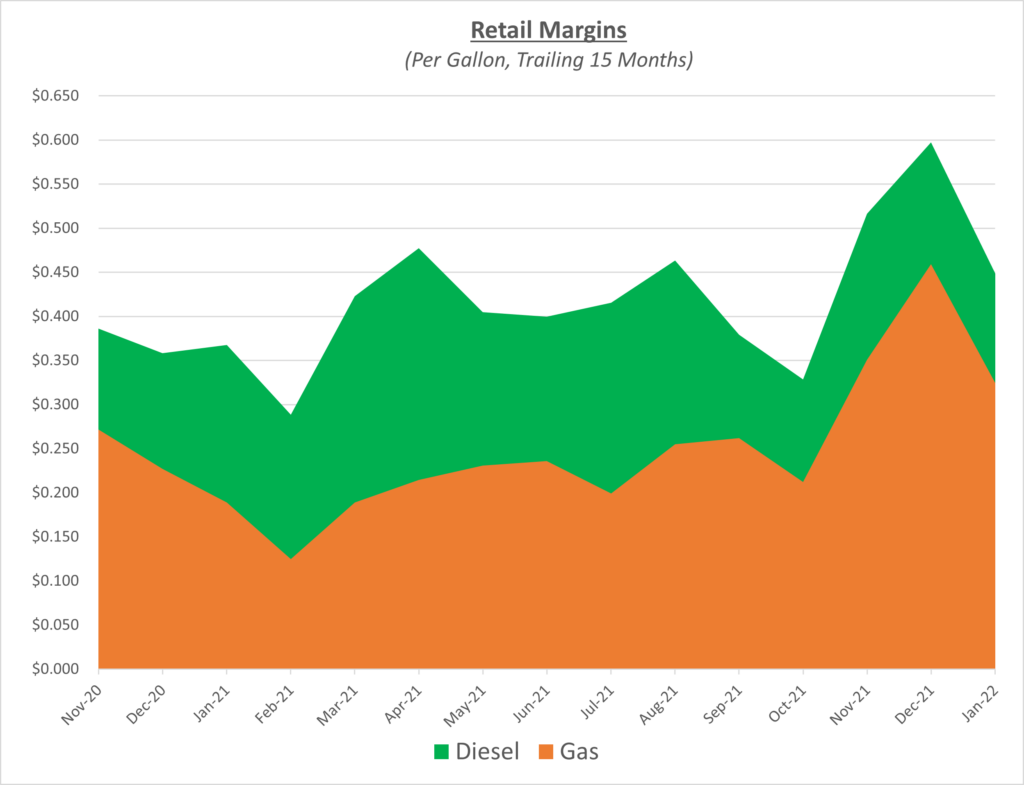

In January retail margins were forced to retreat as wholesale fuel prices were surging and retail could not keep up. Both diesel and gas retail margins fell back from the highs of December as oil prices spiked, but remained elevated from their averages. The following graph shows the retail margins over the trailing 15 months:

Oil would finish January at just over $88/barrel, an increase near 15% from where it began the month. This is the highest mark in seven years. Per AAA, the average price of gasoline was $3.37, an increase of 8 cents from last month and 95 cents from this time last year. The facts are this: demand remains strong, inventories are declining, and the Russia/Ukraine conflict continues to maturate. If there was a disruption of Russian oil and gas to Europe, or the U.S. sanctioned Russia similar to Iran, fuel prices could go through the roof.

Due to the current climate, Sokolis believes that oil prices will continue to rise for the next few months. Prices should remain in the mid-to-high $80s with the ability to reach into the $90s quickly with any further turmoil in the Middle East or developments with Russia/Ukraine.