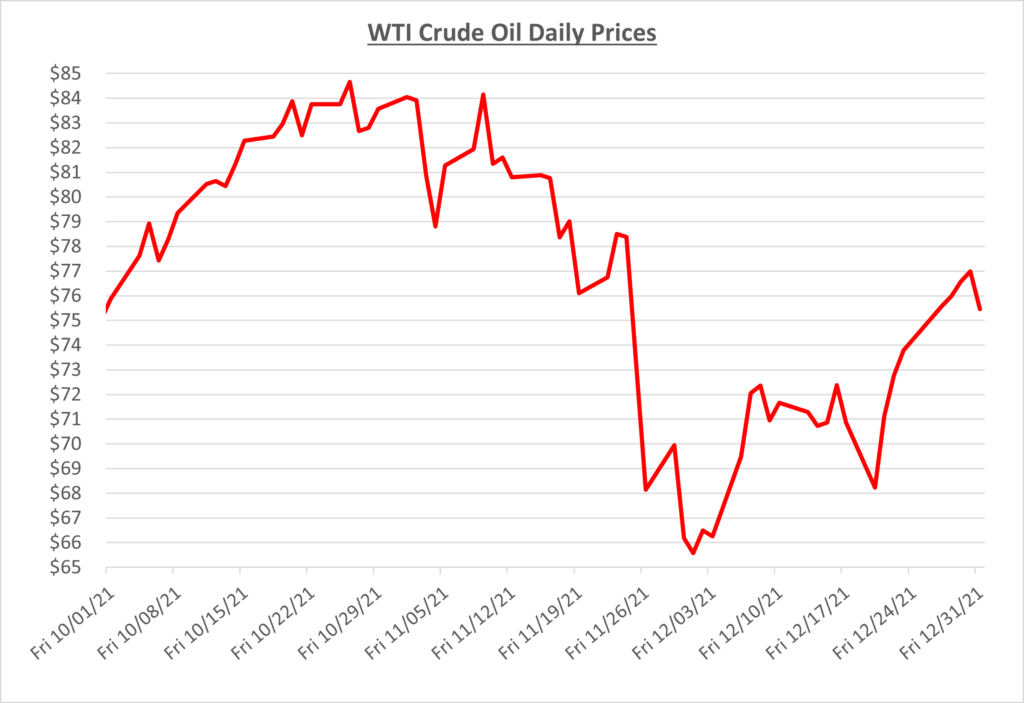

As we get more information about Omicron, oil prices bounce up and down. Oil prices started December creeping back into the $70s as reports came out claiming the newest strain of COVID is milder than originally thought. Not much has changed over the past month with demand and supply otherwise. The following graph shows the daily price movements over the past three months:

As we approached mid-December oil prices continued to go up and down like a yo-yo. Prices ranging from $72/barrel to $68/barrel. Reports of demand increasing, mixed with global fears of the new Omicron strain caused prices to fluctuate. OPEC+ had fears that U.S. oil production would pick up drastically, but that has not been the case thus far.

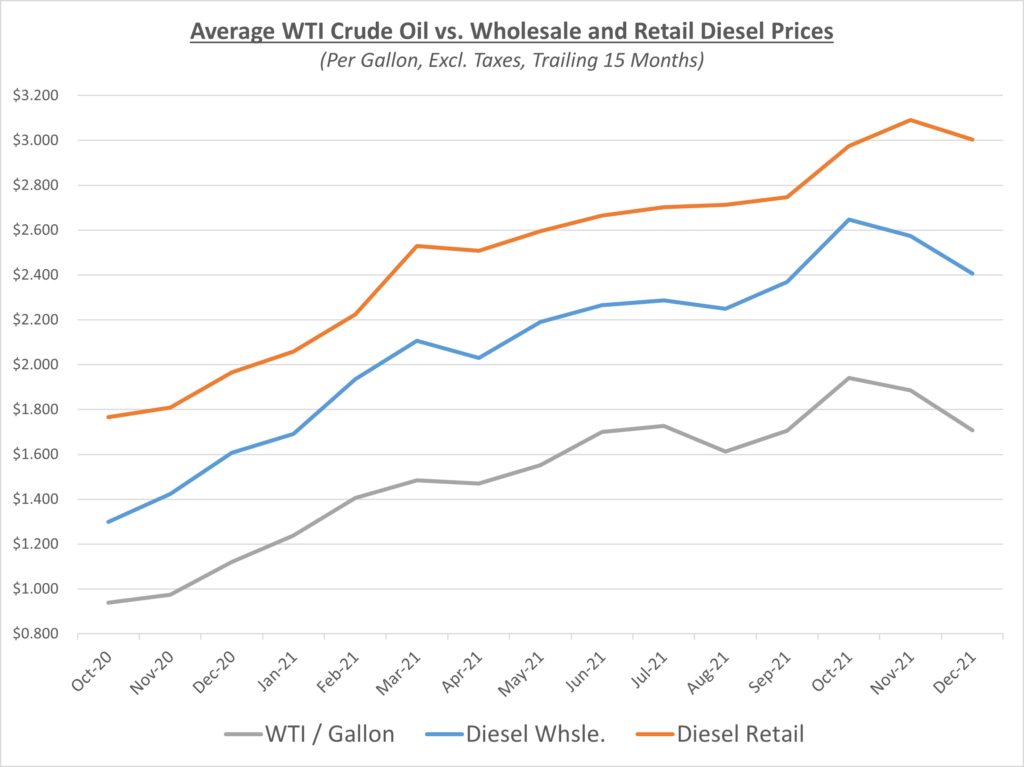

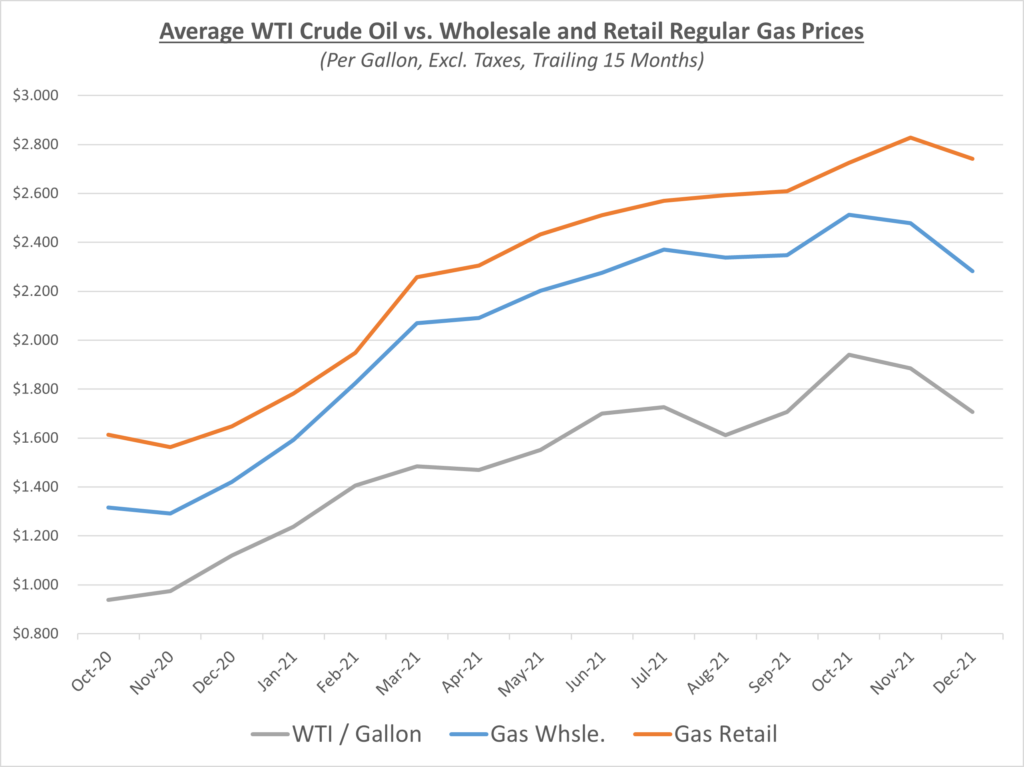

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

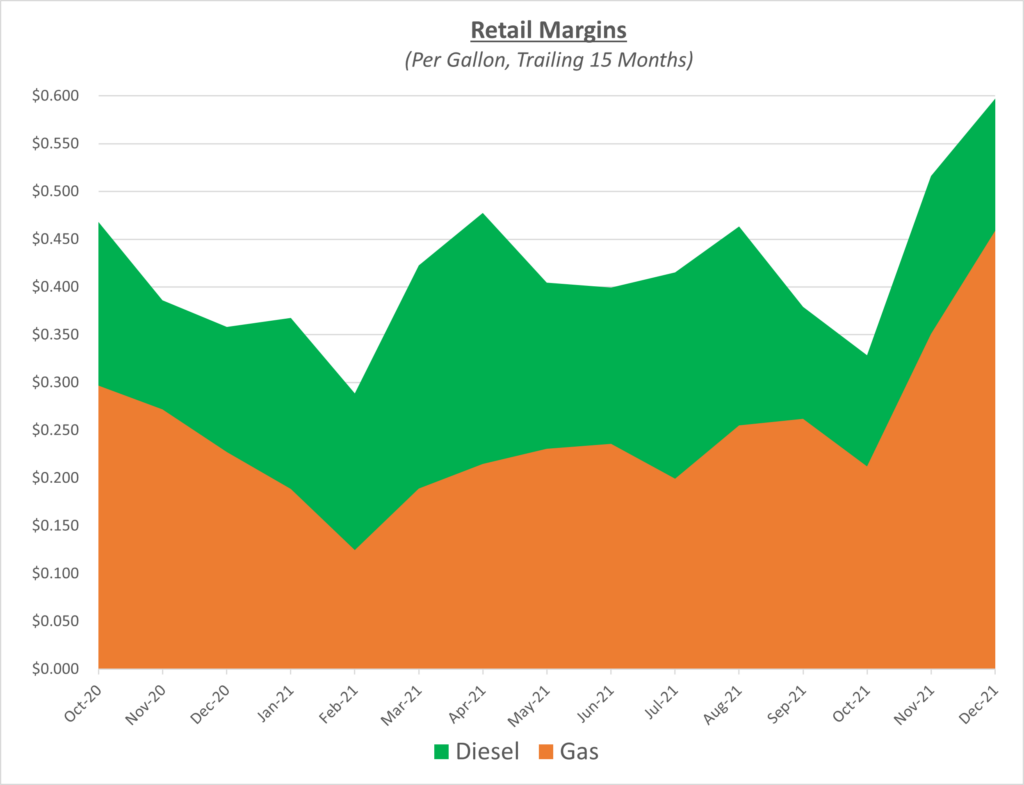

If you thought November retail margins were large, December dwarfed them in comparison. As wholesale prices continued to fall well into December, retail providers did not lower their pump prices for diesel and gasoline. Diesel margins increased by close to 10 cents from last month and gasoline margins by rose more than 10 cents. The following graph shows the retail margins over the trailing 15 months:

Oil finished December at $75/barrel, an increase of roughly 15% from where it began the month. COVID cases continue to surge which can cause problems, but the belief is the Omicron strain (which is now the dominant COVID strain) is not as severe as previous strains of the virus. That along with recent inventory draws, gave the market hope, and caused prices to rise. OPEC+ meets again early in January to discuss if they want to adjust their production plan. The belief is they will continue to hold with their increase of 400k barrels/day.

Sokolis believes that oil will range in the mid-to-high $70s for first few months of 2022. As we get further into this year and the winter weather, we believe prices will reach back into the $80s.