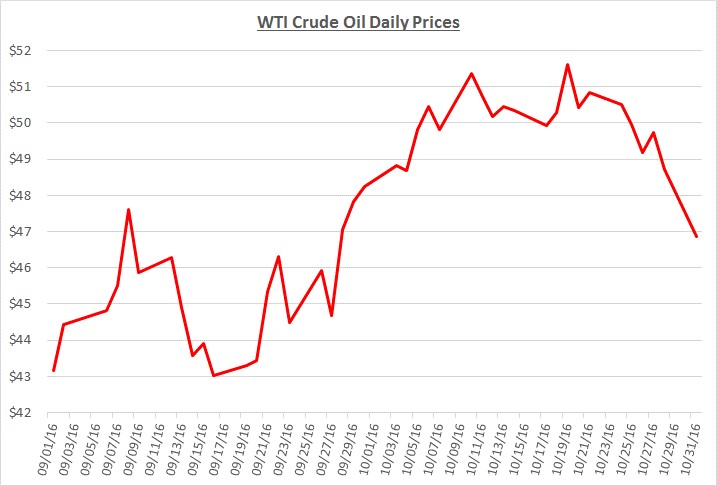

Oil prices traded in a very narrow range during most of October following a rapid increase during the last half of September. The following graph shows the daily price movements over the past two months:

The increase in September was primarily driven by news that OPEC members, along with other foreign oil producing countries, were increasingly likely to place limits on oil production. As October progressed, oil prices remained steady in a higher price range. Continuing headlines from oil producing countries reflected optimism that an agreement would be reached at their next meeting in late November to reduce or cap production. Prices were also supported by reductions in oil inventories which indicated supply and demand might find a balance sooner than anticipated.

Near the end of October, cracks began to emerge in the perceived solidarity of the oil producing countries to reach an agreement. Some of them began to express their desire for an exemption from any agreement to freeze production due to hardships they were recovering from such as Iraq’s wars and Iran’s economic sanctions. This dissent reinforced doubts about the group’s ability to reach an agreement to tighten supply which led oil prices lower.

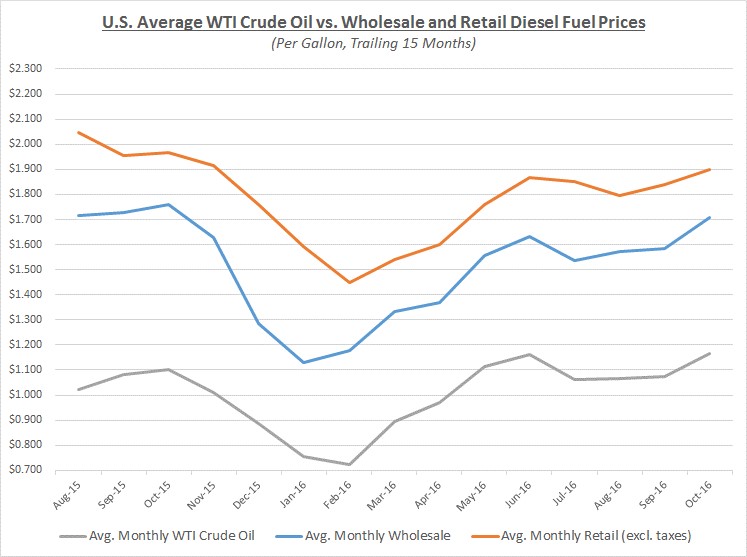

Despite the decline in oil prices toward the end of October, the average price for the entire month increased compared to September. Wholesale diesel fuel prices moved up similarly while retail prices lagged behind. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

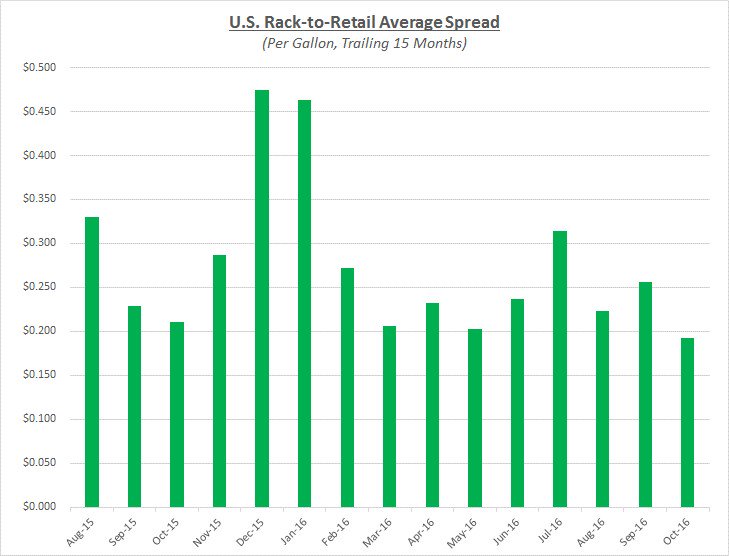

Due to the faster increase in wholesale prices compared to retail prices, retail margins shrank to their lowest level in over a year as shown in the following graph:

As a result of the market changes in October, most fleets would have seen a modest increase in their overall fuel cost compared to September. Heading into November, Sokolis anticipates prices may continue to drift downward as a result of the conflicting messages from oil producing countries leading up to their next meeting at the end of the month. However, it would not be surprising to see prices rapidly turn upward if the headlines begin to reflect broader support of an agreement.

It is difficult to say where prices will be heading beyond November pending the outcome of the meeting. If an agreement is reached, prices would likely to head toward the high 50’s, possibly even low 60’s. If no agreement is reached, prices would likely settle back toward the low 40’s until sometime in 2017 when global supply and demand is anticipated to regain some balance.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.