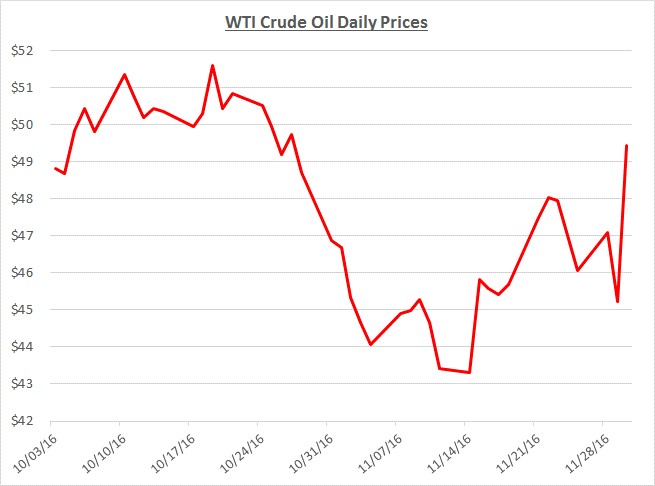

For most of November, oil prices struggled to recover following their significant drop in October. However, at the end of November, prices spiked upward in response to OPEC’s agreement to reduce oil production. The following graph shows the daily price movements over the past two months:

When OPEC announced their desire to limit production near the end of September, prices increased significantly. During October, it appeared as though OPEC would face significant challenges to reach an agreement to cut back production as various members lobbied for exemptions from the cuts. This lack of perceived solidarity was a primary factor leading to the decline in prices in October.

Throughout November, significant doubts remained as OPEC’s members attempted to reconcile their positions. Prices moved modestly up and down depending on the news of the day. Even going into the meeting on the last day of the month, an agreement was far from certain with some analysts believing there might only be a 30% chance of a deal. The end result was not unexpected, yet somewhat of a surprise that an agreement was actually reached.

The OPEC agreement, with cooperation from other foreign countries, calls for a cut of approximately 1.3 million barrels off of the 34 million barrels of current daily production. This represents a decrease of roughly 4%. While that percentage may not seem significant, it would accelerate the possibility of balancing supply and demand.

The bigger impact may be more symbolic as OPEC controls about 40% of worldwide production. Their influence has been waning over the years as other countries like the United States developed their own oil production capabilities. OPEC’s first agreement to decrease production since 2008 has helped them reassert their influence to drive up prices. Now questions remain about their ability to enforce the cuts along with how long their influence will last. If prices do continue increasing, it may lead to a rebound of domestic US oil production which would put downward pressure on prices.

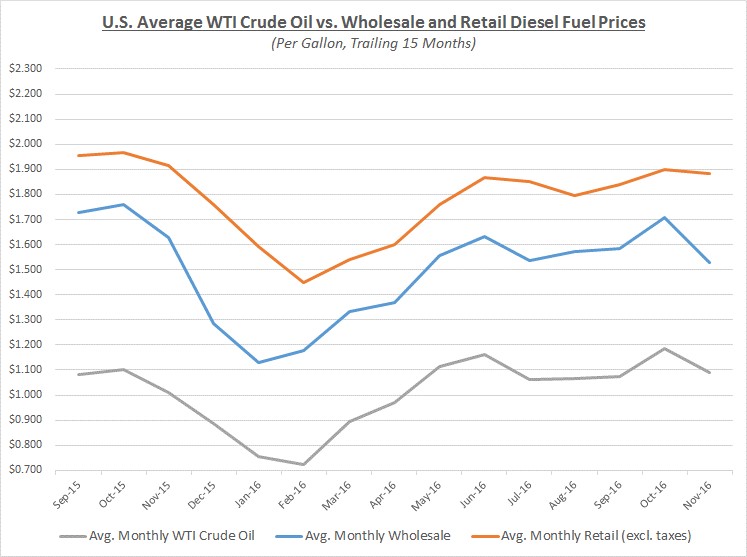

Despite the spike in oil prices at the end of November, the average price for the entire month decreased compared to October. Wholesale diesel fuel prices also decreased while retail prices lagged behind. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

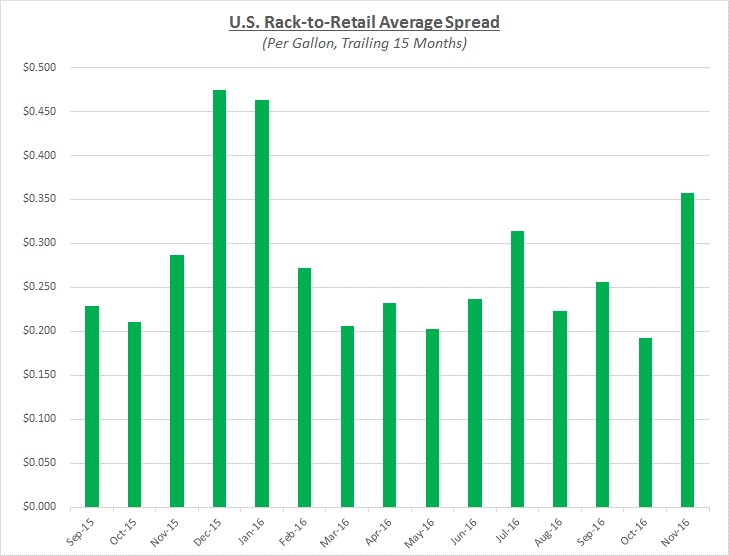

Due to the faster decrease in wholesale prices compared to retail prices, retail margins grew to one of their highest levels over the past year as shown in the following graph:

As a result of the market changes in November, fleets with retail-based purchasing deals would not have seen much change in their prices while fleets with deals based on wholesale prices would have benefited from appreciable declines.

Looking beyond November, Sokolis anticipates prices will continue to hover above the $50/barrel level and possibly increase further through the winter months depending on the severity of the season. However, if there is any news that indicates OPEC will face difficulties implementing their agreed upon production cuts, it could lead to a decline in prices.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.