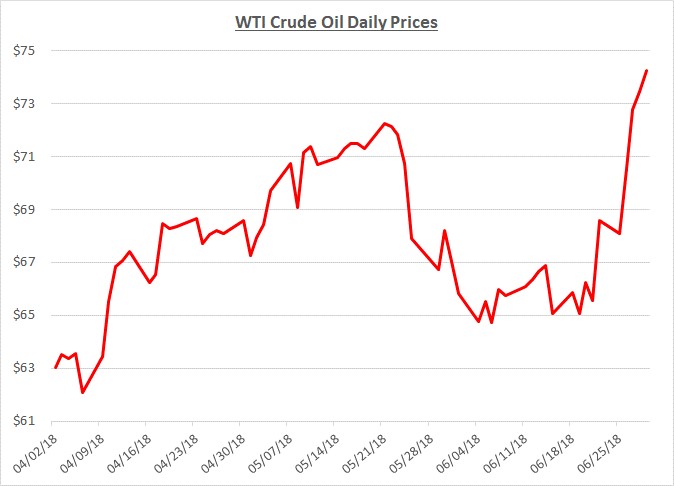

Crude oil prices traded in a narrow range near $65/barrel for most of June leading up to the OPEC meeting on June 22nd. After the meeting, prices quickly rose by over 10% during the last week of June and closed the month at $74.25. The following graph shows the daily price movements over the past three months:

The stability of oil prices during most of June was mainly in anticipation of the OPEC meeting. Back in late May, the market had already priced in a forecasted production increase by OPEC to offset supply constraints caused by Iranian sanctions and Venezuela’s political and financial turmoil. “Wait and see what really happens” might best describe the period in June leading up to that meeting.

At the meeting’s conclusion, OPEC and Russia announced an agreement to increase production by approximately 1 million barrels per day. Although this was not a surprise, concerns remained about how much of that increase could actually be achieved based on some OPEC member countries already at their maximum production capacity. Some analysts estimated that the actual increase might be significantly less than the planned volume.

Additional upward pricing pressure followed the OPEC meeting as the US began pressuring its allies to stop importing oil from Iran and threatened sanctions toward non-abiding countries. Further support for rising prices came from reports of declines in oil inventories along with a significant supply disruption in the Canadian oil sands region.

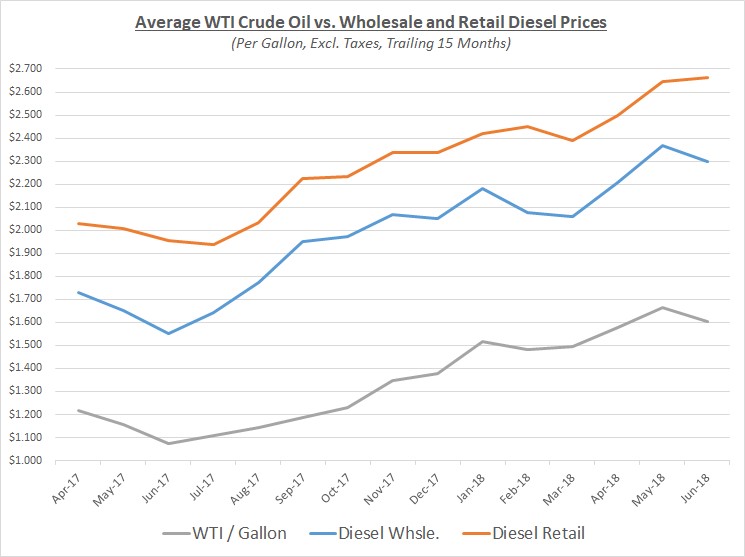

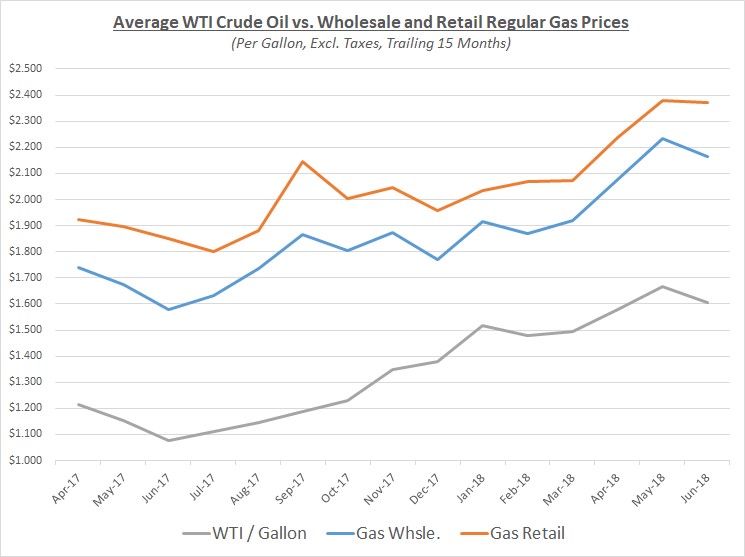

Despite the rapid increase in oil prices during the last week of June, the average price for the month decreased due to lower prices for the first few weeks. Average monthly wholesale prices for diesel and gas declined at a similar rate. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

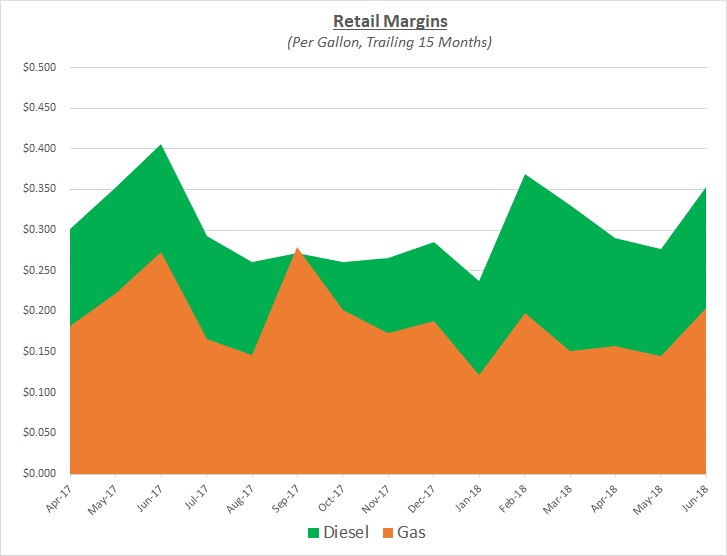

While average wholesale prices for refined products decreased during June, retail prices remained steady which allowed retail margins to spike at relatively high levels. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates crude oil prices will continue to fluctuate above $70 for the foreseeable future. In addition, the possibility for prices to continue rising remains strong. There is still too much uncertainty regarding the impact of OPEC’s planned production increases. As mentioned above, many analysts believe the actual production increase will not be as large as what was communicated by OPEC. The result would be that the increases are not enough to offset supply limitations related to Iran, Venezuela and Canada. In addition, global inventory levels have recently shown more consistent declines toward multi-year lows while demand for oil remains strong.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.